M&A Strategy: ABRAMS world trade wiki for Target Screening

Dr. Jürgen Abrams, inigma LLC. ABRAMS world trade wiki is a division of inigma LLCTarget screening is one of the first tasks in the M&A process and aims to identify potential acquisition targets. The goal is to find companies that strategically, operationally, and financially fit the buyer’s organization. This section highlights the basics and the importance of target screening and how ABRAMS world trade wiki automates important tasks.

1.1 Why ABRAMS world trade wiki?

The process of establishing strategic objectives is fundamentally crucial for the effective identification and subsequent selection of acquisition targets that align with the overarching goals of the organization, thereby ensuring that these targets not only fit within the desired business framework but also contribute to long-term success and sustainability.

In this context, it is imperative to discuss the key evaluation criteria that are utilized to assess potential acquisition targets, which encompass various dimensions such as market coverage, the competitive strength of the entities being evaluated, and the performance metrics associated with supply chains, all of which play a pivotal role in determining the feasibility and potential success of such acquisitions.

Furthermore, it is essential to highlight the myriad challenges that can arise during this process, including but not limited to the prevalent issue of information asymmetry, which complicates the decision-making process, alongside the necessity of establishing appropriate and well-defined selection criteria that can effectively guide the acquisition strategy.

ABRAMS world trade wiki is a powerful, sophisticated tool designed to significantly enhance transparency in the acquisition process, analyze complex supplier and customer networks with greater efficacy, and ultimately mitigate various risks that may jeopardize the success of strategic business acquisitions and partnerships.

1.2 Objectives and Strategic Alignment

Successful target screening starts with clearly defined goals, such as expanding into new geographic markets, diversifying product portfolios, or acquiring innovative technologies that complement the company’s core competencies. This section describes the strategic goals for the acquisition, such as market expansion, diversification, or access to new technologies. It outlines how companies can formulate a strategic alignment.

1.3 Identifying Potential Targets

Identifying potential acquisition targets is a multi-faceted process that requires a thorough understanding of the market and specific criteria to guide the search. Companies often rely on industry analysis, competitor monitoring, and external advisors to compile a shortlist of potential targets. Key criteria for identifying potential targets include:

Market Coverage: Assessing the target’s geographic and customer market reach is essential to determine its ability to support the acquirer’s strategic goals. For example, does the target operate in regions where the acquirer seeks to expand to? How well does the target’s customer base align with the acquirer’s growth plans? Analyzing market coverage helps identify overlaps and opportunities for new market entry.

Competitive Strength: Evaluating the target’s position within its industry involves analyzing its market share, brand reputation, and innovation capabilities. For instance, a target with a strong competitive position may contribute valuable intellectual property, advanced technology, or well-established customer relationships that can enhance the acquirer’s competitive edge.

Current Supply Performance: Reviewing the target’s supply chain efficiency, reliability, and ability to meet demand provides insights into operational strengths and potential risks. This includes examining the target’s dependency on key suppliers, its ability to adapt to supply chain disruptions, and the overall robustness of its logistics and operations. A reliable supply performance ensures that the target can sustain its operations and contribute positively to the acquirer’s supply chain.

These criteria help prioritize targets that meet immediate strategic needs but also offer long-term growth potential. Approaches such as bottom-up analysis focuses on specific financial and operational data, and top-down analysis focuses on broader industry trends and strategic alignment. This ensures that selected targets align closely with the acquirer’s overarching objectives and offer measurable value post-acquisition. Approaches such as bottom-up and top-down analyses further refine the search.

1.4 Evaluation Methods for Targets

Evaluating potential targets is crucial for prioritization, requiring a blend of qualitative methods, such as SWOT analyses to assess strategic fit, and quantitative methods, like financial metrics to evaluate profitability and market potential. This section presents qualitative and quantitative evaluation methods, including SWOT analyses, financial metrics, and market potential.

Leveraging Data Sources and Technologies in Screening

Modern technologies such as artificial intelligence and data analytics can significantly enhance the screening process. For example, platforms like DealCloud or PitchBook provide advanced data analytics and visualization tools to streamline the identification and evaluation of potential targets. This section explores relevant tools and platforms as well as their pros and cons.

Challenges and Best Practices

Target screening often presents a series of challenges that can impede the identification of suitable acquisition targets. One of the primary issues is information asymmetry, where critical data about potential targets is either incomplete or unavailable to the buyer. Companies frequently depend on publicly available data, which might not provide a comprehensive view of the target’s financial health, operations, or strategic goals. To address this, organizations should leverage specialized databases and industry reports while engaging third-party advisors or consultants to gain deeper insights and to mitigate data gaps.

Another significant challenge is setting screening criteria that are either too broad or overly restrictive. Unrealistic criteria can lead to viable targets being overlooked or unsuitable ones being included in the selection process. Companies must ensure that their strategic priorities are clearly defined and regularly refine their criteria as new insights emerge during the screening process. This adaptability allows them to align their efforts with evolving market conditions and organizational goals.

Market dynamics and competitive pressure further complicate target screening. Rapid shifts in industry trends or intense competition can affect the availability and attractiveness of potential targets. Continuous monitoring of market trends and the development of contingency plans are essential to staying ahead of these changes. Such proactive measures enable companies to adapt their screening parameters and remain competitive in their search for suitable targets.

Finally, decision-making during target screening is often influenced by biases. For instance, organizations may overvalue well-known brands or underestimate the potential of smaller, less prominent companies. Implementing data-driven evaluation tools can help minimize subjectivity, while ensuring a diverse screening team can provide multiple perspectives and challenge preconceived notions.

By addressing these challenges and adopting best practices—such as leveraging advanced analytics tools, fostering cross-functional collaboration, and maintaining open communication with stakeholders—companies can enhance the effectiveness of their target screening process. These strategies ensure that the selected targets align with the acquirer’s strategic and operational objectives, paving the way for a successful M&A transaction.

1.5 ABRAMS world trade wiki supports Target Screening

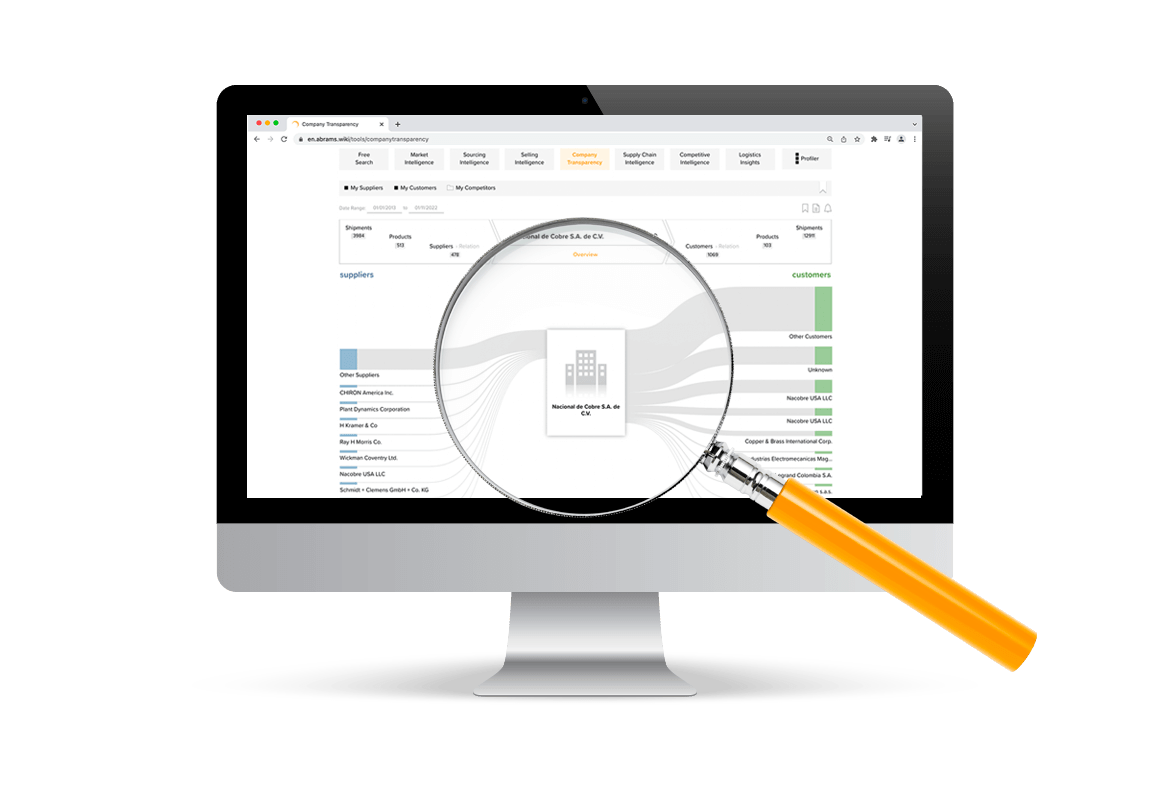

The platform ABRAMS world trade wiki, particularly its solutions for company transparency, provides significant support for the Target Screening process. By offering detailed insights into global company operations, the platform helps address key challenges:

Enhanced Information Access: ABRAMS world trade wiki consolidates extensive data on real company activities based on customs and logistics information and can present existing supply chain relationships. This significantly reduces issues related to information asymmetry by providing detailed operational footprints. These insights enable acquirers to gain a more comprehensive understanding of potential targets and make informed decisions.

Supplier and Customer Analysis: ABRAMS world trade wiki allows users to delve deeply into the supply chain and customer networks of potential targets. By identifying direct suppliers (Tier 1) and their suppliers (multi-tier levels), companies can assess the resilience and vulnerabilities within the target’s supply chain. Similarly, analyzing direct customers and the broader customer ecosystem enables the identification of revenue stability and potential dependencies. This dual analysis is invaluable for evaluating both operational reliability and market reach.

Risk Mitigation: Transparency into compliance records, operational dependencies, and geographic distribution helps users assess and mitigate risks. For instance, the platform highlights areas prone to geopolitical instability or environmental risks, as well as potential regulatory issues. This level of insight allows companies to proactively address vulnerabilities and safeguard their investment strategies.

Strategic Alignment: With access to an extensive and searchable database, the platform supports the identification of companies that align with the acquirer’s strategic objectives. Whether the goal is to expand geographic presence, acquire innovative technology, or strengthen market position, ABRAMS world trade wiki simplifies the process of finding targets with compatible operational and strategic characteristics.

By integrating ABRAMS world trade wiki into the screening workflow, companies enhance their ability to identify, evaluate, and prioritize potential acquisition targets. This data-driven approach improves the precision and success rate of M&A activities while reducing uncertainties in the decision-making process.

1.6 M&A Scenarios and Strategic Goals – Use-Case Selling vs. Sourcing

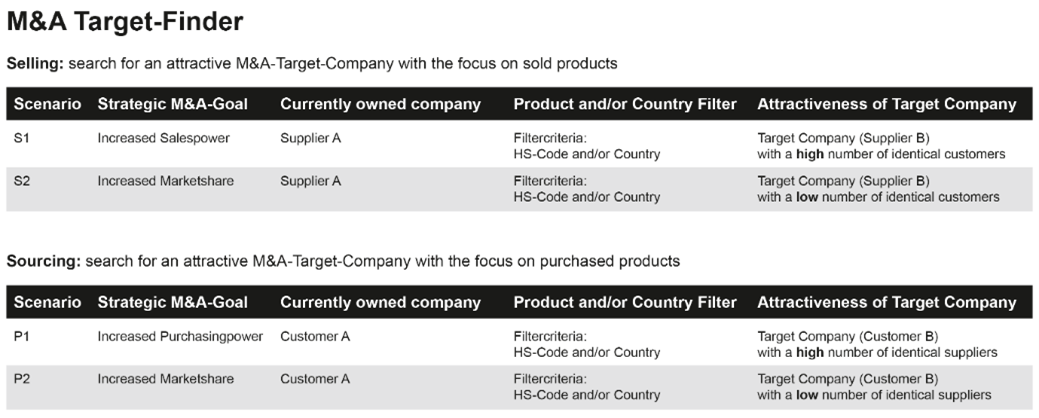

In the field of M&A, different strategic approaches are pursued depending on the business objectives. The following scenarios illustrate M&A strategies formed on sales or procurement, including the relevant selection criteria and key attractiveness factors of potential target companies.

In the following picture you see the different scenarios and their outputs regarding attractiveness of the target company.

Figure Scenarios in M&A Target Finder

Sales-Oriented M&A Strategies ("Selling")

This strategy focuses on identifying attractive M&A targets that can enhance a company's sales performance. The attractiveness of a target company is particularly defined by whether it has a high or low number of identical customers to the acquiring company.

Selling Scenario S1: Increasing Sales Power

Currently Owned Company: Supplier A

Product/Country Filter: Selection criteria based on HS code (Harmonized System code for product classification) and/or geographical regions to target the most relevant market segments.

Attractive Target: A target company (Supplier B) with a high number of identical customers.

Explanation: Acquiring a supplier with a high number of shared customers creates immediate cross-selling and bundling opportunities. The combined entity can offer a broader product portfolio to the same customer base, increase wallet share, and strengthen customer relationships. Additionally, by consolidating sales forces and marketing efforts, Supplier A can improve efficiency and gain better negotiation power with key customers.

Selling Scenario S2: Increasing Market Share

Currently Owned Company: Supplier A

Product/Country Filter: HS code and/or geographical filters to focus on relevant market segments.

Attractive Target: A target company (Supplier B) with a low number of identical customers.

Explanation: This strategy is ideal for expanding into new customer segments. Since there is little overlap in the customer base, the acquisition enables Supplier A to quickly reach new markets, acquire fresh revenue streams, and diversify its risk. The integration process may require stronger efforts in aligning sales strategies, but it ultimately leads to business expansion and increased market reach.

Procurement-Oriented M&A Strategies ("Sourcing")

This approach aims to strengthen a company’s purchasing power by identifying M&A targets that provide strategic advantages in procurement, supplier relations, and cost efficiencies. The attractiveness of a target company is determined by whether it has a high or low number of identical suppliers.

Procurement Scenario P1: Increasing Purchasing Power

Currently Owned Company: Customer A

Product/Country Filter: Selection based on HS code and/or geographical regions to ensure a relevant supplier network.

Attractive Target: A target company (Customer B) with a high number of identical suppliers.

Explanation: Acquiring a company that shares many of the same suppliers allows for volume bundling and stronger negotiation power. By combining procurement volumes, the new entity can achieve cost reductions, secure better contractual terms, and improve supply chain reliability. This strategy is particularly effective for companies looking to enhance procurement efficiency and consolidate supplier relationships.

Procurement Scenario P2: Increasing Market Share through Procurement

Currently Owned Company: Customer A

Product/Country Filter: Selection based on HS code and/or geographical regions.

Attractive Target: A target company (Customer B) with a low number of identical suppliers.

Explanation: This strategy is particularly useful for expanding the supplier network and reducing dependency on existing suppliers. By acquiring a company with a distinct supplier base, Customer A can increase supply chain flexibility, improve resilience to supplier risks, and potentially gain access to new materials, better pricing structures, or innovative production methods. Additionally, the diversification of suppliers may help mitigate risks related to geopolitical issues or supply chain disruptions.

1.7 Conclusion

Each M&A scenario is designed to optimize either the sales or procurement position of a company. The key factor in evaluating a target’s attractiveness is the degree of customer or supplier overlap:

A high number of identical customers/suppliers supports synergies, consolidation, and improved efficiency.

A low number of identical customers/suppliers enables business expansion, diversification, and new market penetration.

Strategic M&A decisions require a thorough analysis of market structures, industry trends, and potential synergies to maximize the value generated from the transaction. ABRAMS world trade wiki provides an innovative approach tapping opaque data to deeply analyze existing supply chain relationships.

Abrams brings you value:

Faster, well-founded analyses for pitch and execution

Deeper insights (e.g., supply-chain risks, market modeling) that are often not covered internally

Competitive advantage over other advisors

Higher deal quality and a stronger negotiating position

Example: Contributions from ABRAMS wiki in target search:

Expand breadth via the supply‑chain view — not just the “visible” firms (large, public, registered) but also critical niche suppliers or specialized customers.

Cluster by role in the value chain — tier‑1, tier‑2, bottleneck, innovation supplier.

Quickly surface hidden champions — e.g., firms with little financial visibility that are key suppliers to industry leaders.

Regional additions — trade‑flow visibility reveals alternative targets across regions (e.g., reshoring options).

Value: the longlist becomes substantially broader and more strategic by factoring in operational relevance.