Image 1 of 4

Image 1 of 4

Image 2 of 4

Image 2 of 4

Image 3 of 4

Image 3 of 4

Image 4 of 4

Image 4 of 4

M&A Reference Model digital subscription: full model data

M&A Reference Model – Overview

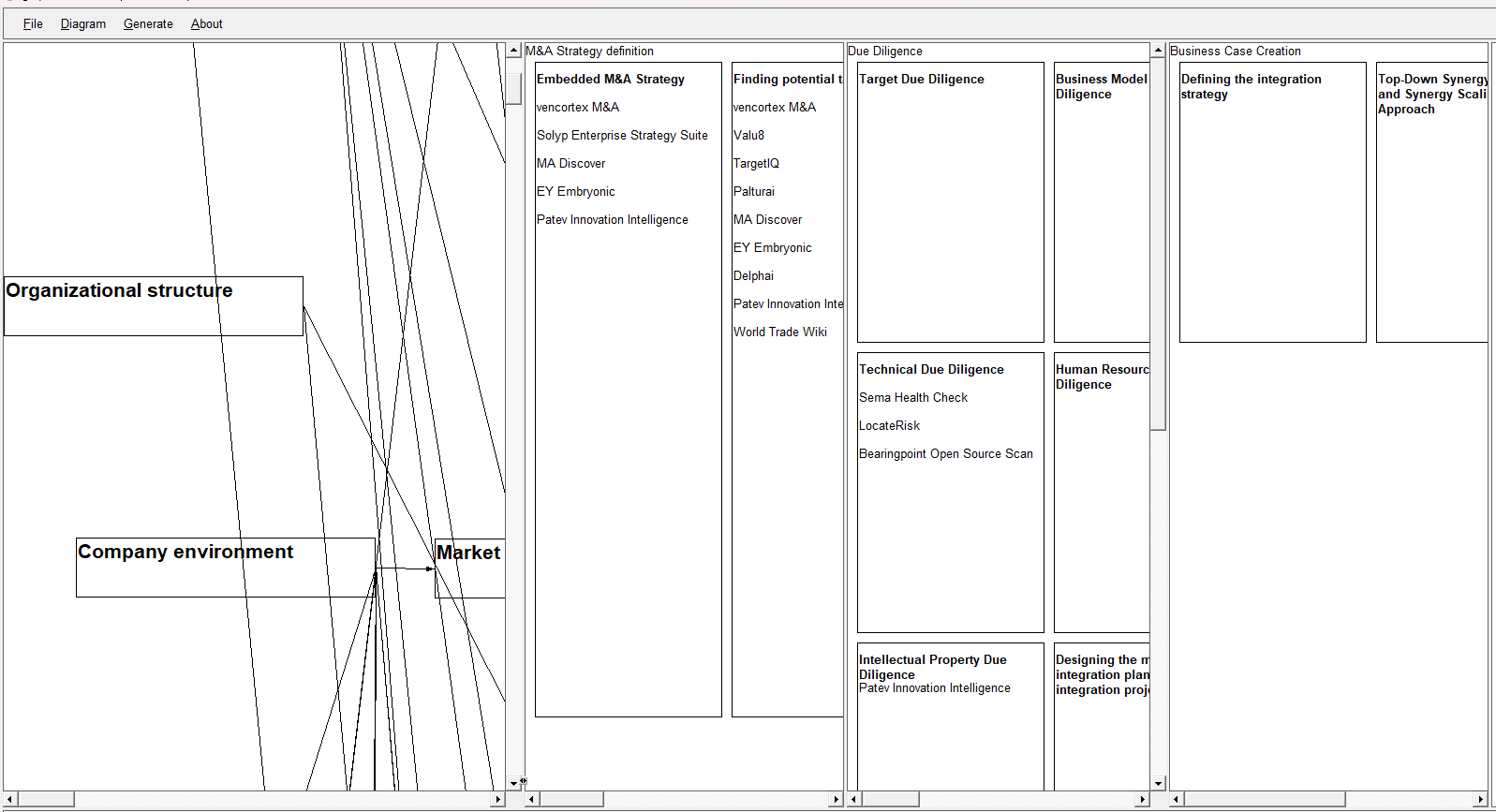

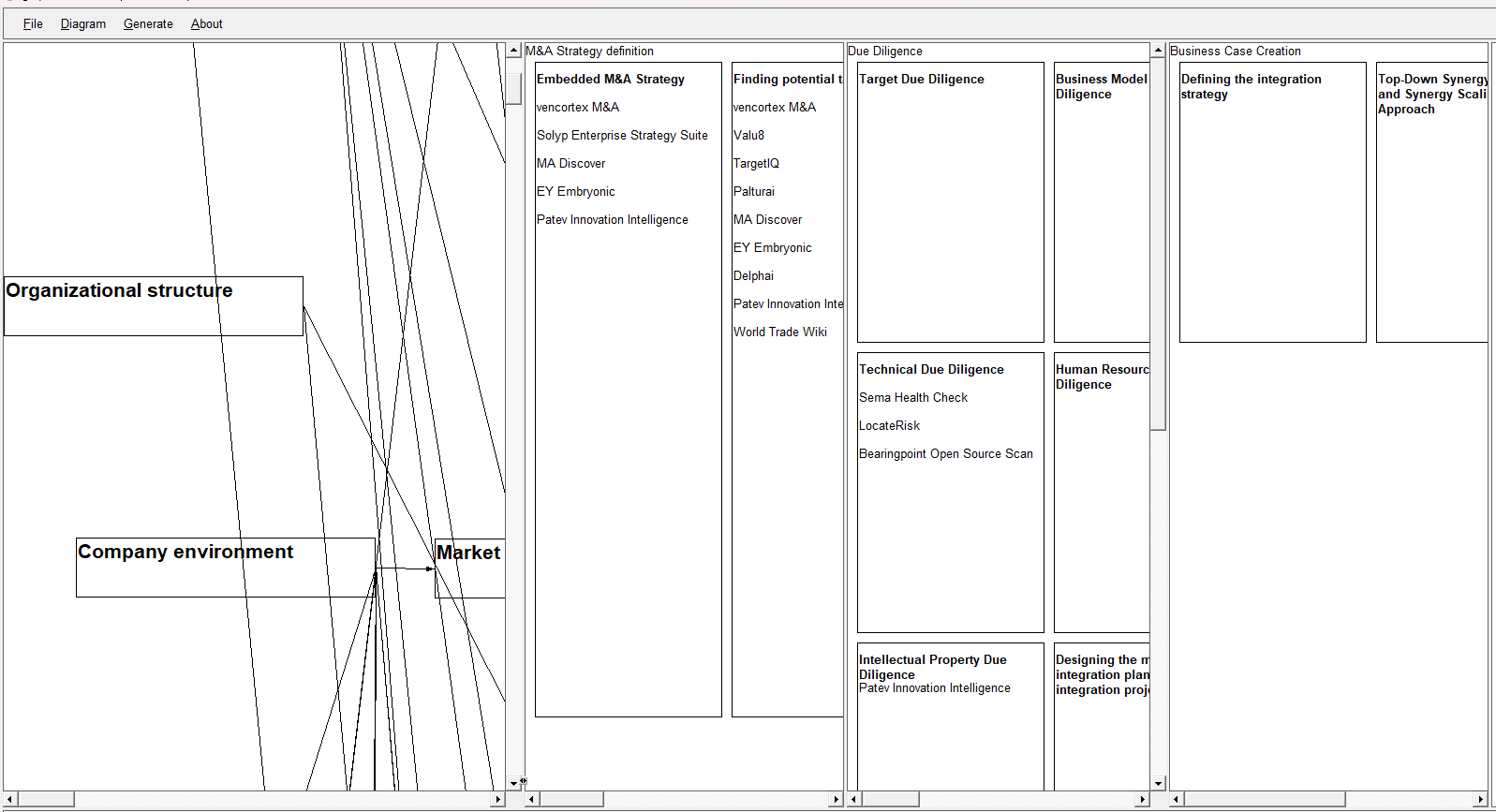

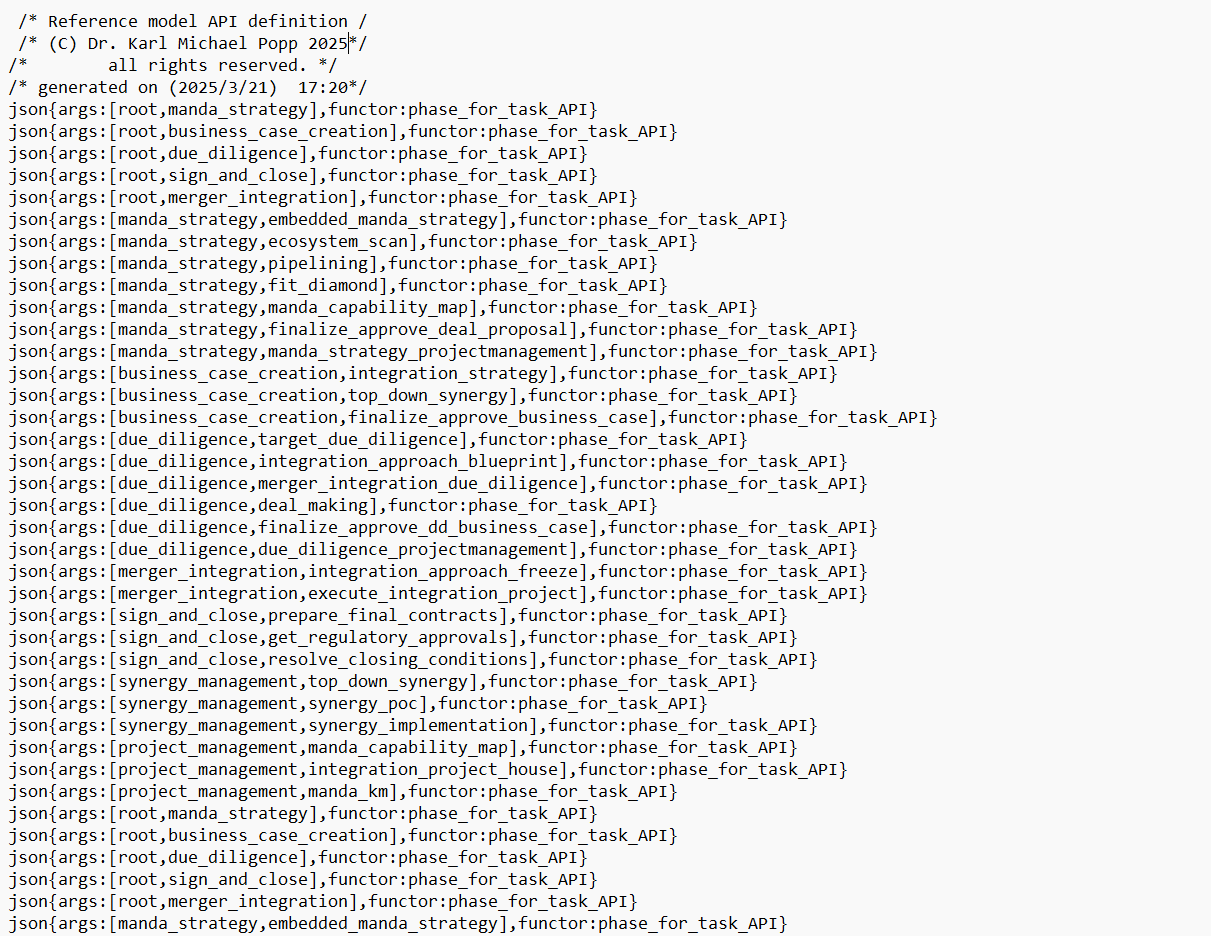

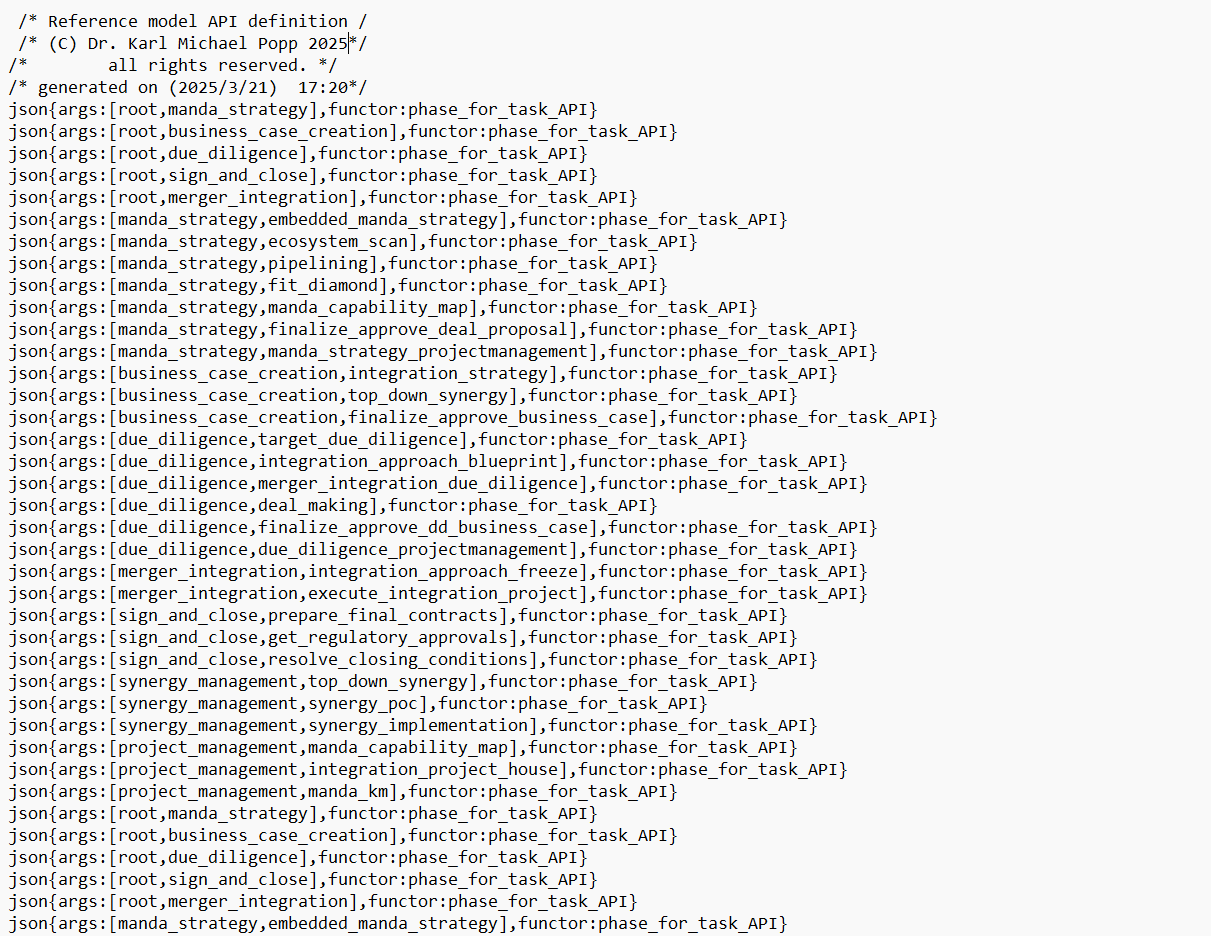

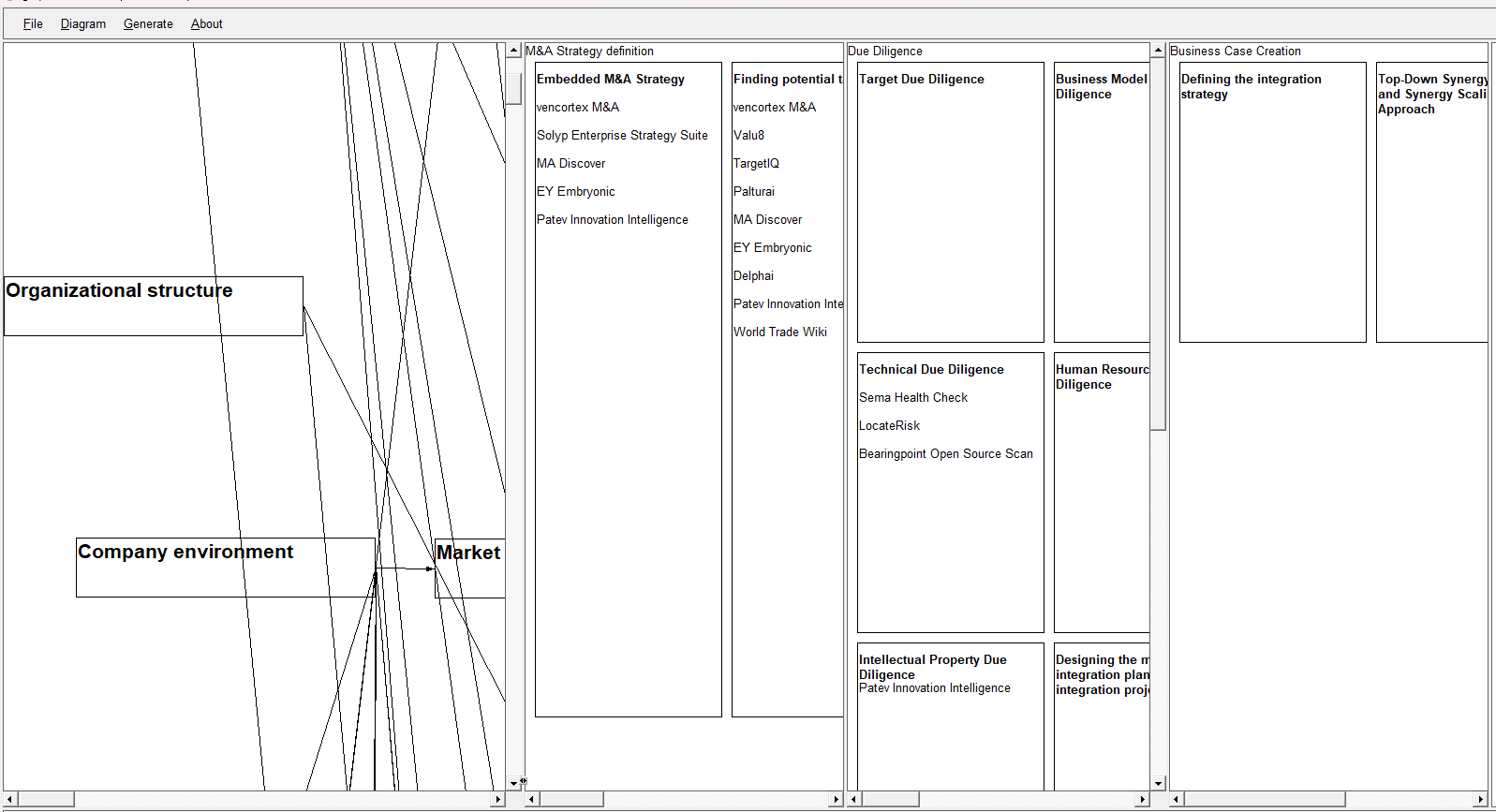

The M&A Reference Model from M&A Automation is an end‑to‑end domain model of the entire mergers and acquisitions lifecycle, spanning from strategy creation through due diligence to post‑merger integration. It specifies the M&A process in a formal, structured way, combining a process model with a rich data model so that every phase can be consistently documented, analyzed, and ultimately automated. The model breaks M&A work into clearly defined tasks (e.g., Embedded M&A Strategy, Finding Potential Targets, Processing the Long and Short List), each with explicit goals, objectives, and classifications such as whether it is a decision or execution task and whether the problem is structured or unstructured. This creates a holistic blueprint that helps organizations move from ad‑hoc dealmaking toward repeatable, systematic M&A execution with shared language and expectations across strategy, finance, legal, and integration teams.

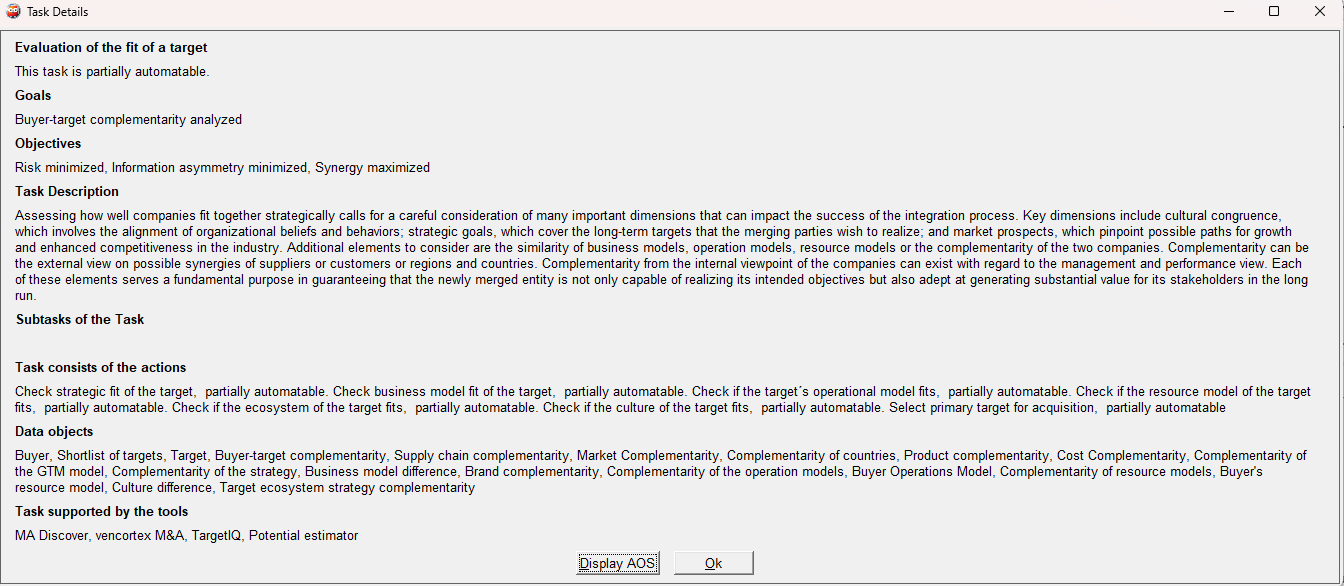

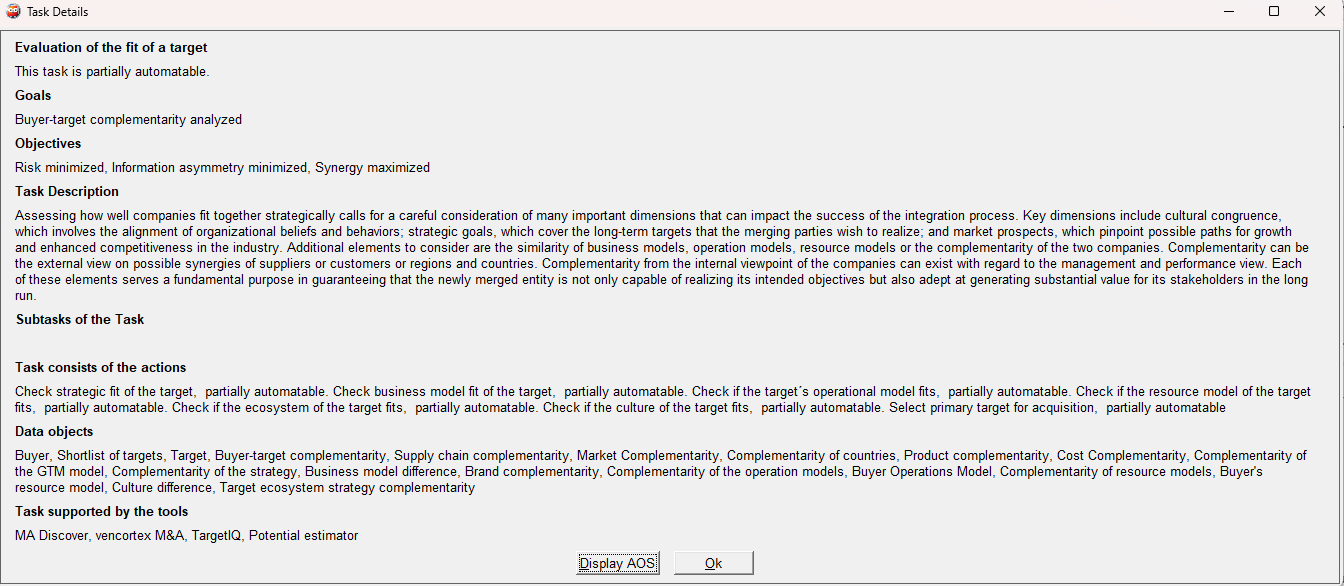

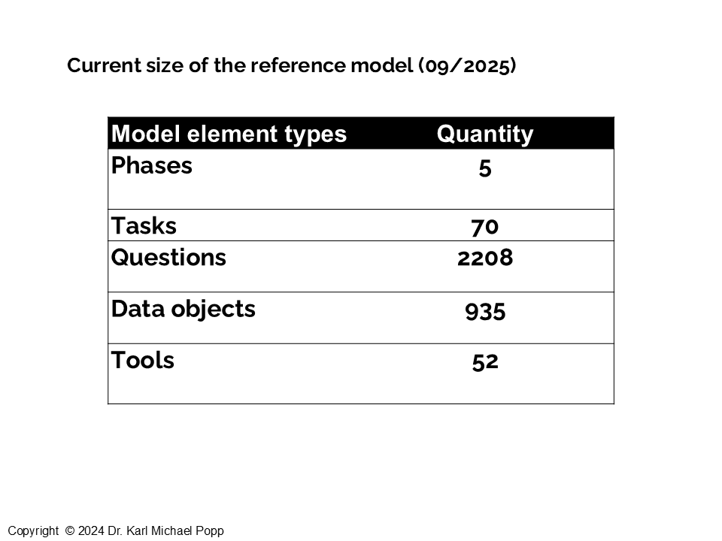

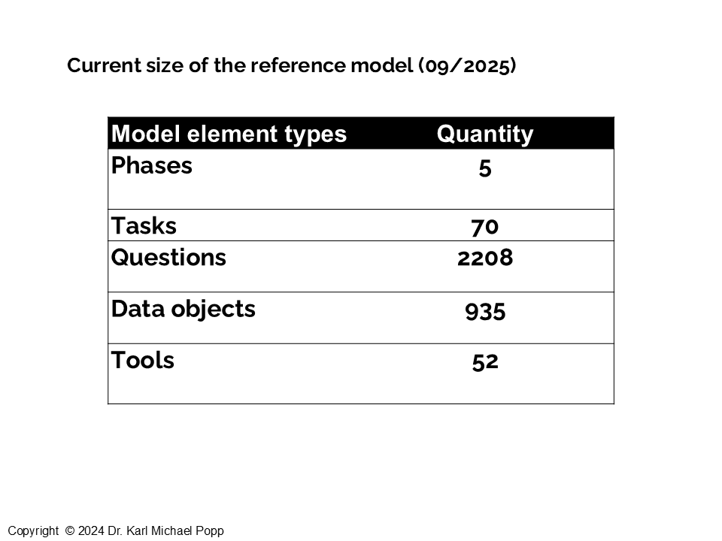

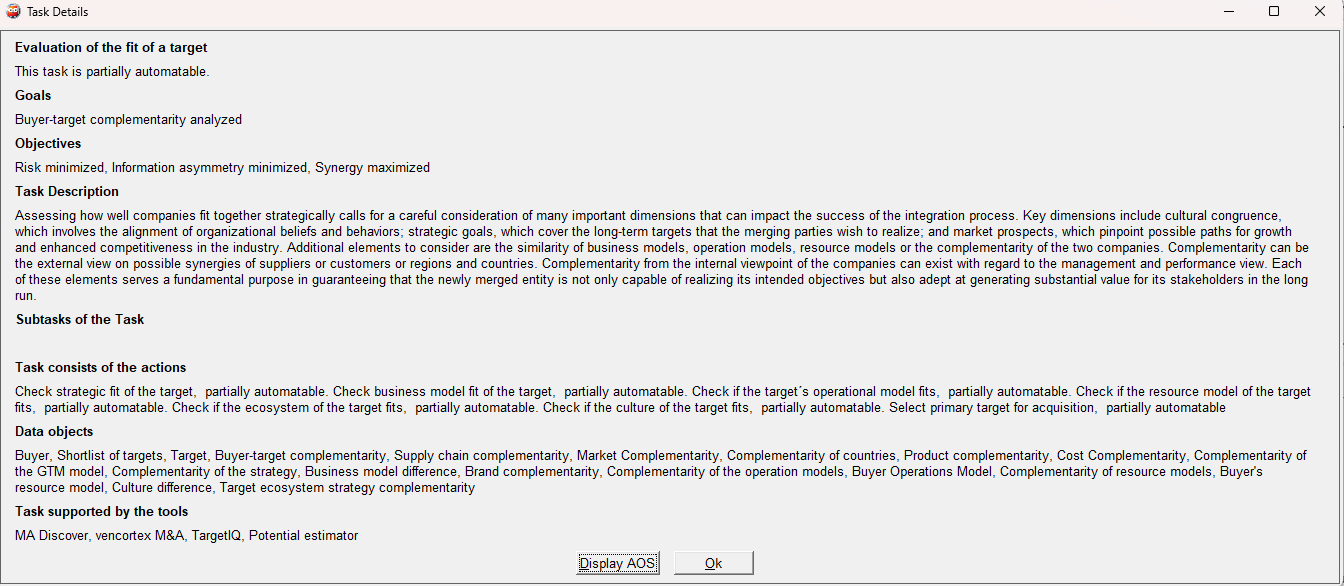

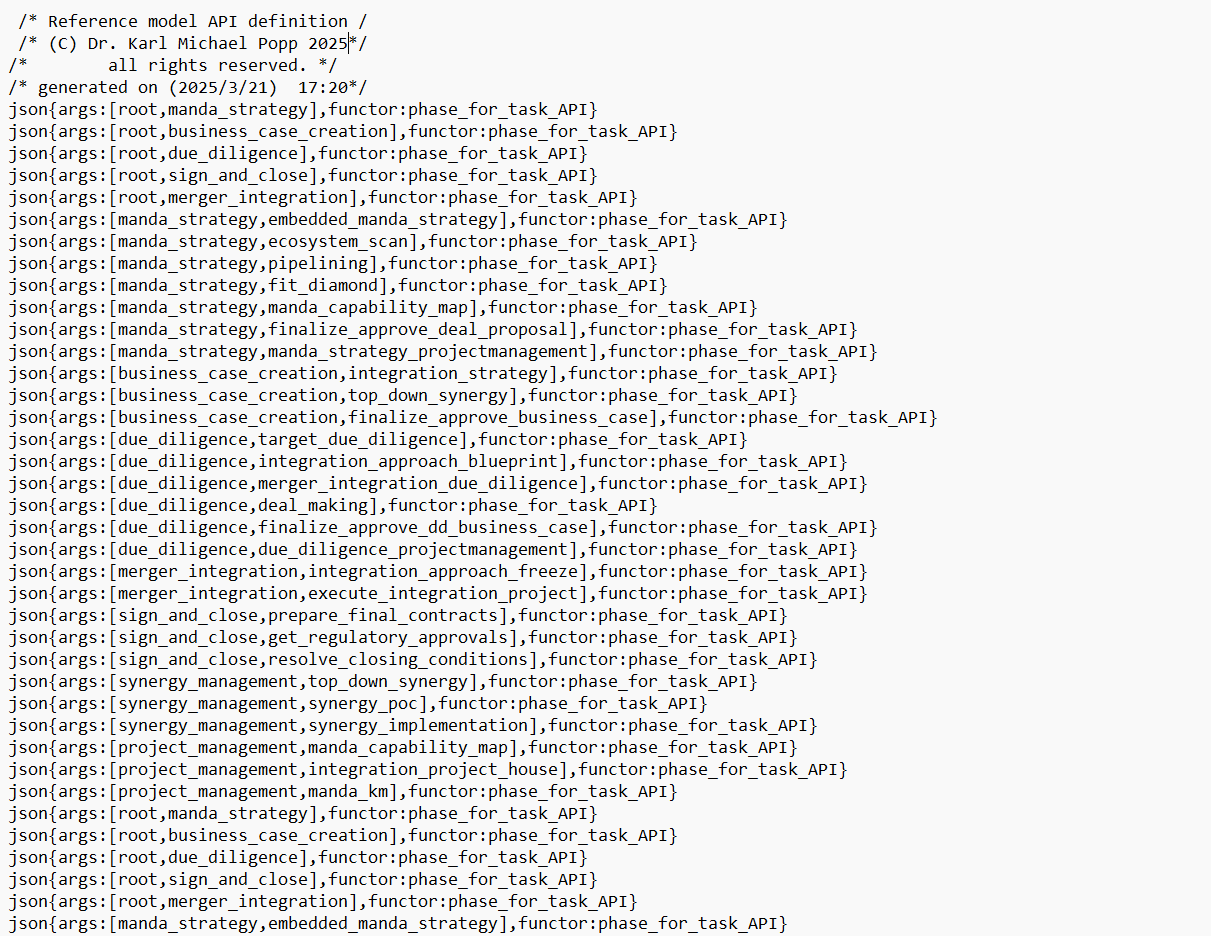

Under the hood, the M&A Reference Model is also a large knowledge base and automation enabler: it defines dozens of roles, hundreds of tasks, over two thousand guiding questions, and a comprehensive data model with hundreds of data objects that are all linked to the tasks that use them. For each task, it specifies required data, typical roles involved, detailed action steps, and extensive question catalogs that guide analysis and decision‑making, while also mapping which actions can be fully, partially, or not yet automated and which M&A tools and technologies (such as analytics, NLP, or AI assistants) are relevant. Tool vendors can license the model as a standardized domain and API layer to build interoperable solutions on top of a common process and data foundation, while M&A teams can use it as a checklist, design template, and analytics engine to assess capabilities, identify gaps, and drive continuous improvement in how they plan and execute acquisitions.

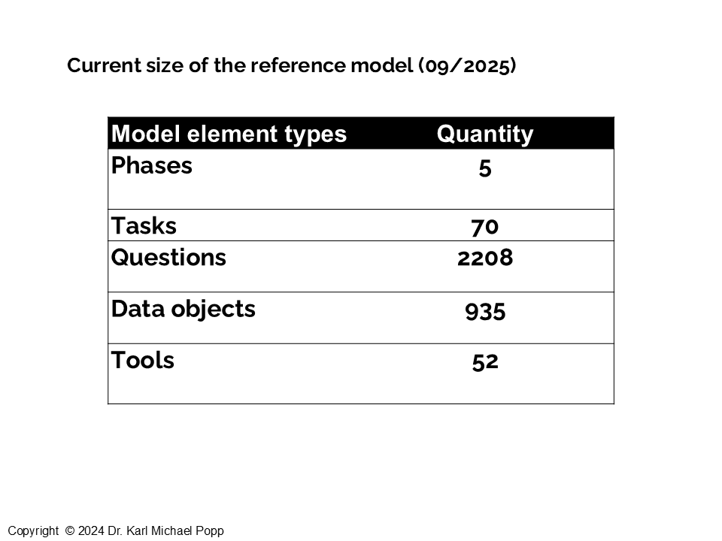

Price will be charged on a yearly basis in this subscription. Data are provided in a JSON file containing information about 70 tasks with 2200 assigned questions and an overarching data model containing 950 data objects, which are also assigned to tasks.

M&A Reference Model – Overview

The M&A Reference Model from M&A Automation is an end‑to‑end domain model of the entire mergers and acquisitions lifecycle, spanning from strategy creation through due diligence to post‑merger integration. It specifies the M&A process in a formal, structured way, combining a process model with a rich data model so that every phase can be consistently documented, analyzed, and ultimately automated. The model breaks M&A work into clearly defined tasks (e.g., Embedded M&A Strategy, Finding Potential Targets, Processing the Long and Short List), each with explicit goals, objectives, and classifications such as whether it is a decision or execution task and whether the problem is structured or unstructured. This creates a holistic blueprint that helps organizations move from ad‑hoc dealmaking toward repeatable, systematic M&A execution with shared language and expectations across strategy, finance, legal, and integration teams.

Under the hood, the M&A Reference Model is also a large knowledge base and automation enabler: it defines dozens of roles, hundreds of tasks, over two thousand guiding questions, and a comprehensive data model with hundreds of data objects that are all linked to the tasks that use them. For each task, it specifies required data, typical roles involved, detailed action steps, and extensive question catalogs that guide analysis and decision‑making, while also mapping which actions can be fully, partially, or not yet automated and which M&A tools and technologies (such as analytics, NLP, or AI assistants) are relevant. Tool vendors can license the model as a standardized domain and API layer to build interoperable solutions on top of a common process and data foundation, while M&A teams can use it as a checklist, design template, and analytics engine to assess capabilities, identify gaps, and drive continuous improvement in how they plan and execute acquisitions.

Price will be charged on a yearly basis in this subscription. Data are provided in a JSON file containing information about 70 tasks with 2200 assigned questions and an overarching data model containing 950 data objects, which are also assigned to tasks.