M&A Strategy: PATEV for IP-based Valuation

Dr.-Ing. Edelbert Häfele, Dr.-Ing. Klaus Illgner-Fehns, Dr.-Ing. Judit Inacsovszky, PATEV Associates GmbH

Self Service Tool PATEV TechValue

In our self-service tool, the starting point is entering a company name. This company could, for example, be involved in an M&A scenario.

The main point of interest is to check whether the Target-company’s technological position correlates with substantial economic value by leadership in EU, US, JP, CN or KR.

Your first input might be "Atriva Therapeutics". This is a fictitious example, the start-up company has no connection with any known transactions or PATEV projects.

Figure 12: Screenshot of PATEV TechValue: Company name selection

You select the "right" company names from a list that pops up – these are the patent applicant names that most closely match your input.

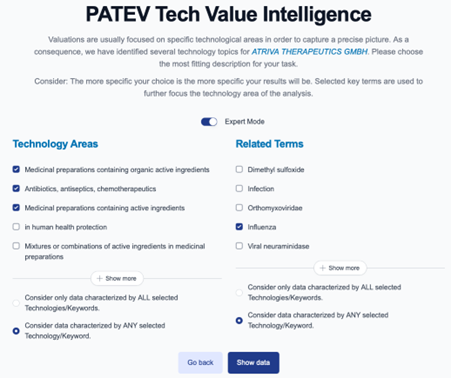

In the next step, the tool will suggest some technology areas identified on the base of the alive patents of the selected patent applicant (company or companies).

Here, "alive" or "active" means that the patents or patent applications are pending or granted and not ceased. Patents or patent applications may expire or be abandoned for a variety of reasons. For example, the products in which they were implemented are no longer manufactured. The owner decides not to pay the patent fees to the patent office and the patent lapses. The (simplified) legal status is "dead" from that point on. A dead patent is part of the state of the art, but it has no protective or restrictive legal force, so it has no value. The maximum term of patents can be 20 years, but this is rarely achieved. This is the case, for example, with standard-essential patents in telecommunications or in the manufacturing of pharmaceuticals.

The PATEV TechValue tool is based on alive patent documents with separate document numbers that are considered and counted (unlike TargetSearch, which considers patent families from the last 5 years).

You can select the most appropriate technology area descriptions for your task. The selected technology areas may contain thousands of patent documents, it is a thematic assignment by AI, not a formal one by the words.

In "expert mode" the search is narrowed and focused by some keywords ("Related Terms") of your choice. These terms are then searched in specific patent text blocks.

Figure 13: Screenshot PATEV TechValue: Technology Area and Related Terms selection

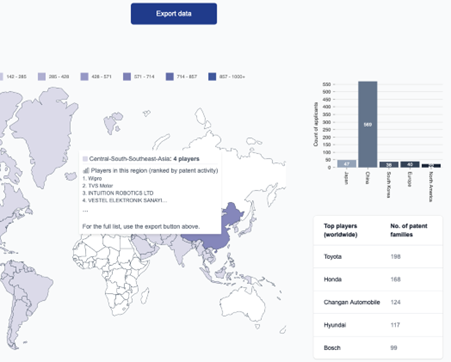

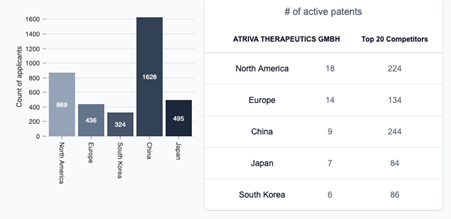

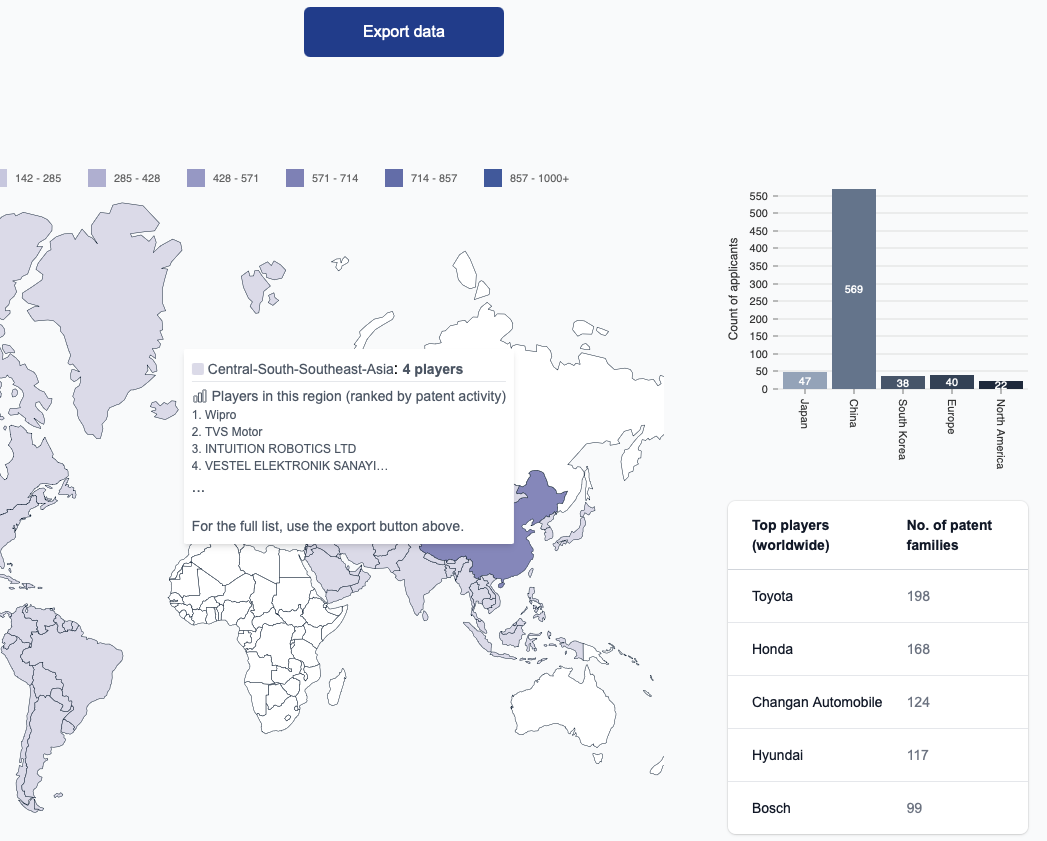

On the next screen, you can move the mouse over the map to see the companies with the most living patent documents in the selected technology areas and geographical regions of the map. You can use the Export data function to obtain the list of patent applicants (companies), including the selected ones, sorted by the number of living patent documents, in separate sheets for the different countries and regions. In our showcase, the selected startup company has a very good ranking in Europe and in the US as well (in the export file, not shown here).

The lower left part of the figure shows the distribution of patent applicants (companies) with the most active patents in Europe, North America, Japan, China and South Korea. The bottom right part shows the companies with the most active patents worldwide.

Patents are territorial rights, i.e. they are effective in the countries where they have been filed. In PATEV TechValue, the regionality of the patents is taken into account (in contrast to PATEV TargetSearch, which uses the location of the headquarters/patenting subsidiaries).

Figure 14: Screenshot of PATEV TechValue: Results by "mouse over" on the map for technological competitors with living patents there. Number of applicant companies per region, Top 20 competitors.

The following M&A relevant questions can be answered with this initial AI-based search and analysis tool PATEV TechValue:

Are there any patents pending or granted with the company in your mind (your client), as applicant/owner?

In which technology areas (as defined by AI) and countries are the patents of it?

In which regions/countries are the most third party (competitor) patents in these Technology Areas?

What is your client's patent position compared to its technological competitors? How many patents do they have compared to your client, in different countries/regions?

(Technological competitors: Companies with patents or patent applications in the same technological area(s) as your client. They can be potential suppliers or customers of your client as well.)

Does your client’s patent portfolio have potential monetary value based on its position in the competitive environment?

Together, the two PATEV Self-Service Tools provide a very good picture of patent positioning and thus an indication of the market positioning of technology-based companies, including those with computer-implemented inventions.

ARE YOU INTERESTED IN PATEV TECHVALUE ?

ORDER A FREE OF CHARGE DEMO BELOW OR CALL TO SCHEDULE A DEMO

tel: +4962025829917

[1] European Patent Office, "First time here? Patent information explained" [Online]. Available: https://www.epo.org/en/searching-for-patents/helpful-resources/first-time-here (accessed Jan. 30, 2025).

[2] Ocean Tomo, "Intangible Asset Market Value Study" [Online]. Available: https://oceantomo.com/intangible-asset-market-value-study/ (accessed March 5, 2025).

[3] World Intellectual Property Organization, "Intangible Assets and Intellectual Property,", WIPO. [Online]. Available: https://www.wipo.int/en/web/intangible-assets (accessed March 5, 2025).