PMI: PATEV for Post Merger Integration

Dr.-Ing. Edelbert Häfele, Dr.-Ing. Klaus Illgner-Fehns, Dr.-Ing. Judit Inacsovszky

PATEV Associates GmbH

The integration of intellectual property (IP) in business mergers extends beyond simply combining patent portfolios—it can lead to significant strategic advantages and new market opportunities.

1.1 IP – Business Integration: Synergies and how they lead to New Market Applications

Figure 38: EY Strategy&Transaction GmbH, Dr. Georg Beckmann: B&I Journey, part 3

Even when the transaction is done and integration follows as the last step in the M&A process, some aspects with respect to IP should be considered. The result is more than just the combination of two patent portfolios.

One aspect is the necessity to review the entire combined portfolio in detail. It might happen that the position in some technological areas gains substantially in relevance leading to a much stronger market position. Note that there are no identical patents. Patents may address the same technological area and share certain elements, but they always differ in coverage. Therefore, it is important to create an understanding of how the coverage of a technological area increases by the combination of the two patent portfolios. The effect gets apparent in the heatmap created by PATEV’s Innovation Intelligence.

1.2 Leveraging heatmaps in IP Integration

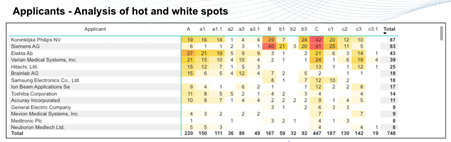

Heatmaps are used to compare the number of patents of companies in certain technological areas. The heatmap in the next figure shows that the portfolio of Siemens and VARIAN are almost complementary in the technological area A and c3. The numbers denote the number of patents in each technological category. The combination creates substantial value. It not only increases the protection of products but creates also new opportunities for licensing.

Figure 39: Heatmap based on the number of patent families of companies in three technological areas A, B, C, including a selected number of technical categories. Screenshot PATEV Innovation Intelligence Showcase Report VARIAN.

This extension of coverage may not only apply to the key technological areas investigated during due diligence, but specifically for larger portfolios, this could apply also to other technological areas. A broader coverage of technological areas may also allow to license a broader scope to manufacturing partners or even other market participants.

It is worthwhile to cross-check if protected technologies in the new portfolio could apply to different applications and use cases. Analyze the portfolio in the light of the new strategic direction of the company and market scope. „Innovation Intelligence" can be used to support this analysis.

1.3 Determine merger impact on key innovation fields

Another aspect is to check if the key innovation fields overall have changed by this merger. It might happen that for some non-core technological areas the position of the merged company gets much stronger. A larger portfolio with a higher relevance pushes the company in the diagram to the right making it a stronger market participant. The position for negotiations, for instance for cross-licensing, gets much better. It may turn out that this technological area is not in the scope of the company anymore. But a stronger and more relevant portfolio allows us to negotiate better licensing or selling conditions. Consequently, for all technological areas covered by the new merged portfolio an "innovation intelligence" should check its new relevance and coverage.

Inventions and innovation flourish only if the culture and environment of a company recognizes and appreciates innovation. Inventions and innovation must be appreciated by the management. The management must clearly communicate that innovations and patents are a key element in its strategic positioning. And it must become apparent to the employes that patents contribute to the value and commercial success of the company. A key task will be to make sure that this spirit prevails in the newly merged organization.

Something one might easily oversee is that inventive ideas require highly skilled employees with the drive to invent. Roughly speaking there are two types of inventors. Some call for an environment with little constraints where they can basically work freely on topics, more like university researchers. Here, disruptive new ideas are likely to be invented. Companies need to sell products and services for which permanent innovations are needed. This requires that innovators understand market demand and market developments and are integrated into the strategic positioning of the company.

Whatever the type of inventor, it is vital for the new company to identify and retain key inventors. Their knowledge and expertise are needed to exploit the technology claimed in the patents. It is therefore particularly important to keep the inventors of the acquired company on board. They should feel comfortable and be assured that the innovation-friendly environment they know will remain intact. Experienced innovators are multipliers in the company and help to train other colleagues. It is important to monitor the integration of two companies from this point of view as well.

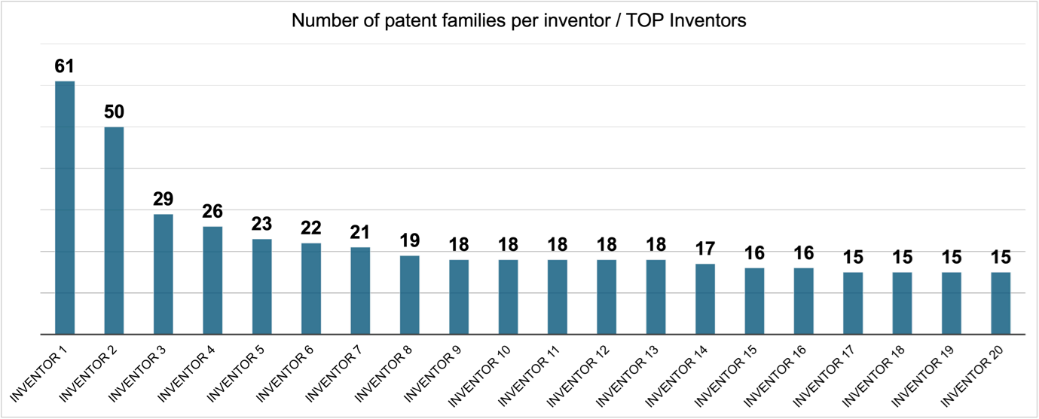

Although companies should have the means to identify key innovators from their HR databases, this may not be trivial, especially in large companies. Patent research is an efficient way to easily identify the key innovators. The next figure analyses the inventors of the patents filed by VARIAN. It appears that there are at least 20 key people who have contributed to at least 15 patents. Note that patents usually have several inventors. Cross-checking the names with internal employment records would then allow their current role and position to be identified and provide incentives for them to stay in the company.

Figure 40: Number of inventions per inventor, PATEV Innovation Intelligence Showcase Report VARIAN

In conclusion, a detailed review of the merged portfolio is essential to understand the enhanced technological coverage and its impact on market positioning. Tools like heatmaps can reveal complementary strengths.

Moreover, the merger may shift the company's position in key innovation fields, potentially strengthening its bargaining power for cross-licensing and negotiations. Beyond the technical aspects, fostering an innovation-driven culture is critical for sustaining long-term success. Retaining key inventors from the acquired company ensures continuity in innovation, as their expertise is vital for leveraging the newly integrated IP. Identifying these innovators through patent research and incentification their retention can maximize the value derived from the merger.