PMI: ABRAMS world trade wiki and Post-merger Integration

Dr. Jürgen Abrams

inigma LLC. ABRAMS world trade wiki is a division of inigma LLC

Post-merger integration (PMI) is key to realizing synergies from M&A. This section explains the primary goals and challenges of integration.

Why ABRAMS world trade wiki for PMI?

With the invaluable assistance and comprehensive resources provided by the ABRAMS world trade wiki, one can delve deeply into a multitude of strategies aimed at effectively integrating the intricate networks of suppliers and customers that underpin the global marketplace.

The insights gleaned from this powerful tool enable a thorough discussion surrounding not only the potential cost synergies that may arise from such integrations but also the opportunities for revenue growth that could significantly enhance overall profitability, as well as the various methods for optimizing distribution channels to ensure efficiency and effectiveness in reaching end consumers.

ABRAMS world trade wiki offers a wealth of market insights specifically designed to facilitate a greater degree of strategic alignment among stakeholders while simultaneously fostering processes that lead to meaningful value creation in a highly competitive environment.

Strategic Goals of Integration with ABRAMS world trade wiki

This section discusses the strategic objectives of PMI, such as cost synergies, revenue growth, and fostering innovation. A critical aspect of achieving these objectives is identifying potential synergies arising from the combined market positions of the two merged companies. The following steps and criteria can help in this analysis:

Analyze Supplier Networks

Evaluating the supplier base is essential to uncover opportunities for synergy:

Distribution Channel Optimization: Merged entities can streamline and integrate their distribution networks, removing inefficiencies such as overlapping routes or redundant logistical hubs, leading to cost savings and faster delivery times.

Overlaps in Distribution Networks: By identifying and addressing overlaps, companies can consolidate distribution points, resulting in reduced operational costs and better resource utilization.

Exploiting Purchasing Power: Combining procurement activities allows the merged entity to leverage increased purchasing volume, which can lead to improved negotiation power with suppliers, bulk discounts, and better payment terms.

Analyze Customer Networks

Understanding and integrating customer networks offers significant growth and retention potential:

Overlaps in Customer Bases: Analyzing customer overlaps enables the merged company to streamline account management, avoid duplication of efforts, and focus on delivering tailored services to retain loyalty.

Sales Power Enhancement: The combined market presence of the merged entity provides opportunities to cross-sell products or services across the expanded customer base, increasing revenue and deepening relationships.

Customer Retention Strategies: A strong focus on retaining key customers by leveraging the strengths of both companies—such as improved service offerings or better pricing—helps to maintain and expand the customer base.

Market Position Analysis

Conducting a detailed review of the market positions of both companies highlights competitive advantages and areas for growth:

Identify Competitive Advantages: The merger may create unique opportunities to combine strengths, such as complementary product portfolios or enhanced innovation capabilities, establishing a stronger market presence.

Address Market Gaps: By analyzing the market position, companies can identify gaps in their offerings or geographic coverage and use the merger to fill these voids, creating a more robust and comprehensive market presence.

Enhance Brand Positioning: Integrating branding strategies ensures a unified and stronger brand image, capitalizing on the reputation and strengths of both entities to solidify market leadership.

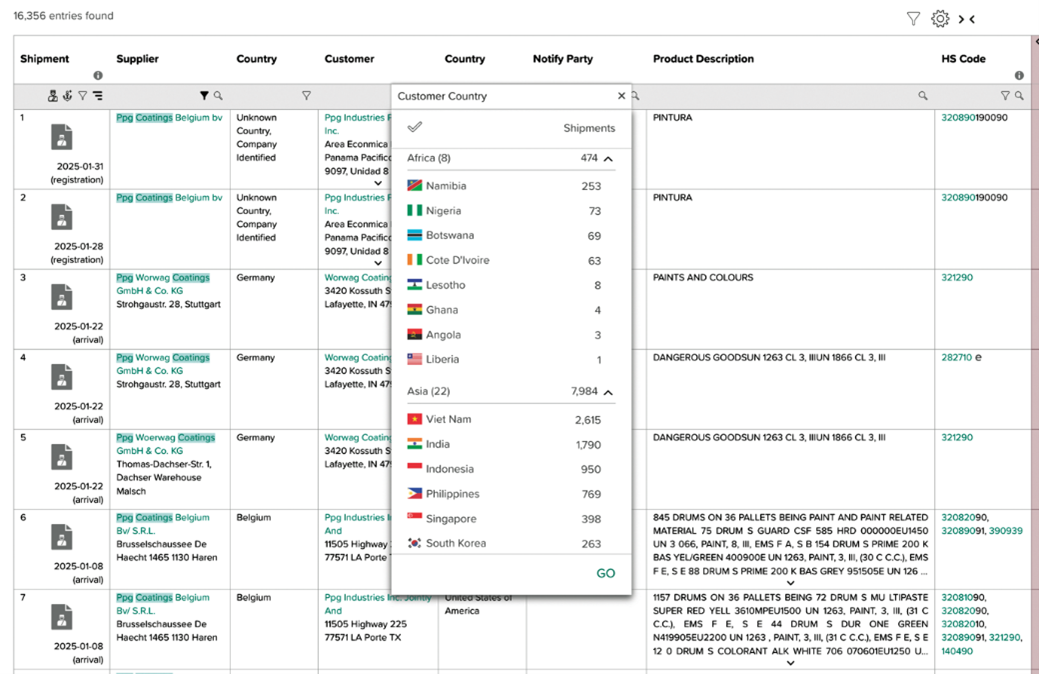

Here is an example regarding Company Transparency: The specifics concerning the shipment details that illustrate the principal customer countries associated with a hypothetical merger and acquisition target company, which specializes in exporting coating products, include notable countries such as Vietnam, India, and Indonesia, each of which plays a significant role in the company's overall market strategy and revenue generation.

Figure 36: Company Transparency: Shipment details showing the main customer countries of a theoretical M&A target company

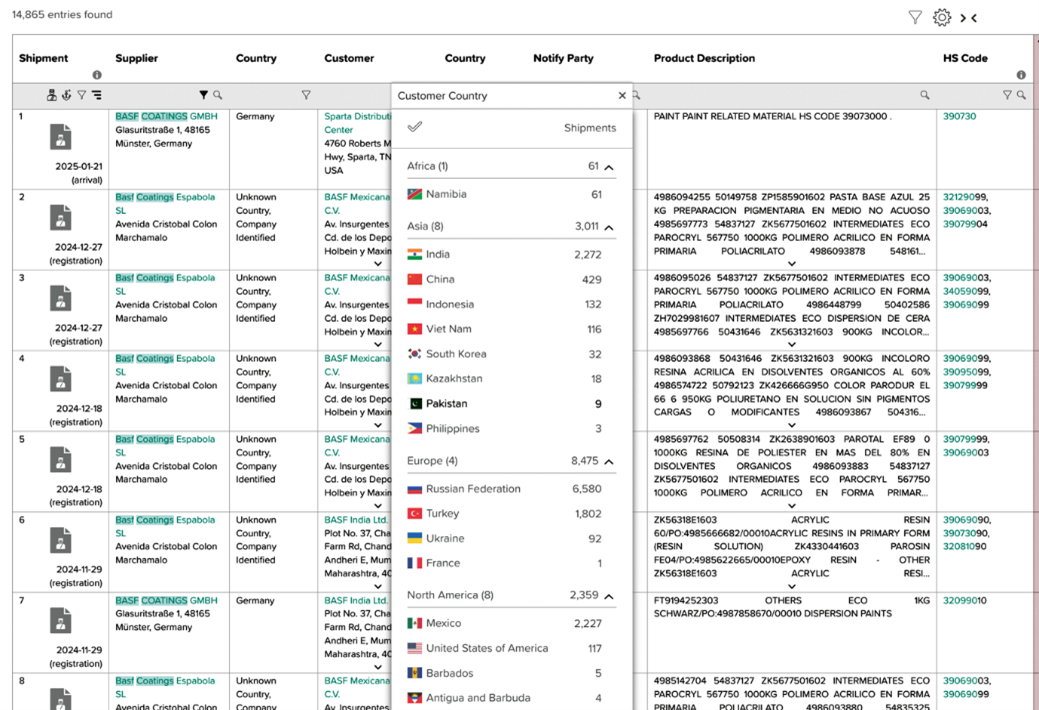

Next, we present additional details about the notion of Company Transparency, particularly focusing on the specifics of shipment data that highlight the main countries that are significant buyers for a hypothetical target company engaged in mergers and acquisitions (M&A) within the coating products export sector, where the primary customer nations identified are the Russian Federation and India.

Figure 37: Company Transparency: Shipment details showing the main customer countries of another theoretical M&A target company

This detailed analysis not only aids in defining the strategic goals of integration but also ensures that the merger delivers maximum value through well-identified and actionable synergies. A critical aspect of achieving these objectives is identifying potential synergies arising from the combined market positions of the two merged companies.

Abrams brings you value:

Faster, well-founded analyses for pitch and execution

Deeper insights (e.g., supply-chain risks, market modeling) that are often not covered internally

Competitive advantage over other advisors

Higher deal quality and a stronger negotiating position

Example: Contributions from ABRAMS wiki in target search:

Expand breadth via the supply‑chain view — not just the “visible” firms (large, public, registered) but also critical niche suppliers or specialized customers.

Cluster by role in the value chain — tier‑1, tier‑2, bottleneck, innovation supplier.

Quickly surface hidden champions — e.g., firms with little financial visibility that are key suppliers to industry leaders.

Regional additions — trade‑flow visibility reveals alternative targets across regions (e.g., reshoring options).

Value: the longlist becomes substantially broader and more strategic by factoring in operational relevance.