M&A Strategy: PATEV for Target Search

Dr.-Ing. Edelbert Häfele, Dr.-Ing. Klaus Illgner-Fehns, Dr.-Ing. Judit Inacsovszky, PATEV Associates GmbH

Customer Journey: Is IP relevant on SellSide and BuySide projects?

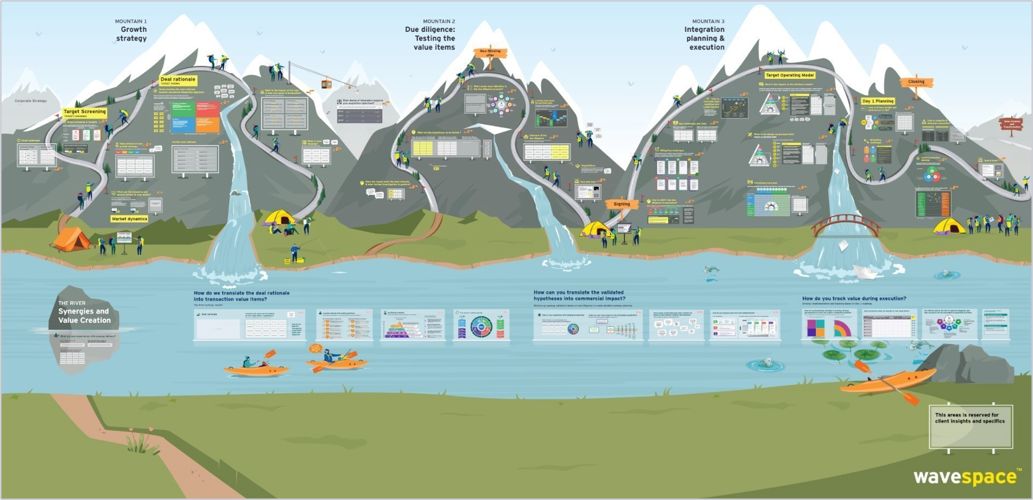

The M&A process is a long journey with many ups and downs. EY – one of our business partners - has put that demanding process in a nice picture with activities like climbing into mountains and crossing rivers - "a state of the art and fun to work with methodology".

In general, four phases follow each other.

M&A Strategy: Your company has a clear strategy to sell (parts of) a company and/or to buy a third-party company (or one of its business units). Key financials are in place and allow the development of an M&A profile, including a clear expectation of key markets, including related patented technologies and brand protection. AI-powered IP-based TargetSearch presents the best technology targets from around the world. Potential buyers - often larger companies with a strong IP-based market position. Potential sellers - often hidden MidCap or SME companies with a strong IP position that is being merged for value and not yet fully translated into market success.

Business Case Definition: Whenever strategy meets reality the big matching starts.

The business case now considers a specific setting. Two merging companies enter jointly in a competitive market. The business case scenario is driven by independent third-party data. Business case scenarios are the precursor of company valuation by example according to IDW S1 standard.

The business case should also be made for new market applications based on an improved patent position. Profit is king, so achieving a price premium through patent-protected technologies using well-known brands is an absolute must.

Figure 5: EY Strategy&Transaction GmbH, Dr. Georg Beckmann: B&I Journey

Due Diligence: With an attractive business case on the table, the due diligence phase can begin. All relevant assumptions need to be checked to avoid investing in risks: Overpaying or underbidding. All too often, both still happen.

Technological leadership is protected by strong patents - is this a hard fact or just a soft argument? Is the enterprise value in reasonable proportion to the independent IP value according to international standards such as IDW S5?

Post Merger Integration: This phase following signing and closing is the most challenging and integration is a must to realize the synergies. Integration is a team effort between the buy side and the sell side. The more know-how drives the combined business, the more the key development leaders/IP inventors need to be involved in the first steps of integration.

Joint IP bridges technology gaps to create a pole position for business development with new market applications through synergies based on IP-protected and highly profitable products and services.

Valuable part of the deal – which IP Assets are offered or needed?

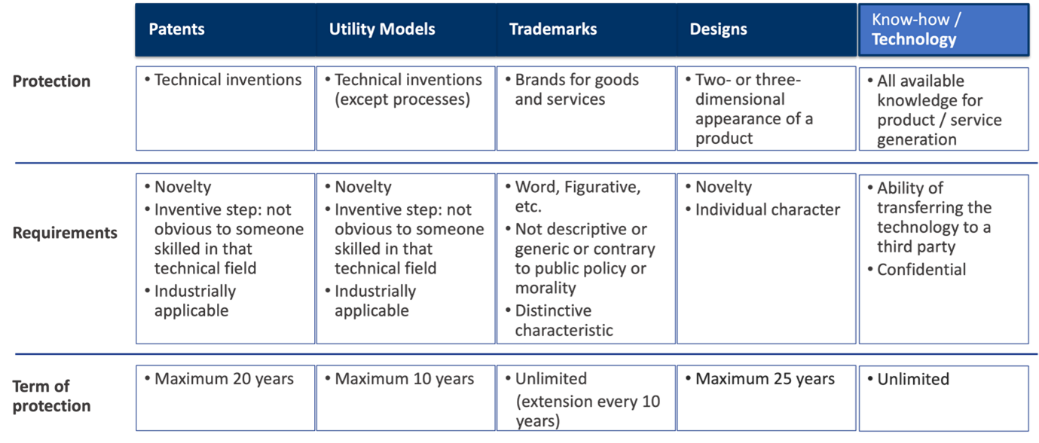

Let's look at Intellectual Property. What are the main types of Intellectual Property and what are their main characteristics?

Figure 6: IP summary

We use the term Intellectual Property Rights (IPR) synonymously with patents, patent applications, utility models, trademarks and designs. We use the term Know-how in a broad sense, including all intangible property such as licensed technology or confidential information, excluding patents. Know-how includes trade secrets.

Patents are granted for inventions in all fields of technology, if they are new, useful and non-obvious in the light of the "prior art" - i.e. all publicly available knowledge prior to the filing of the patent application. A patent is a set of exclusive rights, i.e. it allows its holder to prevent third parties from making, using, selling, offering for sale or importing the patented invention, except for certain forms or private and non-commercial use.

A patent application is usually published 18 months after filing. The whole examination and grant process takes several years, and in the end about 50% of applications are granted patents, often with amendments to the application, the rest being abandoned. A patent document with a separate publication number in a patent database may be a published patent application or an issued patent.

Please note that the legal function described above represents only one aspect of the broader picture! Other aspects are:

Patent documents contain comprehensive descriptions of inventions, including how they are constructed, used, and their benefits compared to existing technologies.[1] This provides deep insights into a company's design and innovation processes.

Patents often reveal technical details of research long before products reach the market, making them a valuable source for tracking the latest developments in a particular field.

By using patent information, consulting firms and analysts can gain valuable insights into companies' financial investments, in their technological strengths and innovation strategies.

The following table, compiled by PATEV and included in our IP Valuation reports, summarizes the commercial patent functions used in business contexts:

|

Patent function |

Explanation and examples of potential effects |

|

Protection |

Premium prices due to exclusive production and / or sale; cost reduction through internal implementation |

|

Stock / Improvement |

Preventive protection of future products and processes |

|

Obstacles to competition |

Patents not used by the proprietor; additional R&D expenses for competitors being restricted who need to invent around |

|

Cooperation currency |

Access to third-party technologies, markets and property rights of third parties; compensation for current or future license agreements |

|

Licensing |

Revenue from current or future license agreements |

|

Transfer/sale |

Revenue generation through sale |

|

Misleading information |

Misleading information about the company’s development activities, intimidation of competitors |

|

Reputation/ Motivation |

Employee motivation; remuneration-based incentives; improved corporate image; improved fundraising situation |

Figure 7: Patent functions

Apart from its function as a source of information, which is particularly prevalent in patents (and utility models), the most important function of IP from an M&A perspective is its potential economic value. Depending on the business context, any type of IP can be considered as an asset.

Recent observations show that intangible assets, particularly intellectual property (IP), have become an increasingly valuable component of a company's value:

S&P 500 companies: intangible assets account for up to 90% of total market value in 2020 (in 1975: 17%). [2]

Value chain contribution: IP and other intangibles contribute twice as much value as tangible capital to manufactured and traded products. [3]

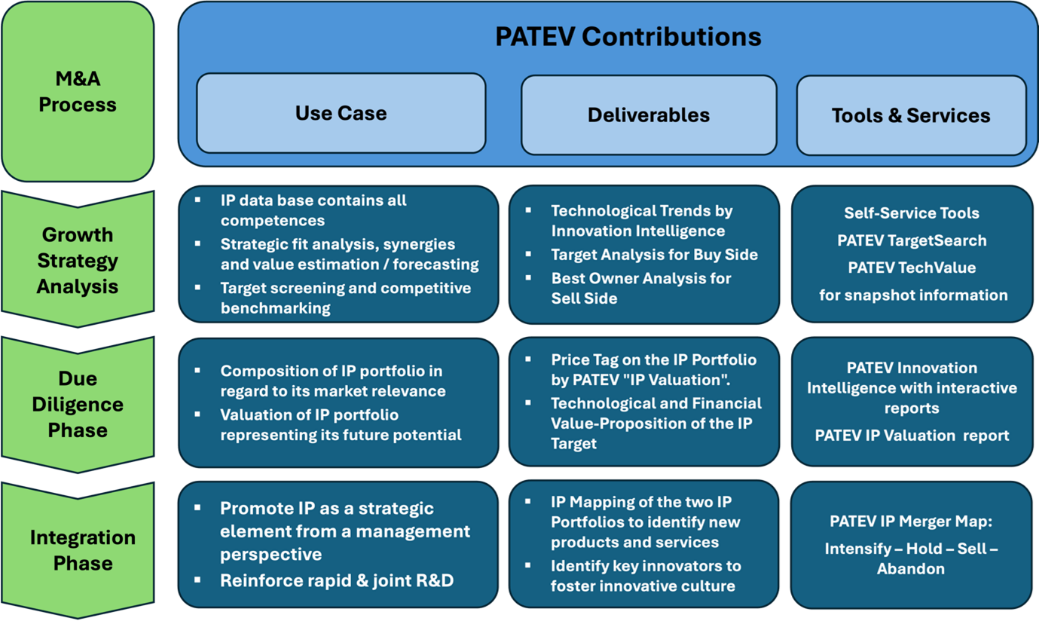

AI based Tools and Customized Services

In the M&A process we distinguish three phases, where different PATEV Tools, ready to use and different customized PATEV Services are applied in order to finalize a valuable deal.

Figure 8: PATEV Contributions

Growth Strategy Analysis: Two precious minutes to find the right targets and to determine their technological leadership position

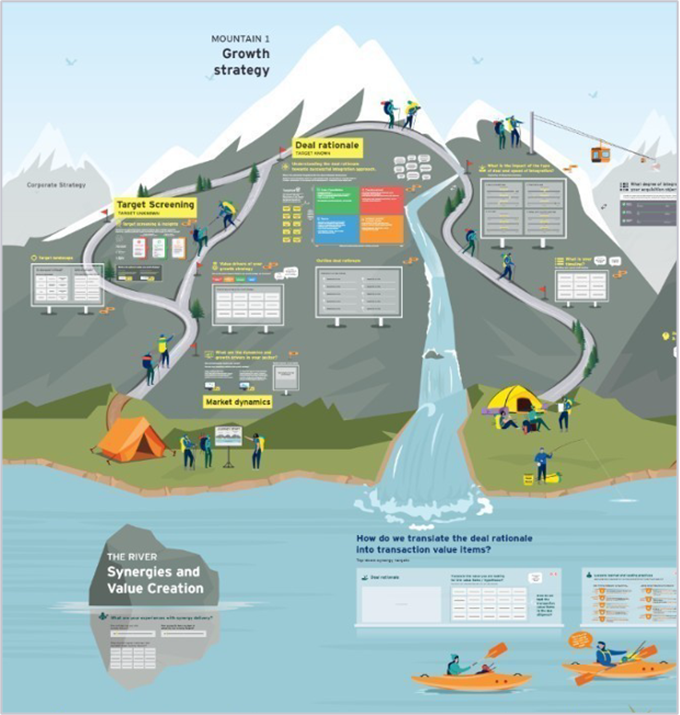

Figure 9: EY Strategy&Transaction GmbH, Dr. Georg Beckmann: B&I Journey, part 1

In this phase of the M&A Process it is most important to do a fast and reliable analysis of the names of the best targets (buy- or sell-side) and to get an instant overview of their IP based, technological leadership in the most relevant countries like EU, US, CN, JP and KR.

In sellside projects it is important to analyse instantly the relevant Corporates and their huge and international IP portfolio with thousands of Patents in ten or more languages.

In buyside project MidCap or even SME companies might be interesting. Then the analysis must be very precise in order to find also smaller corporates down to single inventors.

PATEV has developed two self-service tools against the background of patents as a source of business information and patents as a potential source of economic value.

In this context, self-service means that the tools are made available on the PATEV website and can be used by clients without the permanent assistance of PATEV. Introduction and support are part of the offer of PATEV, however.

Self Service Tool PATEV TargetSearch

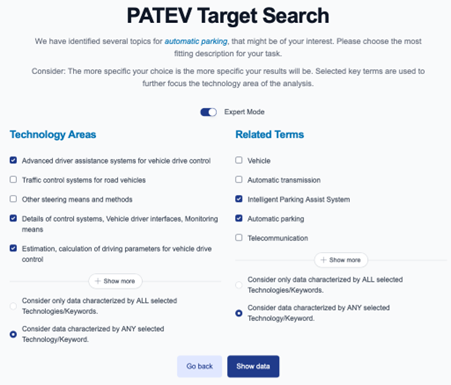

The starting point is to characterize the topics, technologies or product areas of your interest. Your task could be to find or to evaluate companies. This should be described using a few meaningful terms. Let us show an example.

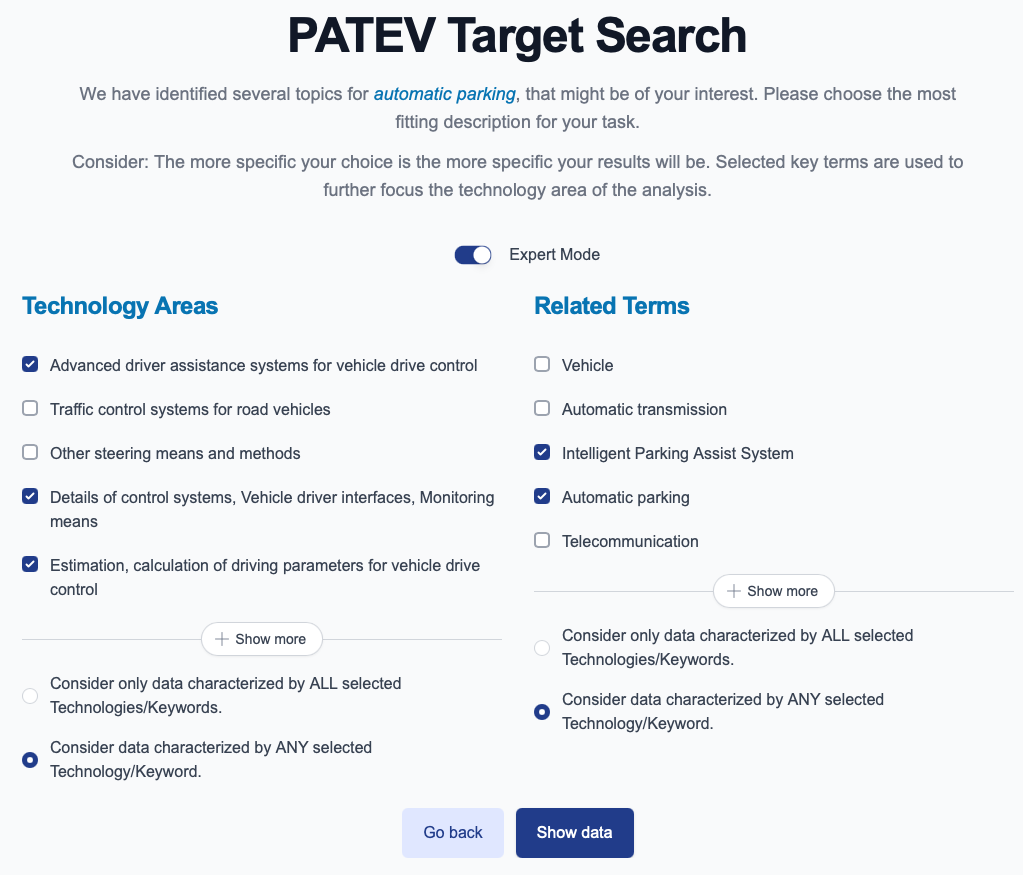

Your first input might be "automatic parking".

The tool will suggest some technology areas identified for automatic parking that may be of interest to you. You can select the most appropriate technology area descriptions for your task. The selected technology areas may contain thousands of patent documents. This is a thematic assignment by AI, not a formal one by the words.

In "expert mode" the search is narrowed and focused by some keywords (“Related Terms”) of your choice (see figure below). These terms are searched in the patent text, in the next step.

Figure 10: Screenshot PATEV TargetSearch Technology Area and Related Terms selection

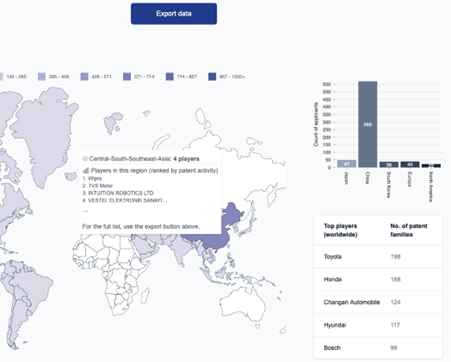

On the next screen you can move the mouse over the map to see the companies with the most patent families over the last 5 years in the selected technology areas and regions of the map. You can use the Export data function to get the full list of patent applicants (companies).

The top right shows the distribution of patent applicants across Europe, North America, Japan, China and South Korea. Below are the companies with the most patent families worldwide.

A patent family comprises patents/patent applications for the same invention in different countries and regions. PATEV TargetSearch works internally on the basis of patent families.

The regional allocation is based on the location of the headquarters/patenting subsidiaries of the companies.

Figure 11: Screenshot of PATEV TargetSearch results: Companies in the selected technology areas, "mouse over" for geographical regions of the headquarters

The following M&A relevant questions can be answered with this AI-based search and analysis called TargetSearch:

Which companies are currently dominant in your technology/product area and geographical region of interest (indicated by the number of their patent families)?

Which companies are the leading developers today and the key market players of the future? (Recent patent applications indicate current development activity and new current or planned products and services.)

In which geographical regions are the most recent patenting (=developing, with actual or planned production) companies located?

What is the ratio of the recent patent family volumes between companies? This is an indication of recent or projected product/service sales value or market share proportions.

Self Service Tool PATEV TechValue

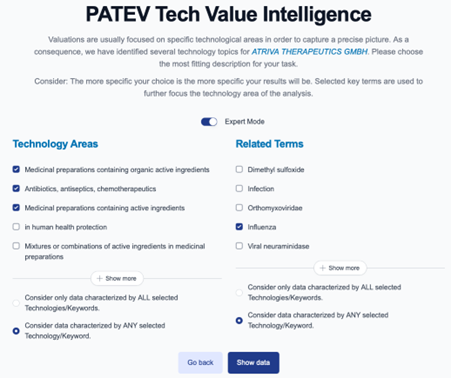

In the other self-service tool, the starting point is entering a company name. This company could, for example, be involved in an M&A scenario.

The main point of interest is to check whether the Target-company’s technological position correlates with substantial economic value by leadership in EU, US, JP, CN or KR.

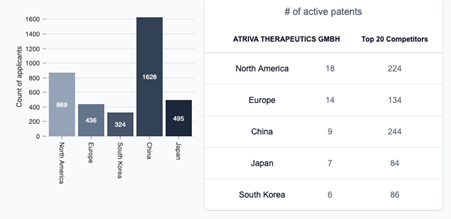

Your first input might be "Atriva Therapeutics". This is a fictitious example, the start-up company has no connection with any known transactions or PATEV projects.

Figure 12: Screenshot of PATEV TechValue: Company name selection

You select the "right" company names from a list that pops up – these are the patent applicant names that most closely match your input.

In the next step, the tool will suggest some technology areas identified on the base of the alive patents of the selected patent applicant (company or companies).

Here, "alive" or "active" means that the patents or patent applications are pending or granted and not ceased. Patents or patent applications may expire or be abandoned for a variety of reasons. For example, the products in which they were implemented are no longer manufactured. The owner decides not to pay the patent fees to the patent office and the patent lapses. The (simplified) legal status is "dead" from that point on. A dead patent is part of the state of the art, but it has no protective or restrictive legal force, so it has no value. The maximum term of patents can be 20 years, but this is rarely achieved. This is the case, for example, with standard-essential patents in telecommunications or in the manufacturing of pharmaceuticals.

The PATEV TechValue tool is based on alive patent documents with separate document numbers that are considered and counted (unlike TargetSearch, which considers patent families from the last 5 years).

You can select the most appropriate technology area descriptions for your task. The selected technology areas may contain thousands of patent documents, it is a thematic assignment by AI, not a formal one by the words.

In "expert mode" the search is narrowed and focused by some keywords ("Related Terms") of your choice. These terms are then searched in specific patent text blocks.

Figure 13: Screenshot PATEV TechValue: Technology Area and Related Terms selection

On the next screen, you can move the mouse over the map to see the companies with the most living patent documents in the selected technology areas and geographical regions of the map. You can use the Export data function to obtain the list of patent applicants (companies), including the selected ones, sorted by the number of living patent documents, in separate sheets for the different countries and regions. In our showcase, the selected startup company has a very good ranking in Europe and in the US as well (in the export file, not shown here).

The lower left part of the figure shows the distribution of patent applicants (companies) with the most active patents in Europe, North America, Japan, China and South Korea. The bottom right part shows the companies with the most active patents worldwide.

Patents are territorial rights, i.e. they are effective in the countries where they have been filed. In PATEV TechValue, the regionality of the patents is taken into account (in contrast to PATEV TargetSearch, which uses the location of the headquarters/patenting subsidiaries).

Figure 14: Screenshot of PATEV TechValue: Results by "mouse over" on the map for technological competitors with living patents there. Number of applicant companies per region, Top 20 competitors.

The following M&A relevant questions can be answered with this initial AI-based search and analysis tool PATEV TechValue:

Are there any patents pending or granted with the company in your mind (your client), as applicant/owner?

In which technology areas (as defined by AI) and countries are the patents of it?

In which regions/countries are the most third party (competitor) patents in these Technology Areas?

What is your client's patent position compared to its technological competitors? How many patents do they have compared to your client, in different countries/regions?

(Technological competitors: Companies with patents or patent applications in the same technological area(s) as your client. They can be potential suppliers or customers of your client as well.)

Does your client’s patent portfolio have potential monetary value based on its position in the competitive environment?

Together, the two PATEV Self-Service Tools provide a very good picture of patent positioning and thus an indication of the market positioning of technology-based companies, including those with computer-implemented inventions.

[1] European Patent Office, "First time here? Patent information explained" [Online]. Available: https://www.epo.org/en/searching-for-patents/helpful-resources/first-time-here (accessed Jan. 30, 2025).

[2] Ocean Tomo, "Intangible Asset Market Value Study" [Online]. Available: https://oceantomo.com/intangible-asset-market-value-study/ (accessed March 5, 2025).

[3] World Intellectual Property Organization, "Intangible Assets and Intellectual Property,", WIPO. [Online]. Available: https://www.wipo.int/en/web/intangible-assets (accessed March 5, 2025).