Due Diligence: PATEV for Commercial Due Diligence

Dr.-Ing. Edelbert Häfele, Dr.-Ing. Klaus Illgner-Fehns, Dr.-Ing. Judit Inacsovszky

PATEV Associates GmbH

Figure 21: EY Strategy&Transaction GmbH, Dr. Georg Beckmann: B&I Journey, part 2

In the Due Diligence phase of the M&A process, especially in the Commercial Due Diligence, a detailed value analysis has to be done answering mainly two questions in detail:

r How strong is the technological impact of the IP to be aquired on the business of the merged company?

r The technological impact can be analyzed by a Deep Dive Analysis in IP and Technology by PATEV "Innovation Intelligence", a Microsoft Power BI application, readable by the management.

r What financial value (price tag) has the IP to be acquired?

r This Price Tag of the IP Portfolio by PATEV "IP Valuation" is a baseline of the Corporate Value. The Expert Opinion is done according to international Standards like IDW and ISV standards on Patents, Utility models and Know-how, Brands and Design patents.

1.1 PATEV Innovation Intelligence insights: Good or NOT?

Patents can be granted for inventions in all fields of technology. A sophisticated analysis of the patents filed worldwide allows for deep insights into selected industries, market situations, and even some kind of forecast of market development as new patent applications describe current developments mostly before products being launched. "PATEV Innovation Intelligence" is a service supported tool which is designed specifically for such analysis. The unique power lies in its ability to operate on different levels of granularity as it helps to identify markets, analyse specific companies and compare them with other competitors and even drill down to each individual patent which was identified as relevant for the technical field.

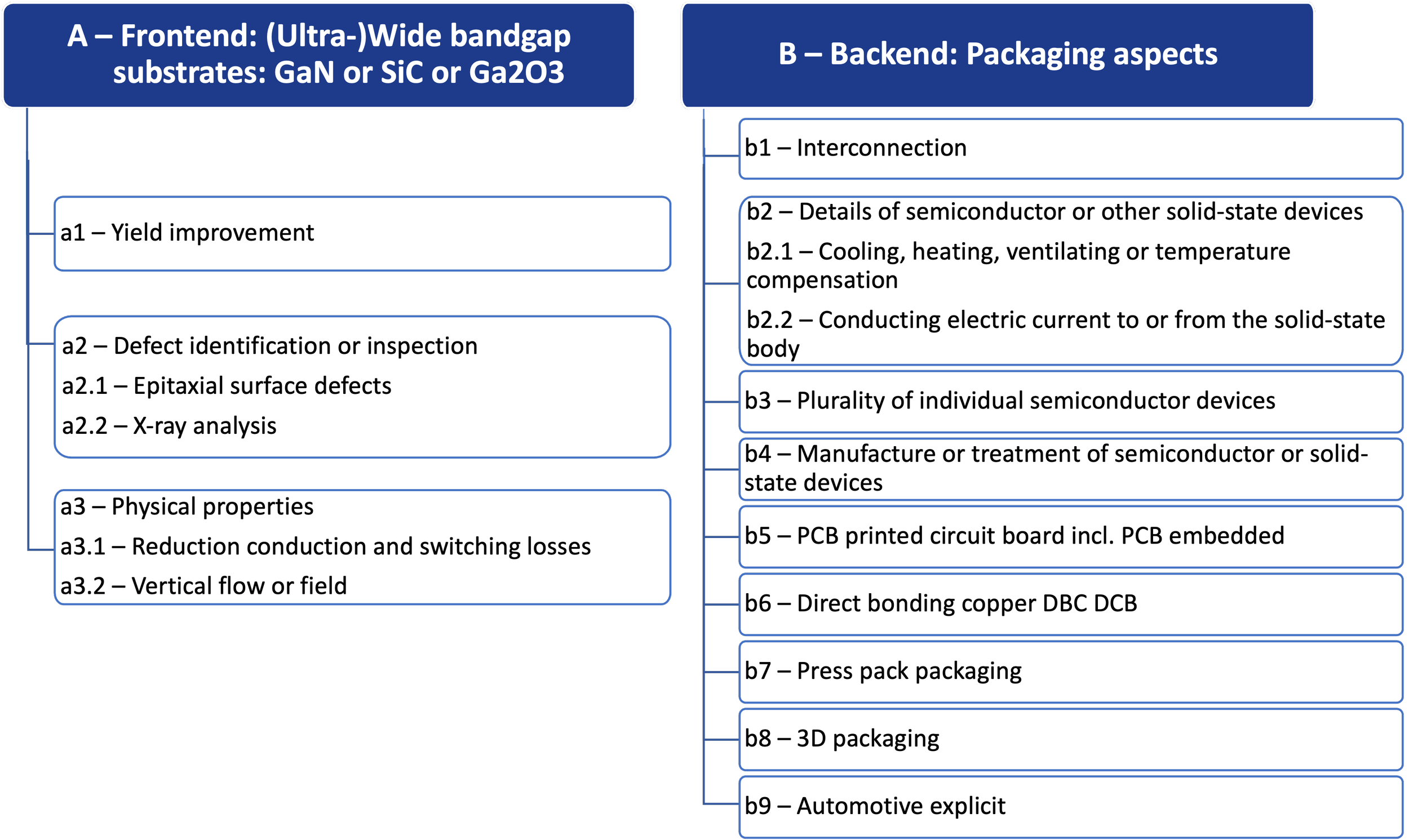

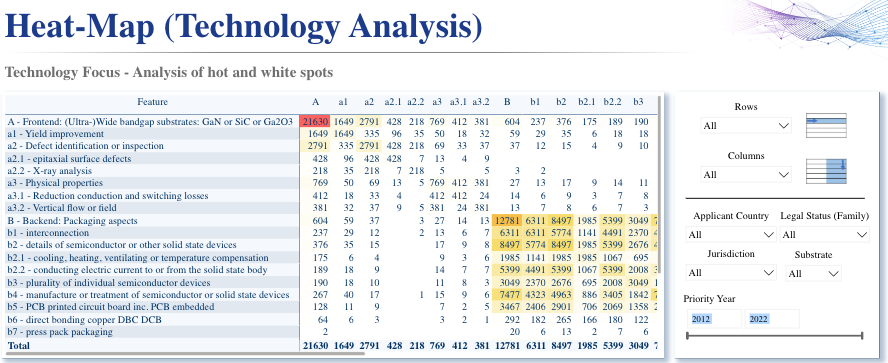

Typical industry categories like semiconductors, automotive or chemicals are too broad for a deep analysis. Therefore, the "industry" needs to be narrowed down to a specific technological area. Even this can still be very broad. For detailing the area of interest, the starting point may be a technical area of a specific company but is not restricted to it. Furthermore, it might be of interest to check not only for specific technologies but also for applications for those technologies. There might also be different technical approaches to solve a specific technical problem, it might be different elements which together create a larger entity, like die, bonding, packaging etc. which together create a chip. An example is given in the figure below. Two technological categories have been selected, the frontend side which is structured into three technological groups, and the backend side, again structured into different aspects relevant on the backend side.

Figure 22: Example of how to structure features of a technology area within an industry. PwC Strategy& - PATEV: Semicon wide-bandgap and packaging innovation analysis, July 2023.

Hierarchical maps are well suited to structure the different related aspects of a technological area. This identification of technologies, areas, applications is key for a successful deep dive analysis. Bottomline, it is important to carefully characterize those terms, in order to optimally guide the query definition and subsequent search in the patent databases.

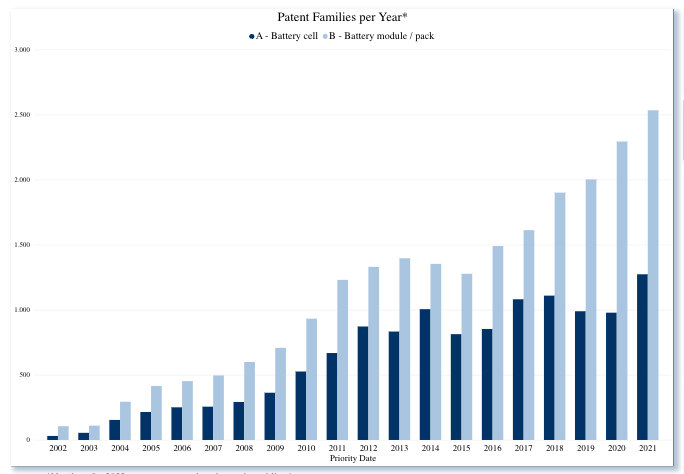

Once patent literature has been searched and the retrieved information is being processed, an extensive and comprehensive analysis is possible providing a deep market insight. An overview of the patenting activities over time (see next figure) gives an insight into when there was a high interest in this domain and when companies spent resources to develop new technologies in the selected field. A sharp increase indicates that companies identified this area as very important while a decrease signals that the relevance of the field goes down. There are several takeaways from this information. If the increase in patenting activities is very recent[1], it means that there is high expectation in future business. If the technology area might affect the company under investigation, you should check the positioning of the company in this field. Maybe it is a good point in time to buy another company which is very active, just because our company has no resources, only little knowledge or simply is too late in the development.

Figure 23: Patenting activities as number of filed patent families (priority: first filing) per year in the selected technology areas. PwC Strategy& - PATEV: EV Battery Innovation analysis, November 2022.

However, a decline in activity does not mean that the technology has lost its relevance. Rather, it may be time to check whether the expectation that the technology was developed has been realized in the marketplace, i.e. whether products based on the patents have entered the market. Although companies usually file patents during technology and product developments, there is no guarantee that a strong portfolio correlates directly to a strong product portfolio and market position. So, it might be time for consolidating portfolios. Companies may want to sell their portfolio because they failed to get traction in a market or want to find partners with complementary portfolios to secure or enlarge their market.

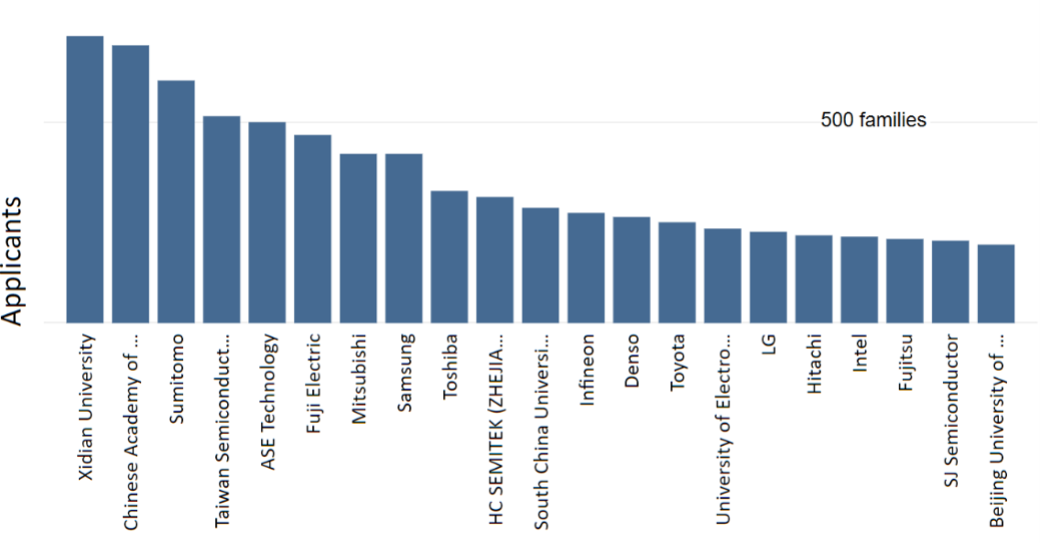

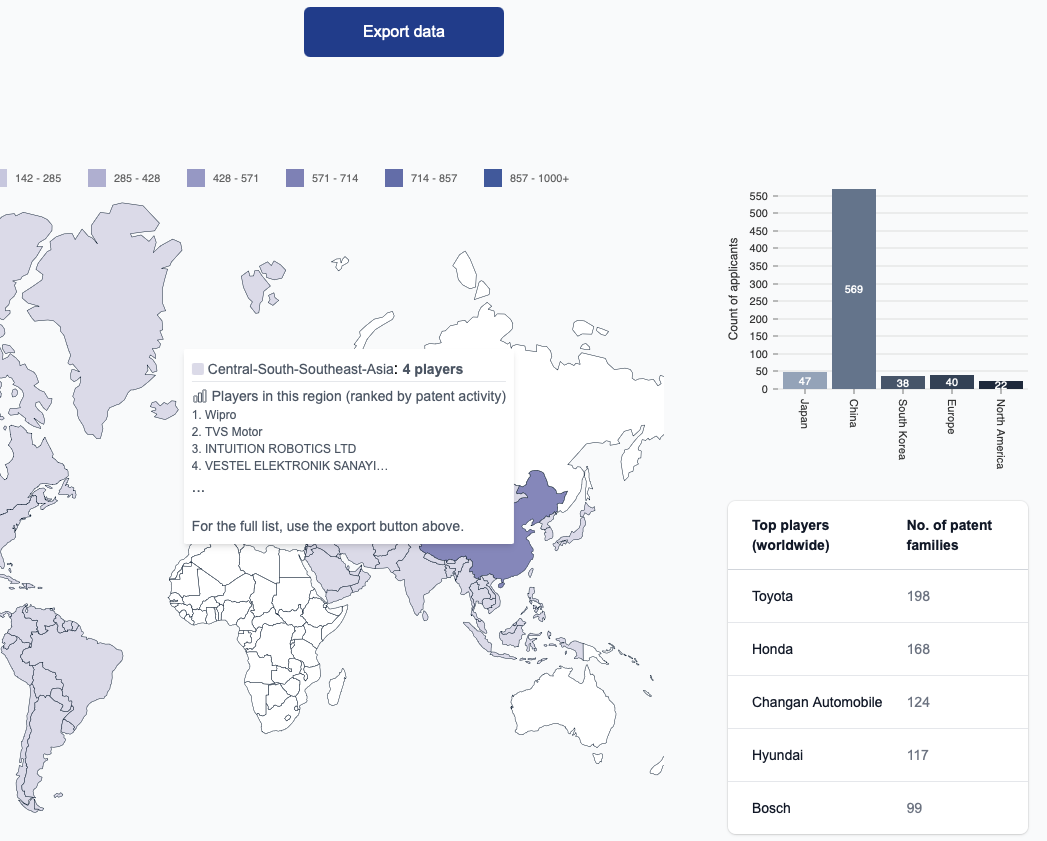

"PATEV Innovation Intelligence" reveals the companies that are active in this area. The most relevant companies are those which have filed the largest number of patent families compared to other companies active in the field (figure below). Filing patents is costly, so for the respective companies this technology is of high commercial importance. At the same time, it demonstrates a high level of competence.

Figure 24: Top applicants in a technology field rated over the number of patent families. PwC Strategy& - PATEV: Semicon wide-bandgap and packaging innovation analysis, July 2023.

There is one more important market insight. Over how many companies are most patents distributed? A very diverse field could be interpreted as it is relatively easy to get into this technical area. When many companies are working in the same field while each of them must differentiate[2] from the others, there is a high likelihood that there is a high number of quite specific[3] patents. In contrast it could also be seen that only a few companies filed most of the patents, hence these companies are the key players in this technology area.

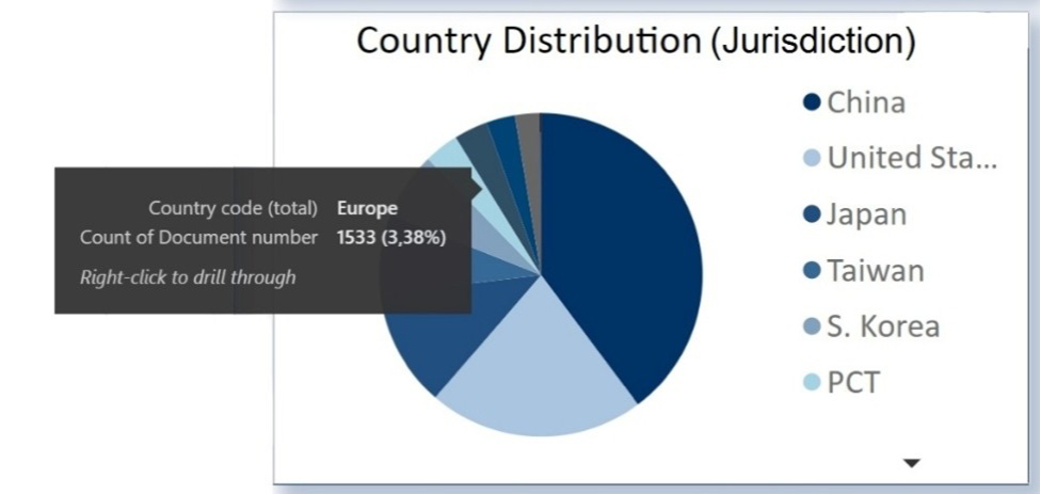

A patent family is a set of patents filed in different countries for the same invention. The distribution of patents across countries provides further insights as it reveals which regions are the commercially most interesting. More important patents are usually filed in those countries where products are manufactured and / or sold or in case of recent developments where those markets are expected. In the example below China has by the far the biggest share in patent coverage which attributes to the fact that China is both an important market and at the same time an important manufacturer. The technology under investigation in the example is for instance relevant for e-mobility. At the same time, it is revealed that Europe does not play a relevant role in this domain.

Figure 25: Geographical distribution of patents. PwC Strategy& - PATEV: EV Battery Innovation analysis, November 2022.

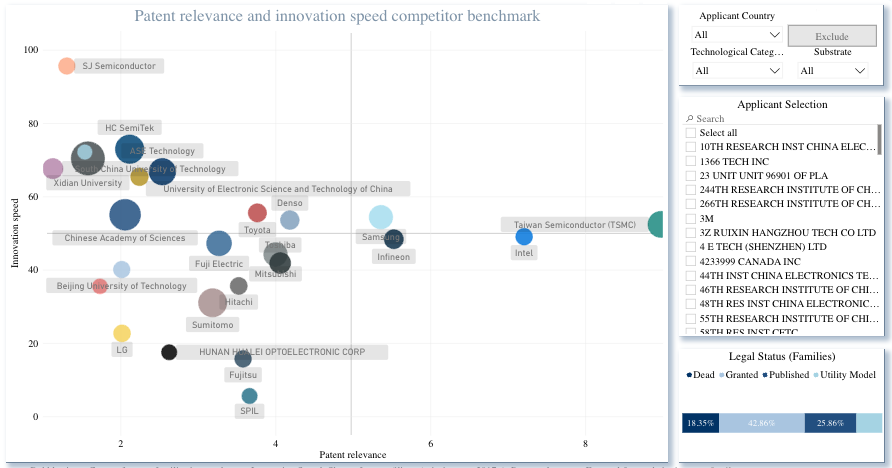

The absolute number of patents is only one important dimension. There are patents which obviously cover a fundamental technical element, while there are also patents which are very specific and address a technical niche. To really understand the company’s IP portfolio from an M&A perspective it is important to know the relevance of the patents in its portfolio. If a patent is of high relevance, it will frequently be cited by other, later applications. The forward citation, very similar to the citation index in the scientific literature, is a reliable indicator for the relevance of a patent. The diagram generated by PATEV Innovation Intelligence (next figure) shows average numbers for the patent relevance. A high or low patent relevance represents high or low relevance of the entire portfolio. When looking into the company relevance there is another criterion: the intensity of development or how much the company focuses on the subject. A suitable indicator is the relation of patent filings in a certain recent time frame to the total number of patents filed by that company in that technology area. Combining this criterion termed "innovation speed" with the forward citation index creates a very instructive diagram.

Figure 26: Performance analysis in selected technological categories

It can be read somehow like a SWOT-diagram. Companies with a high innovation speed and high patent relevance appear in the top right corner, while companies with little focus (low innovation speed) and low patent relevance appear in the lower left corner. The radius of the circle indicates the number of patent families filed by that company in the technology area under investigation. In this example well known large companies lead in terms of relevance. However, this might not be always the case, as in this analysis small companies can show up with a high relevance, which will not have been identified by just looking at the sheer number of patent families. Those companies with relevant patents, often having only a small portfolio, can be of high interest for M&A.

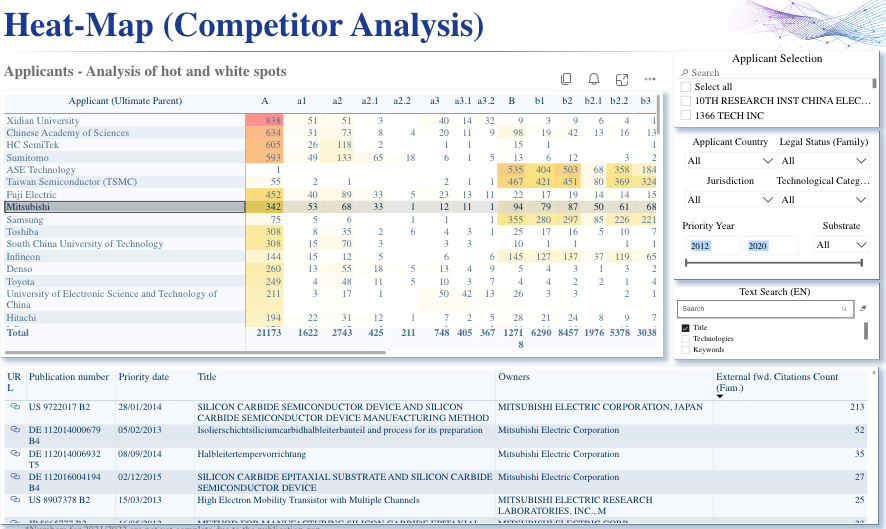

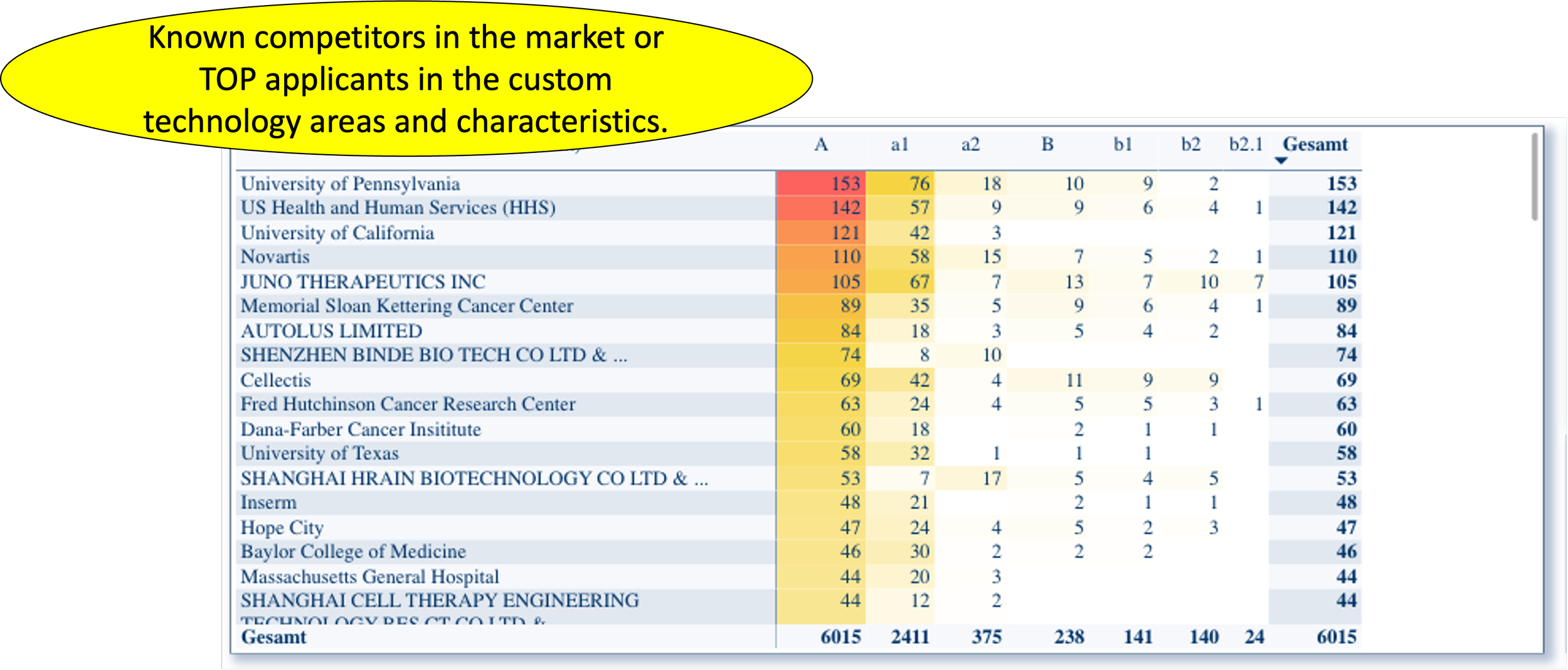

So far, the analysis was on the technology area in total. Nevertheless, the specification of the features at the beginning was more detailed. For a more detailed view, the complete analysis as described up to now can be done also on individual feature categories (e.g. A and / or B). Listing the number of patents per individual feature reveals in more detail what the company is really focusing on in a specific field (next figure)[4]. In this example ASE Technology for instance has no activities in the frontend (category A) while it has substantial activities in the category B (backend). This so-called "White Space Analysis" makes areas with little or even no activity apparent. In contrast, Sumitomo focuses mostly on frontend with very little activities in the backend. Assuming Sumitomo would like to strengthen its position also in category B, then this analysis of the patent distribution over the features would indicate that a combination of Sumitomo with ASE Technology would create a very powerful portfolio. Also, direct competitors can be identified which work on the same technology area and feature, like Fuji Electric and Mitsubishi. A check back on relevance (see figure before) shows also similar positions in average.

27: Competitor heatmap as a listing of patenting activities for each individual feature. PwC Strategy& - PATEV: Semicon wide-bandgap and packaging innovation analysis, July 2023.

Furthermore, PATEV Innovation Intelligence allows to drill down into the individual patent families and patents. Here, it becomes apparent that Fuji’s most relevant patent family has a citation count of 50 while Mitsubishi has a patent family in this field with a forward citation count of 213.

So far only individual features have been analyzed. At the same time patents may apply to several features. Correlating two features brings new insights regarding the coverage. In the example shown below there is a high correlation between the features in category B whereas in category A there are even some white spaces. White spaces indicate that there is no patent covering both aspects. As an intelligent combination of features may fulfil the novelty criterion, such white spaces signal potential for new applications. Obviously not all combinations are sensible. From an M&A perspective this view on the portfolio could signal additional market potential by addressing those white spots.

Figure 28: Technology Heatmap visualizing correlations between two technology features. PwC Strategy& - PATEV: Semicon wide-bandgap and packaging innovation analysis, July 2023.

The analysis of filed patent applications provides a powerful tool to get insights into the market situation in a specific technology area and the position of companies in this area. Answers to the following questions can be found:

Who is leading the development in a certain technology area / product or applications?

What is the strength of a company in a certain technical field?

Who are key competitors?

When did relevant developments happen?

Who has made relevant developments?

Where are technical gaps in the coverage?

Which are the most active geographical regions?

What is the innovation speed?

How relevant are the patents?

Are there any hidden champions?

Relating to M&A, the answers to these questions could help

to pick the right company with the best IP fit

to find hidden champions

open up new dimensions for M&A success

1.2 Valuation of IP Assets: Real Value or Substantial Risk?

In the due diligence phase, a key step in the M&A process is valuation. IP can represent a significant part of the company's value, up to 90%. The focus should therefore be on IP valuation.

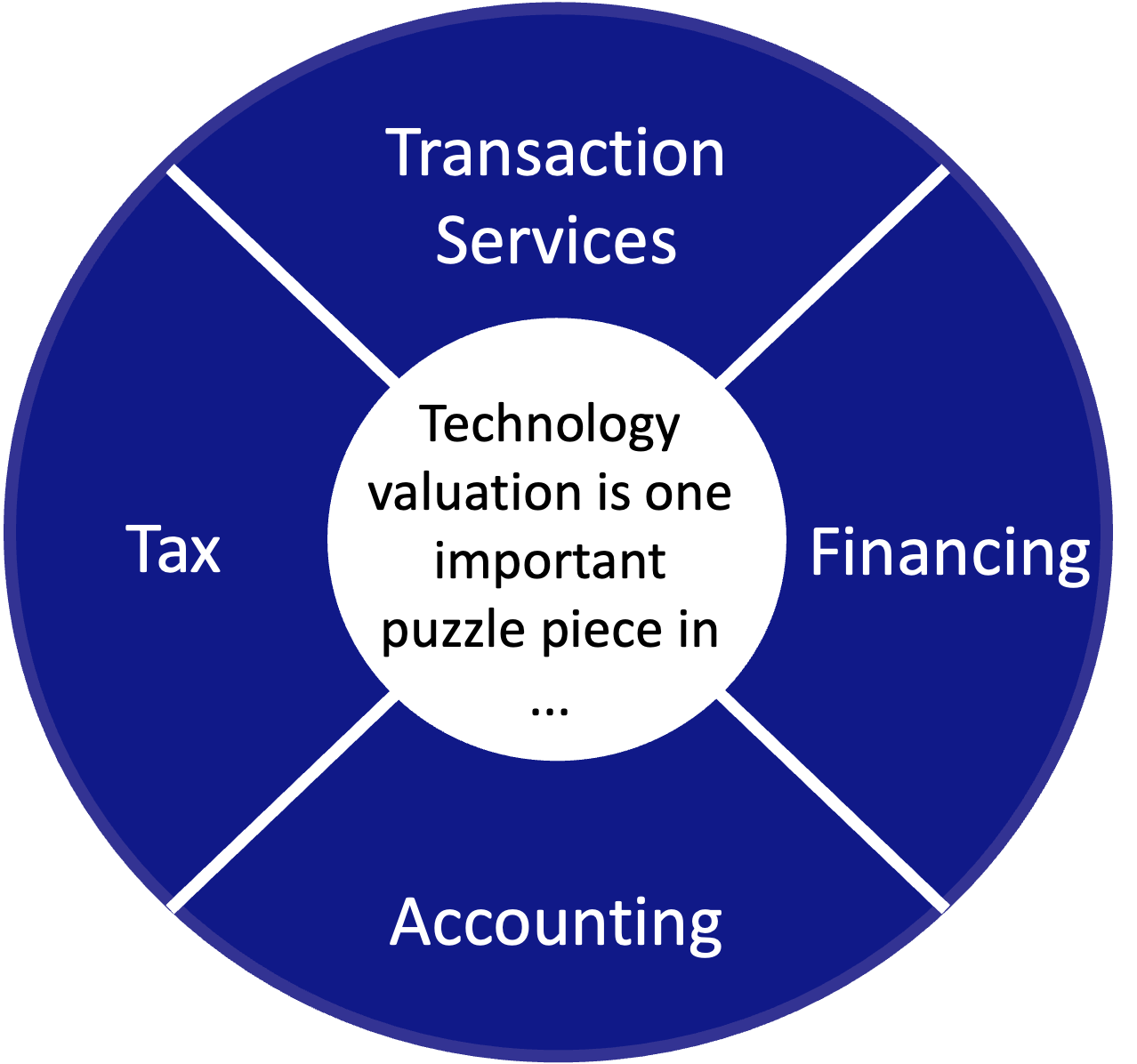

In M&A and other occasions, there are four applications of the valuation of IP. The following figure is a schematic representation and grouping of these occasions.

Figure 29: Main applications for IP valuation

The following is a detailed list of valuation situations - all of which can be solved by a PATEV valuation service using IP analysis tools, sometimes in cooperation with advisors and consulting companies.

Transaction services

Typical transactional situations include Mergers, Acquisitions, Corporate/Business Transactions, Licensing and Technology Transfer.

M&A: Valuation is needed to assess the fair market value of IP assets for negotiation, pricing and integration planning. Proper IP valuation prevents buyers from overpaying or overlooking hidden IP value. Some IP rights, such as licenses, may not be transferable, affecting post-merger integration. Part of the M&A process is determining strategic fit - assessing how the acquired IP fits with the buyer's existing portfolio and business strategy. In addition, an IP valuation helps to forecast the revenue potential of the acquired IP.

In an M&A journey, valuation can play a role in several steps of the process:

Due Diligence prior to an acquisition: Before acquiring a company, the acquirer conducts due diligence to evaluate the target's assets, including its IP portfolio. The objective is to identify and evaluate the quality, scope and financial value of the target's IP assets to ensure that they are aligned with the acquirer's strategic objectives and do not present significant risks.

Negotiation and pricing: During the negotiation phase, both parties must agree on the value of the target company, including its IP assets.

Especially in IP and Know-how driven deals the collaboration with STIFEL Investmentbank[5] has shown a clear relevance of IP Valuation, in Business Cases where the Business Value based on Profits was not an option. Even with no Profit but a clear Value Proposition based on technological leadership has shown up with high revenues in the transaction.

Financing and investment decisions: Acquirers may need to value IP assets in order to secure financing or attract investors for the acquisition. They need to demonstrate the value of IP assets to lenders or investors to ensure adequate financing for the transaction.

Valuation for Purchase Price Allocation (PPA): After the acquisition, the purchase price must be allocated to the acquired assets, including IP, for financial reporting and tax purposes.

Post-Merger Integration (PMI): After the acquisition, the acquirer integrates the target's IP assets into its existing portfolio. The valuation is necessary to assess the value and strategic fit of the acquired IP, to ensure effective integration and to maximise synergies.

Corporate/Business Transactions: IP valuation is often required in various corporate transactions, including spin-offs, IPOs, divestitures and restructurings. It is necessary to assess the value of the IP assets involved in the transaction and to ensure fair treatment of all parties. Valuation can help identify and sell off unused or under-utilized IP assets.

Licensing: IP owners may wish to monetize patents, trademarks or, for example, copyrights through licensing deals. When licensing IP to third parties, it is essential to determine appropriate royalty rates and license fees. When negotiating licensing agreements, a fair License Fee determination ensures that both parties enter into a fair and profitable agreement.

Technology transfer: Universities, research institutions and companies may value IP for technology transfer and commercialization purposes. Licensing, spin-offs or technological partnerships are common opportunities.

Finance

Startups and other R&D-intensive companies seeking investment often need to value their IP to attract investors or secure financing. Companies may use their IP Assets in Financial Engineering. A credible valuation can enhance the ability to attract investors or obtain loans. The purpose is therefore to demonstrate the value of IP assets to potential investors or lenders. Studies show that patent and trademark applications are real funding boosters. [6] [7]

IP based financing in leasing structures like Sale and Licensing Back (SLB):

Using IP Sale and Licensing Back structures in Financial Engineering is well known in US and is more and more used in Europe, too. Doing so, the IP Assets (brands or patents) are bought by the Buyer, a Specific Purpose Vehicle PPV. So the Company gets money for its secret reserves. For further use of these IP Assets the company pays monthly license fees. At the end of the agreement, often after 5 years, the IP Assets are transferred back to the company, the former owner.

Venture capital and private equity decisions: Investors assess the IP portfolio before committing capital. Startups and growth stage companies often rely on their IP portfolio to attract venture capital (VC) or private equity (PE) investors. Investors need to understand the value of the company's IP to assess its potential for generating future revenues and competitive advantages.

Debt Financing: Debt advisory is getting more and more important in Corporate Finance[8]

Debt Funds require a reliable valuation of IP assets before accepting them as a key value in the Financing Structure.

Initial Public Offerings (IPOs): Companies preparing for an IPO must disclose the value of their IP assets in their prospectus to attract public investors. IP valuation helps to establish the company's overall valuation and demonstrates the strength of its intangible assets to potential shareholders. IP valuation helps to justify the investment by demonstrating the value of the company's innovations and their market potential.

Reverse IPO: An intermediate solution between a direct listing and a traditional IPO: going public quickly through a shell company (reverse IPO, reverse merger, cold IPO, shell purchase)[9].

Raising Funds for R&D and Innovation: Companies seeking funding for research and development (R&D) or innovation projects can use their existing IP portfolio to demonstrate their potential for future growth.

Bankruptcy, Insolvency: In bankruptcy proceedings, IP assets may need to be valued for liquidation or reorganization purposes. If a company goes bankrupt, its valuable IP assets can be a solution element in planning the future. Companies in financial distress may re-evaluate the IP to attract potential buyers. The value of IP assets is determined for creditors, stakeholders, and legal proceedings[10].

Accounting

In financial reporting and accounting companies need to report the value of their IP assets in financial statements for compliance with accounting standards (e.g., IFRS, GAAP). Valuation ensures accurate financial reporting and compliance with regulatory requirements. Determining fair market value is essential for accurately reporting assets on the balance sheet.

Financial Reporting and Capital increase: Companies are required to report the value of their IP assets in financial statements according to accounting standards such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) or German Commercial Code (HGB).

Especially when IP Assets from one of the shareholders are used in the context of an increase of capital ("Capital Replacement") a reliable value of the IP Assets is a basic need.

Goodwill allocation / Purchase Price Allocation: When a company acquires another, part of the purchase price may be attributed to intangible assets, thereby affecting goodwill in the financial statements. After a business combination (e.g., merger or acquisition), the purchase price must be allocated to the acquired assets, including IP, to ensure accurate financial reporting.

Impairment Test: Companies must periodically test their IP assets for impairment to ensure that their carrying value does not exceed their recoverable amount, i.e. they must identify and account for any decline in the value of IP assets, to ensure accurate financial statements.

Amortization of IP Assets: IP assets with finite useful lives must be amortized over their expected lives in order to allocate the cost of IP assets over their useful lives and reflect their consumption in the financial statements.

Internal and External Audits: Auditors may require IP valuation to verify the accuracy of financial statements and ensure compliance with accounting standards.

Tax Planning and Compliance

Valuation of IP is required for tax purposes, including transfer pricing, capital gains tax, tax amortization benefits and determining tax liabilities on asset transfers. The purpose is to determine the taxable value of IP assets and to ensure compliance with tax regulations. Incorrect IP valuation can lead to tax audits and penalties for mispricing. Governments may also offer tax incentives for R&D investments, which require accurate IP valuation.

Compliance with International Tax Laws: Governments require fair valuation of IP to prevent tax evasion.

Avoidance of Double Taxation Issues: Ensures fair taxation when IP is transferred between jurisdictions.

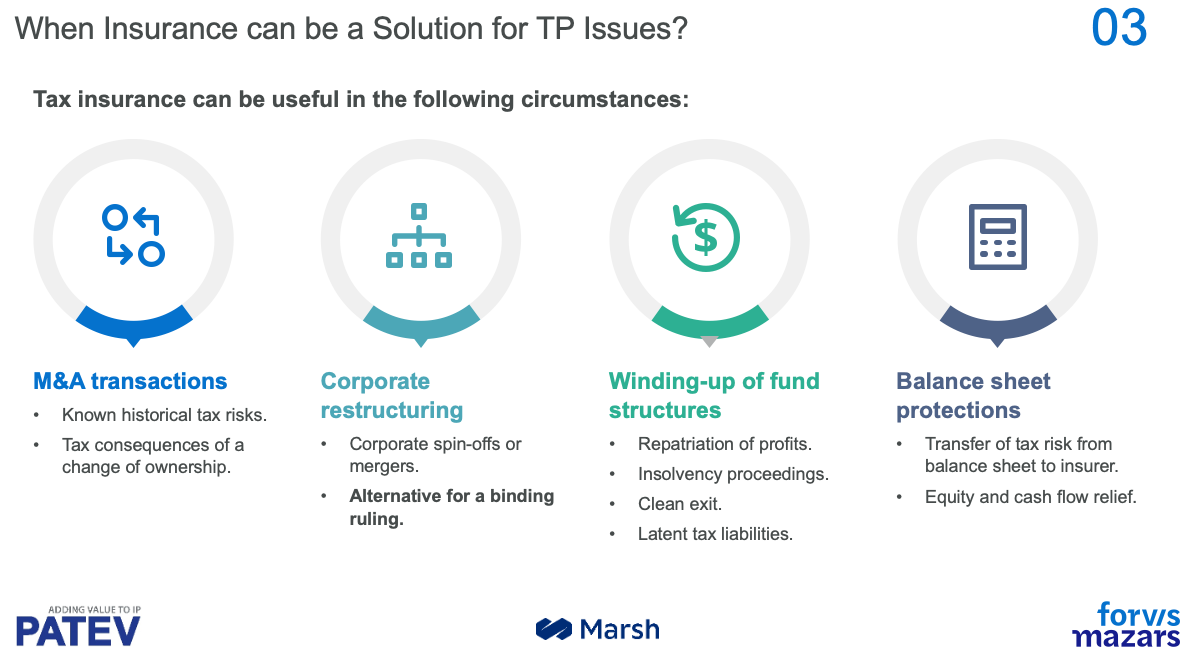

Figure 30: Forvis Mazars: Reducing TP Risks and Improving Legal Certainty, Webcast Forvis Mazars – PATEV – Marsh, March 2025.

Transfer Pricing: Multinational enterprises need to value IP when transferring it between related entities in different tax jurisdictions, to ensure that the transfer price reflects the arm's length principle, as required by tax authorities, and to avoid penalties for non-compliance.

Capital Gains Tax: When IP assets are sold or transferred, the capital gains tax liability must be calculated based on the difference between the sale price and the asset's tax basis. The valuation purpose is to determine the taxable gain or loss and to ensure accurate tax reporting.

Tax Amortization Benefits (TAB): Companies can amortize the cost of IP assets over their useful lives for tax purposes, thereby reducing taxable income. It is therefore necessary to calculate the tax benefits associated with the amortization of IP assets.

Figure 31: Marsh: Tax Insurance, Webcast Forvis Mazars – PATEV – Marsh, March 2025.

Tax Reporting for IP Holding Companies: Companies that hold IP assets in separate entities (e.g., IP holding companies) need to value their IP for tax reporting purposes.

Other tax reporting purposes include tax deductions for R&D expenses, related to the creation of IP or withholding tax on royalties, when IP is licensed to foreign entities.

Other occasions

Here is an overview of other occasions for IP valuation:

Litigation and Dispute Resolution: In cases of intellectual property infringement, breach of contract, or ownership disputes, valuation is required to quantify damages or settlements.

Investor Relationship: Investors of public companies are looking for investments with a positive development of value. There, one indicator of a solid investment, especially in Life Science companies, is the Value of the activated IP Assets in the balance sheet.

Strategic planning and management: Companies may value their IP as a baseline for strategic decisions, such as R&D investment, market entry, or portfolio management. The goal is to align IP strategy with business objectives and optimize the value of IP assets.

Joint Ventures and Partnerships/Strategic Alliances: When forming joint ventures or partnerships, the IP assets contributed by each party need to be valued, to ensure equitable contributions and fair sharing of profits or losses. Valuation can also determine the value of IP assets when the joint venture is dissolved.

Insurance: Companies may seek to insure their high valuable IP assets against risks such as infringement, theft, or damage. The goal is to determine the appropriate coverage and premiums for IP insurance policies.

Research and Development: Companies may wish to value their IP to prioritize R&D projects or assess the potential return on investment for new innovations. They want to allocate resources effectively and maximize the value of their R&D efforts.

By understanding these detailed reasons for IP valuation, companies can make informed financial, legal, and strategic decisions in different business contexts.

PATEV's New Value services offer solutions for all these different valuation situations.

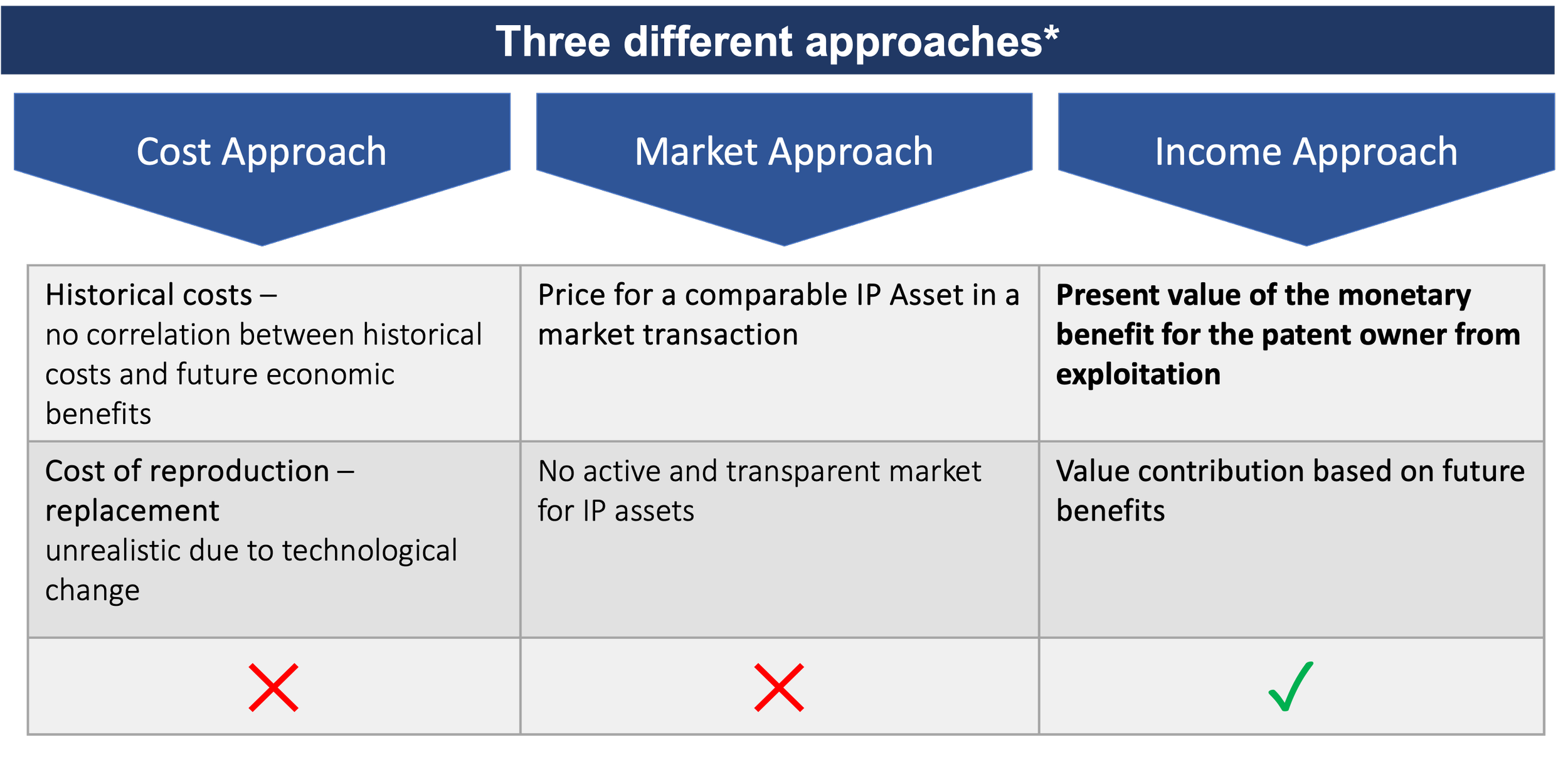

PATEV applies valuation methods that are particularly in line with the activities of standardization communities (IDW S5[11], DIN/ISO[12], IVS 210[13]).

The valuation method is determined by the purpose of the valuation.

The first step is to assign the purpose of the valuation to one of the two valuation concepts: value in use or transfer value. In both cases three concepts are applicable as defined in the standard IDW S5.

Figure 32: Basic valuation approaches

In most cases, the license analogy method is chosen. The effective royalty rate is the most value-driving parameter. Even if the royalty rates of similar business cases are well known in the literature, these baseline royalty rates still need to be adapted to the unique technological business case. In the case of patents, the following 10 specific factors need to be considered.

In the case of patents, a key valuation criterion is the patent position of the company or business unit in the competitive environment. Innovative strength alone does not guarantee a company's success - just as intelligent analysis tools do not automatically generate added value.

Figure 33: Valuation factors for patents

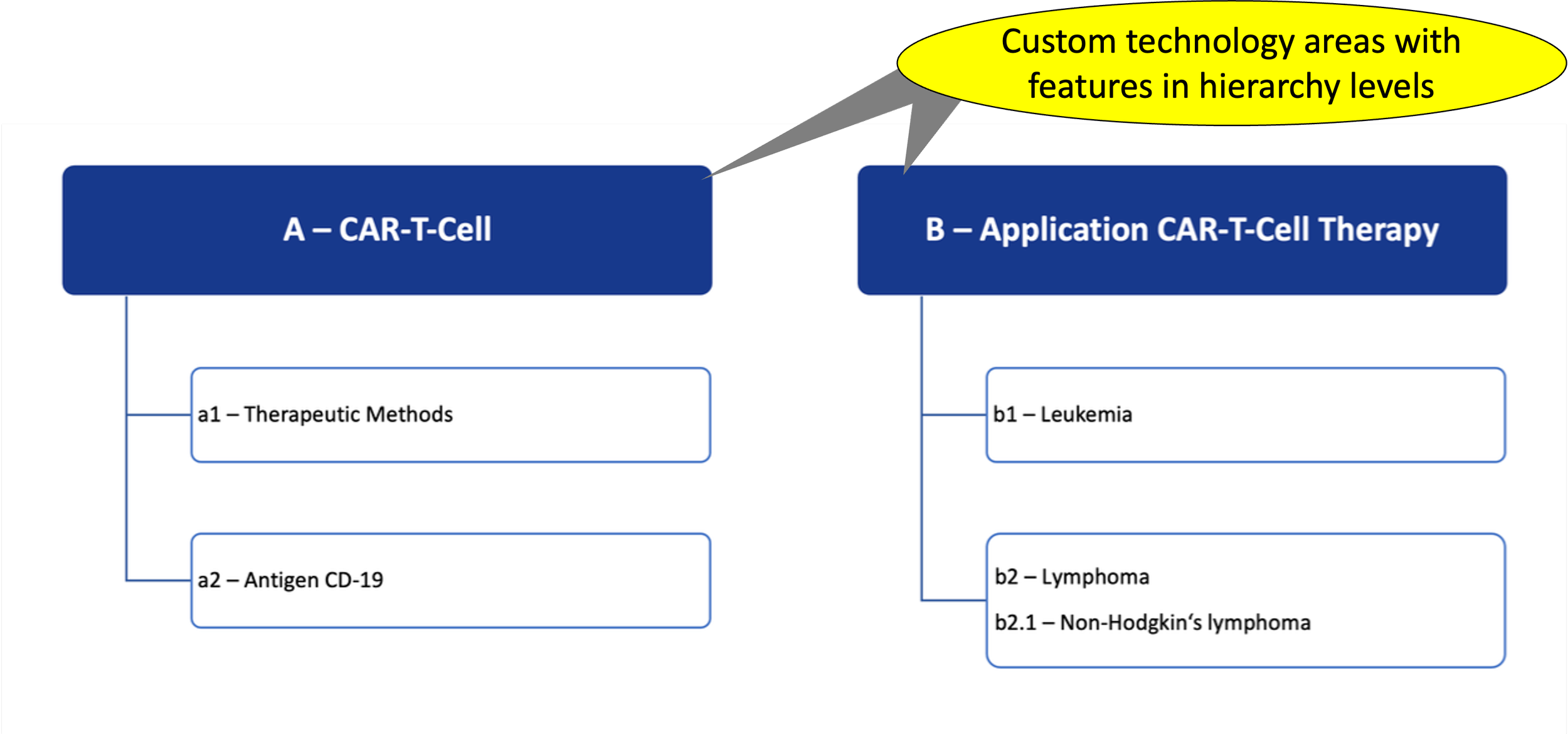

PATEV Innovation Intelligence provides transparency and the right answers to important questions about technological competence and leadership. We use this software tool in our patent valuation. For competitive analysis, we define customer-specific technology fields with technological characteristics in hierarchical levels.

Figure 34: Customer-Specific technology fields and characteristics for patent search and analysis

The following figure shows a heatmap of a competitive analysis, with the abbreviations A, a1-a2, B, b1-b2-b2.1 for the technological structuring and hierarchical levels of characteristics.

Figure 35: Valuation Report, Heatmap – competitive environment,

Sources

[1] Patent applications are usually published 18 months after filing.

[2] A patent application is evaluated by the patent office for its novelty, inventive step and industrial applicability

[3] Narrow protection scope

[4] The numbers cannot be added, as patents may match several features and counted for each feature.

[5] Dr. Bernd Schneider, Managing Director STIFEL, Office Frankfurt

[6] European Patent Office and European Union Intellectual Property Office, "Patents, trade marks and startup finance: Funding and exit performance of European startups," Oct. 2023. [Online]. Available: https://link.epo.org/web/publications/studies/en-patents-trade-marks-and-startup-finance-study.pdf (accessed Jan. 31, 2025).

[7] World Intellectual Property Organization, "Securing Loans with Your IP Assets," Hands-on IP Finance Series, WIPO Publication No. 2011EN, 2024. [Online]. Available: https://www.wipo.int/edocs/pubdocs/en/wipo-pub-2011-en-securing-loans-with-your-ip-assets.pdf. [Accessed: Jan. 31, 2025].

[8] Peer Macketanz, Director Capital & Debt Advisory | Transactions & Corporate Finance (TCF), EY-Parthenon GmbH Wirtschaftsprüfungsgesellschaft

[9] Werner Weiss, Managing Director Yggdrasil Bridge Finance GmbH, CEO Yggdrasil SPAC 1 AG, www.IPO-Mantelgesellschaft.de

[10] Markus Fröhlich, Owner, Attorney, Certified Restructuring and Restructuring Manager, Specialist Attorney for Restructuring and Insolvency Law, FROEHLICH Lawyers Insolvency Administrators Tax Advisors

[11] IDW (German Institute of Public Auditors) Section 5: "Guidelines for measuring intangible assets", introduced by the Technical Committee for Business Valuations and Commerce (FAUB), latest version 16.04.2015 [online] Available at: https://www.idw.de/idw/verlautbarungen/idw-s-5/43024 [Accessed 31 Jan. 2025].

[12] DIN ISO 10668 Brand valuation - Requirements for monetary brand valuation (ISO/FDIS 10668) 2011

[13] International Valuation Standards Council, IVS 210 Intangible Assets, Effective 31 January 2020. Pp 63-79: IVS 210 Intangible Assets, [online] Available at: https://www.ivsc.org/new-edition-of-the-international-valuation-standards-ivs-published/; https://www.appraisers.org/docs/default-source/5---standards/ivs-effective-31-january-2025-redline-edition-33-51.pdf?sfvrsn=d768966b_1 [Accessed 31 Jan. 2025].