M&A Strategy: Growthpal for Finding Potential Targets

GrowthPal’s AI-powered M&A copilot helps you identify off-market targets, validate fit, and accelerate deal execution turning strategy into action within days, not weeks. Let us look at the process of finding targets and evaluating their fit.

Instead of relying on traditional filter-based databases, Growthpal uses a multi-layered AI matching engine that understands the full nuance of a mandate—capabilities, geography, sector nuances, digital footprint, headcount patterns, funding history, hiring trends, leadership signals, and even inferred strategic intent. This allows it to predictively surface the most relevant companies, even those that might not appear in standard searches or industry directories. The result is a curated, high-precision recommendation list that dramatically reduces noise and gives Corp Dev teams and strategics the best possible starting point for each mandate.

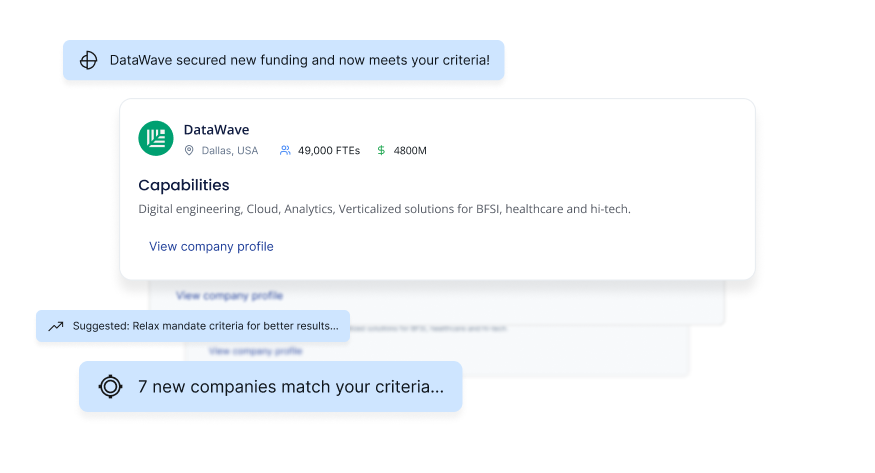

In our scenario here, Datavision in Dallas has a mandate to search for fitting companies with capabilities Digital Engineering, Cloud computing, Analytics etc.

Growthpal finds the company Datawave and proposes to review the company. In addition, seven additional companies are found.

Target capabilities automatically analyzed

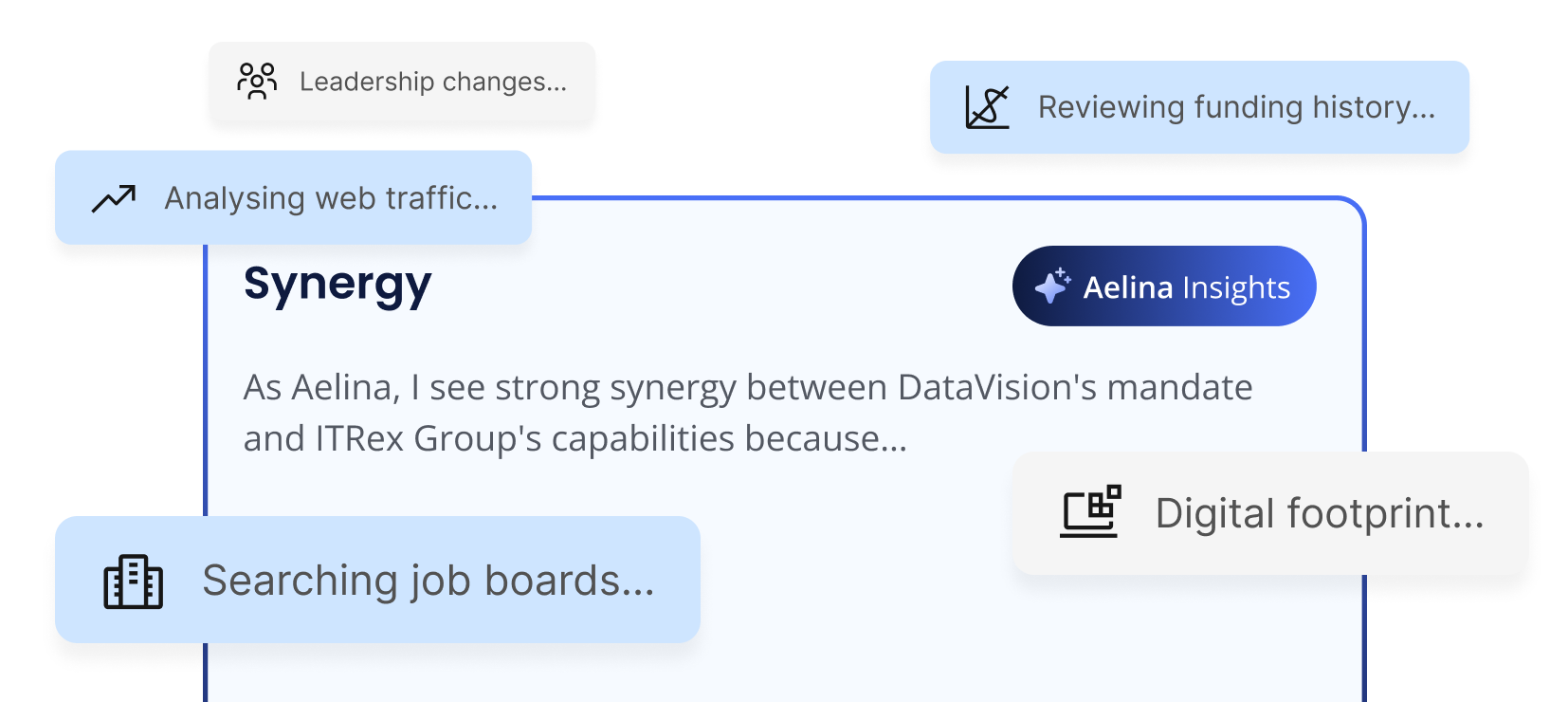

One of the other companies is ITRex. Growthpal automatically analyzes the potential synergy between Datavision and ITRex. It does so by analysing web traffic, funding history, ITRex´s digital footpring and job boards of the company.

Synergies automatically analyzed

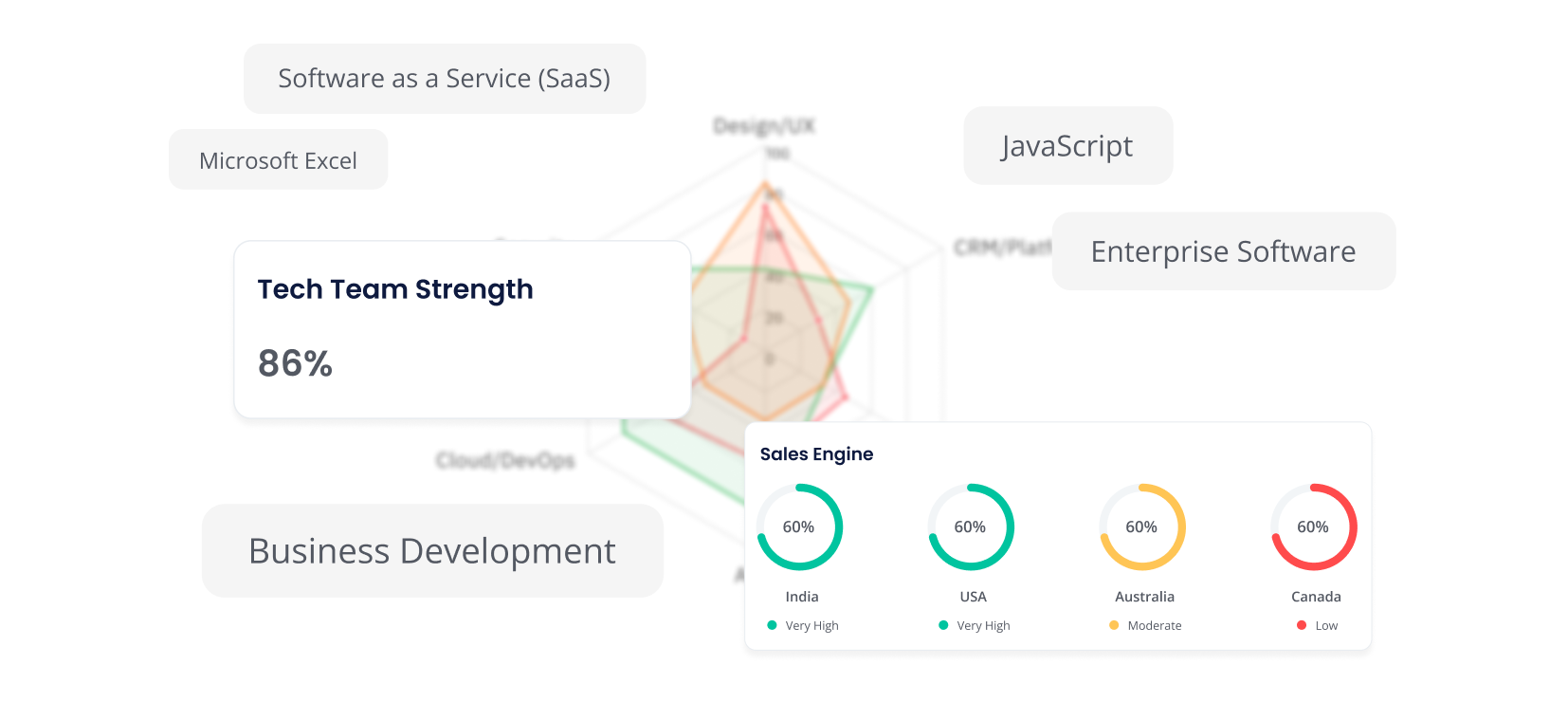

Team strength of targets automatically analyzed

Growthpal also provides powerful analysis of the team strength of ITRex by providing an overview of the different requested capabilities of the target company’s employees.

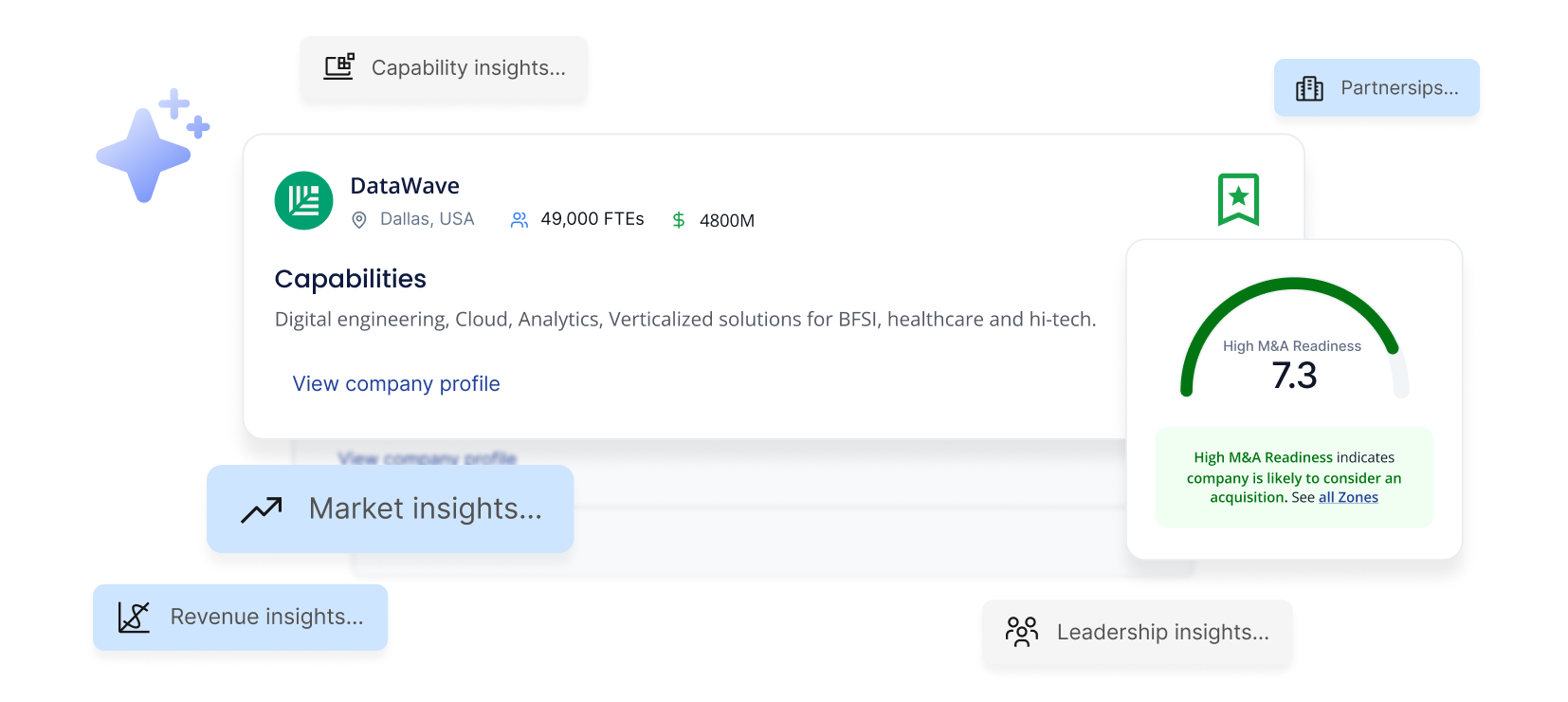

M&A Readiness analysis

The key question remains: is the company ready for being acquired? Growthpal evaluates key indicators and provides analytics about the readiness of targets for M&A. In our example the readiness of Datawave is 7.3 meaning the company is likely to consider an acquisition.

M&A Readiness analysis

Summary

GrowthPal’s AI-driven M&A copilot revolutionizes the process of finding and evaluating potential acquisition targets. Unlike traditional databases, GrowthPal uses a multi-layered AI engine that interprets strategic nuances such as company capabilities, geography, digital footprint, funding history, leadership signals, and inferred intent to deliver highly tailored recommendations.

Growthpal assesses readiness for acquisition based on diverse data sources such as web traffic and hiring trends. This approach enables corporate development teams to move from strategy to actionable insights much faster and with greater precision.