M&A Reference Model: Story and Overview

The M&A reference model is a model of a holistic M&A process, from strategy creation to merger integration. For the strategy phase, it integrates aspects of business models as explained above plus tasks within the process.

The story

Finally, the M&A reference model covering all phases of the process is available, an effort that took me about ten years. Why did it take me so long? The goal was to create an end-to-end M&A process and data model to leverage it for the automation of the M&A process.

Since there are massive dependencies of integration activities and data on the earlier phases of the process, I had to dive into the details of strategy and due diligence phases before I work on the details of the merger integration phase. So, I published contents of the M&A reference model for the strategy and the due-diligence phases first and now I was able to relate to earlier phases in a complete and consistent manner.

The M&A reference model as of today has the following content:

70 Tasks with detailed descriptions and goals and objectives

2200 Questions are assigned to tasks and help during the execution of the tasks

935 DataObjects are in the corresponding data model of the M&A reference model. Each of the data objects is assigned to one or more tasks.

Many M&A tools are assigned to tasks and show if and how much of the task can be automated.

Fundamentals of modeling companies

Let us look at companies from a systemic perspective as goal-oriented companies.

Companies are goal-oriented

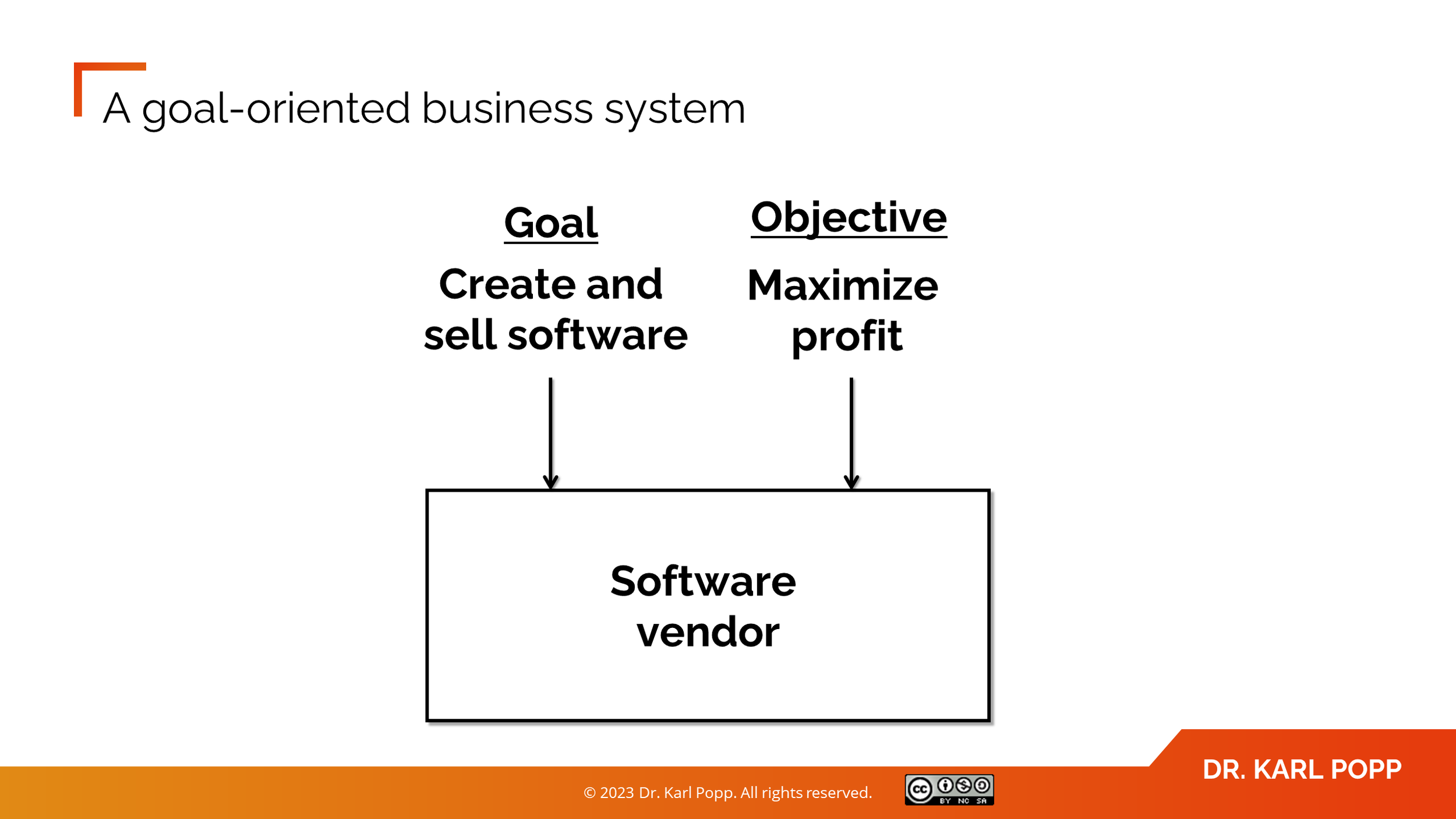

A company is a goal-oriented system because there are goals that the company tries to achieve. These goals are achieved by executing business processes within the enterprise. Business processes, regardless of whether they are automated or not, consider the behavior of the company.

Figure 1: A goal-oriented company

Types of goals

We distinguish between goals that specify the goods and services delivered by the company and objectives that measure business success. Figure 1 shows an example of the goals and objectives of a software vendor.

Because companies are goal-oriented, it makes sense to include goals in due diligence. Goals drive execution in companies, but there are also design goals that determine the structure and behavior of business processes.

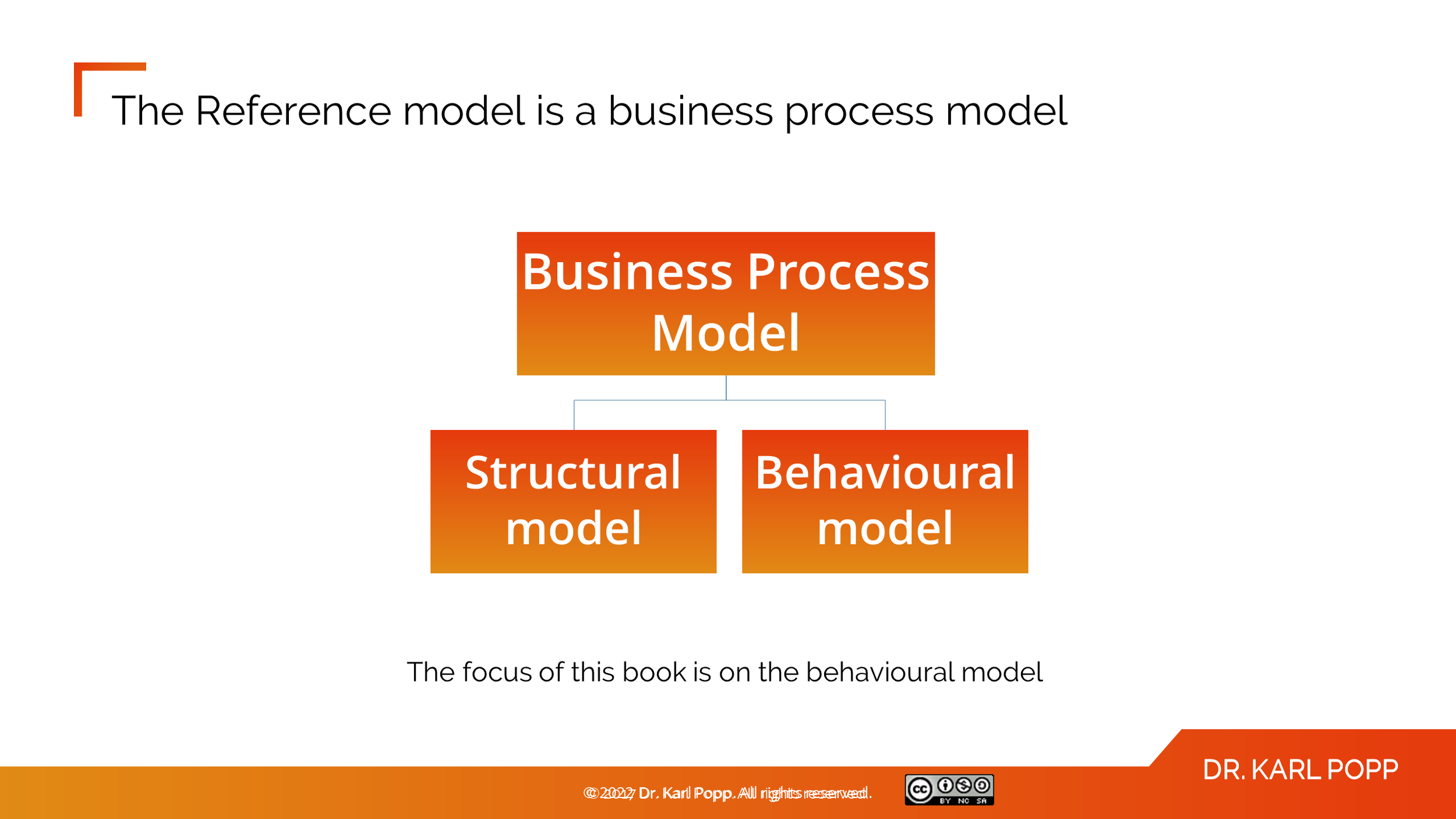

The business process model takes an internal view of the company and analyzes the structure and behavior within the company.

Generally, two views of the behavior of the company are used: a structure view, which shows the tasks and their breakdown, and a behavior view, which shows the execution of the tasks as part of business processes. For space reasons, this book does not deal with the structure view, but only with the behavioral view.

Brief description of the reference model

To be able to talk about digitization of M&A processes, the domain "M&A process" must first be precisely described, so that questions of automatability and the automation of tasks can be addressed.

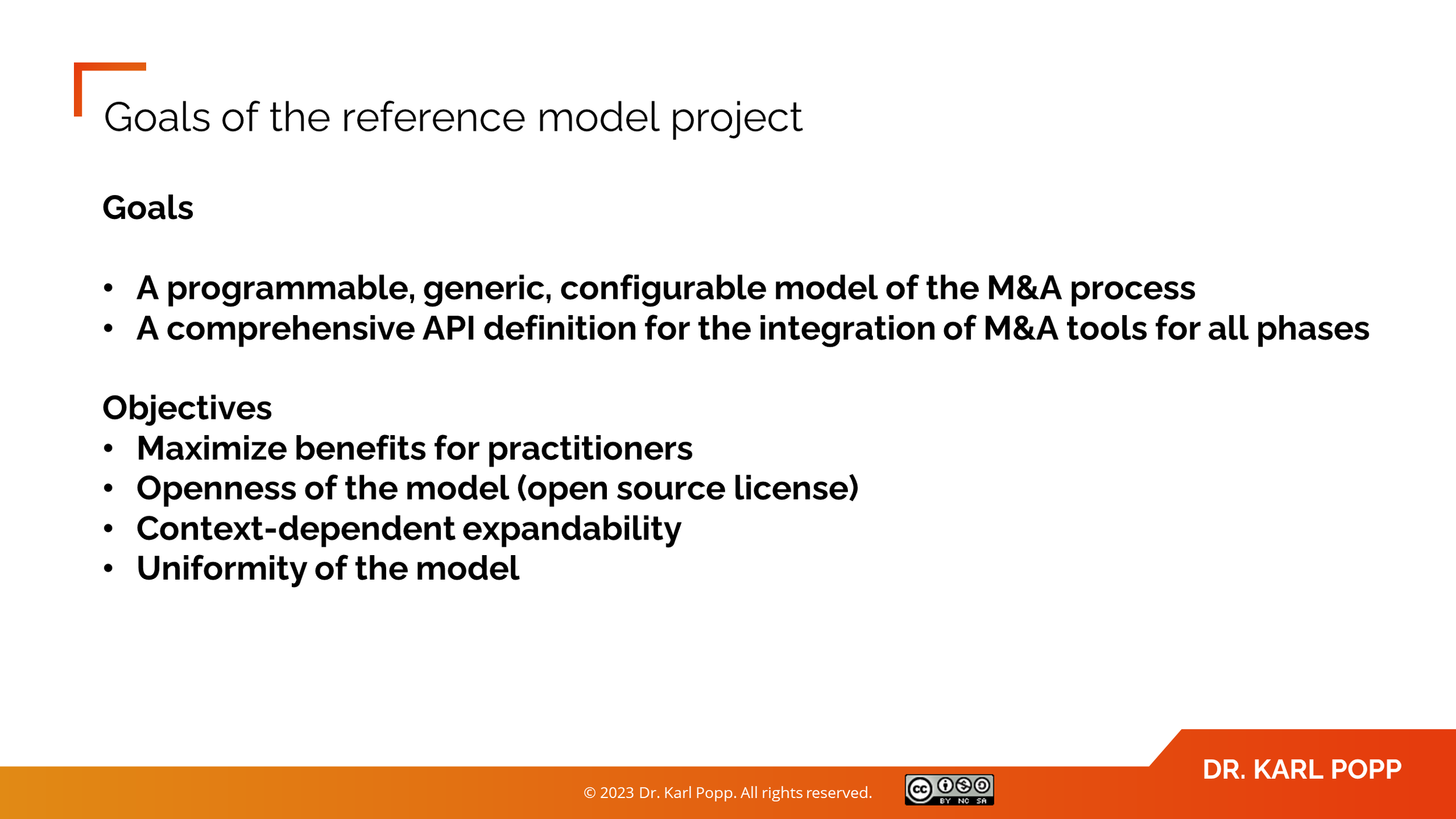

Therefore, the work on a reference model of the M&A process, which describes the tasks in the M&A process in detail, was a logical step. Realistically, a rigid and therefore inflexible reference model is not suitable for specific companies in a specific context such as an industry.

For this reason, the reference model was implemented in the form of an application system in the programming language Prolog. This allows the model to be restricted based on different contexts such as different industries, share deal vs. asset deal, and the generation of context-specific versions of the reference model. Large parts of this book have been automatically generated from the model.

Figure 2: Goals of the project

Based on a complete specification of the tasks, an API definition for the M&A process can be derived as shown in chapter 8.3. This can then be used as a standard for integrating different tools in the M&A process.

Figure 3: Reference Model is a Business Process Model

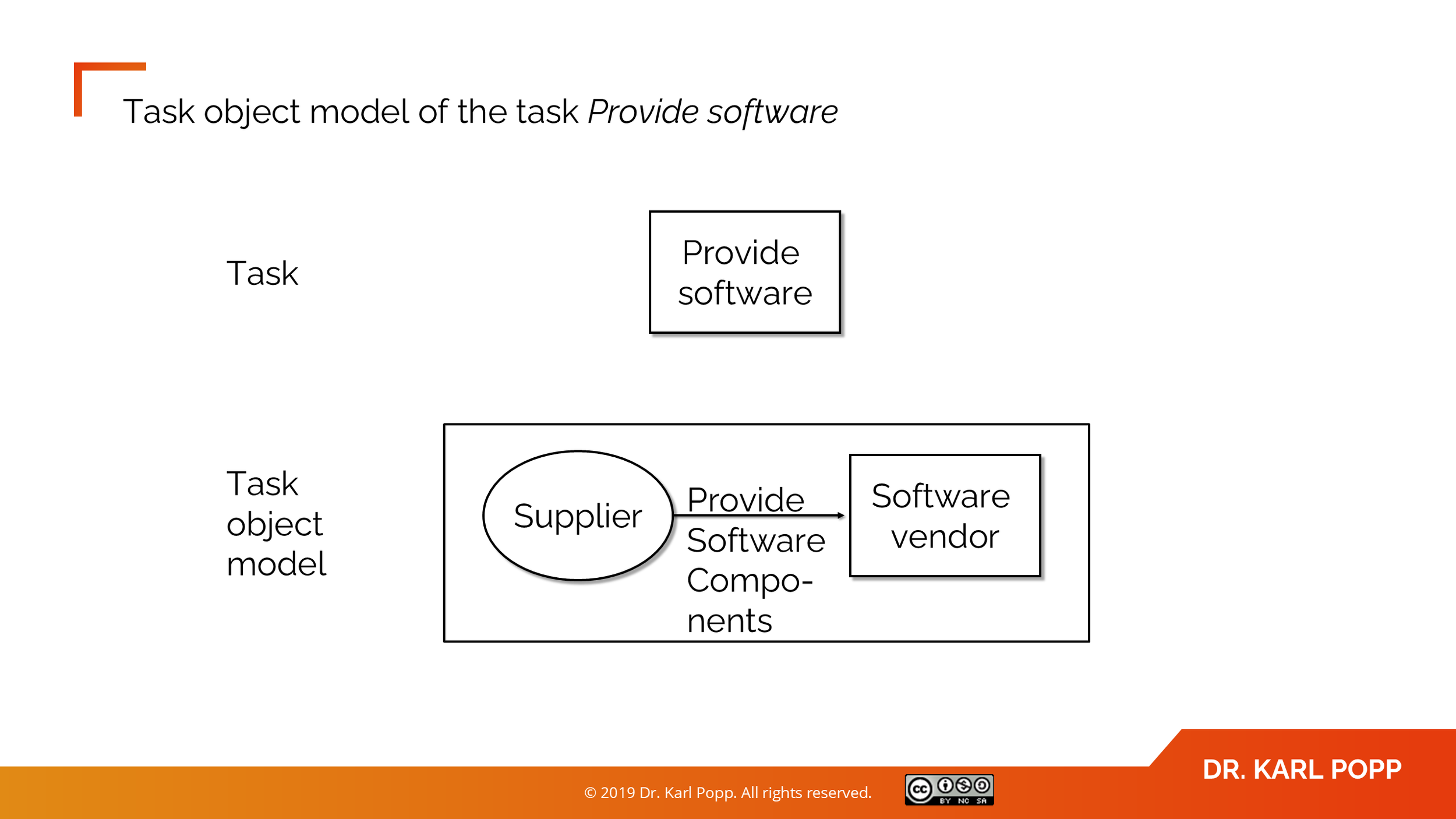

Well, what is the reference model? It consists of the behavioral model part of a business process model. In our case these are tasks and their specifics. Additionally, the data objects used by a task are listed.

Figure 4: Division of the model into phases

Tasks

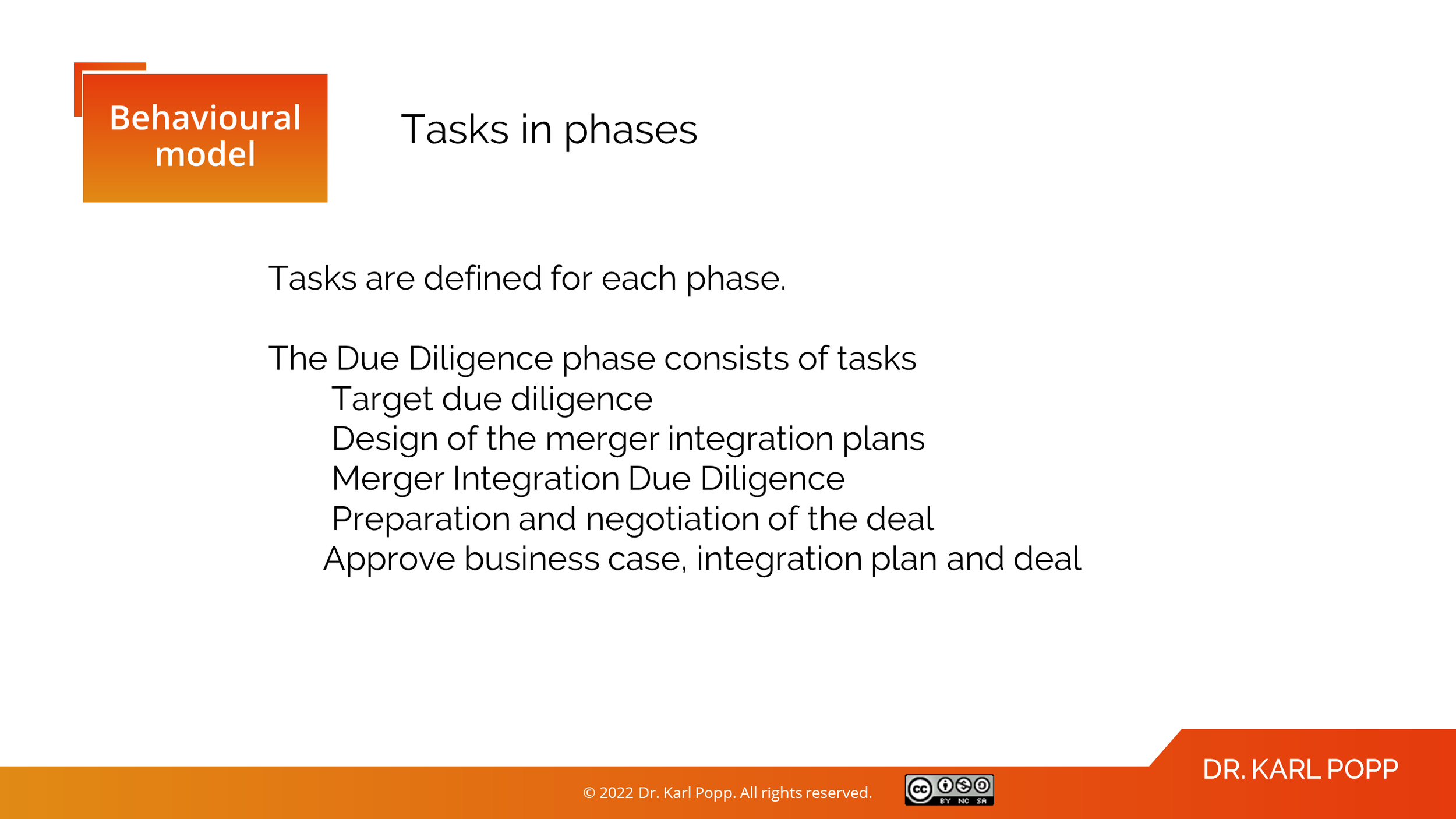

Tasks are assigned to individual phases of the M&A process. This book shows an example of how to assign tasks to phases. Future configuration may result in a different assignment. The names of tasks and phases are based on [Feix,20].

Several tasks are assigned to each phase, for example, Target Due Diligence and Merger Integration Due Diligence are assigned to the Due Diligence phase.

Figure 5: Examples of tasks in phases

Tasks can be broken down into subtasks, as the following example shows:

Figure 6: Splitting tasks

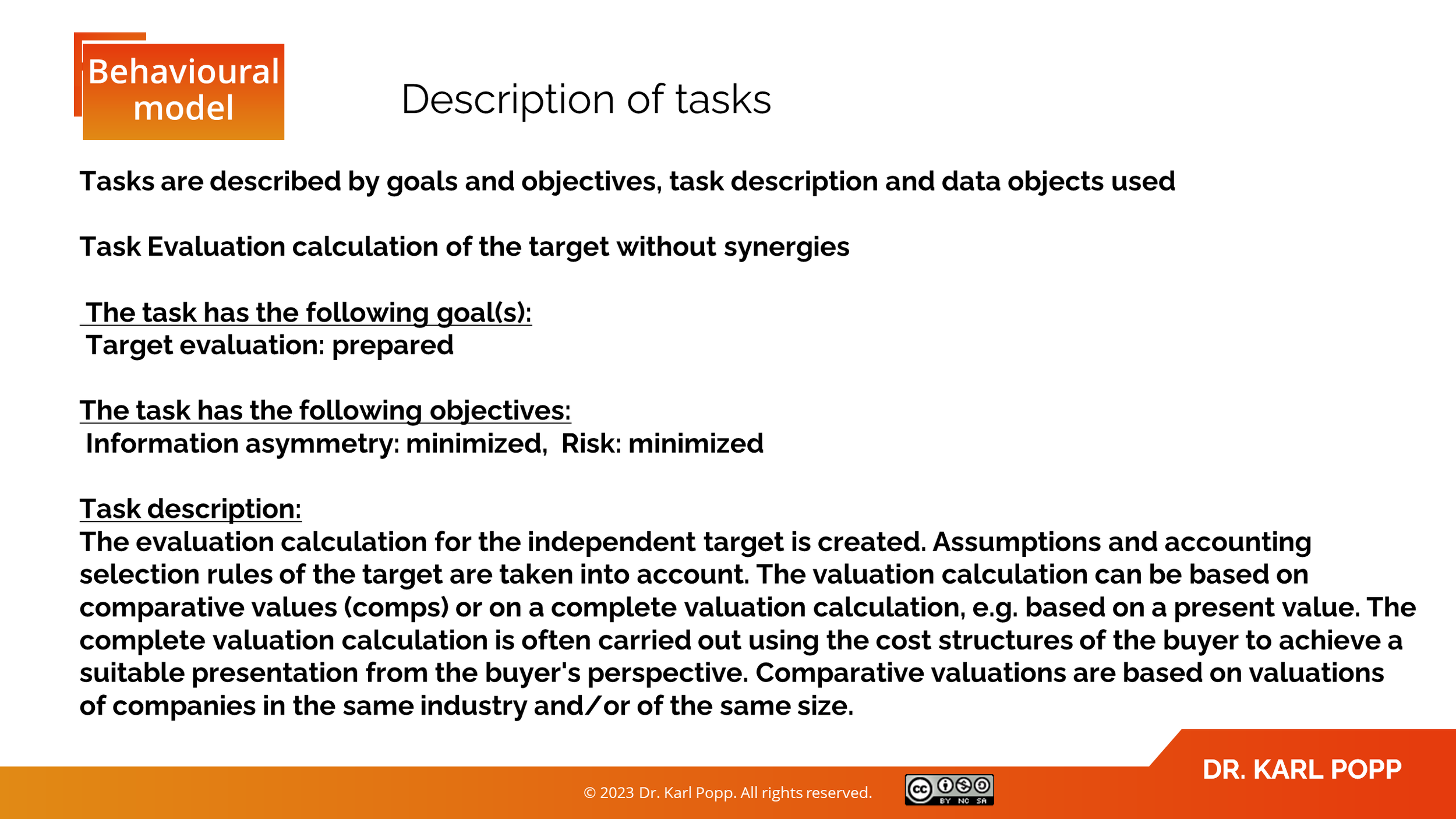

Tasks are documented by a detailed task description. It is important to note here that the task is described from an external point of view and theoretically several procedures for solving a task are possible. The degree of automation of tasks is also not described. Theoretically, a task can be performed non-automated (i.e., manually), partially automated or fully automated. The task description consists of the specification of goals and objectives and a descriptive text.

Figure 7: Task description

Besides these attributes in our model, there might be several alternative procedures to carry out the task. Which of the procedure applies and should be selected depends on the available resources.

For manual execution of the task this might be procedure documents describing the different steps a worker has to fulfill. For fully automated execution, an algorithm describes which steps an application software system has to execute. For partial automation, it is a combination of both.

Documentation of the data object types used by a task is advantageous for subsequent automation, for documenting tools and for generating APIs. You will find numerous data object types in chapter 12.

Figure 8: Assignment of data objects to tasks

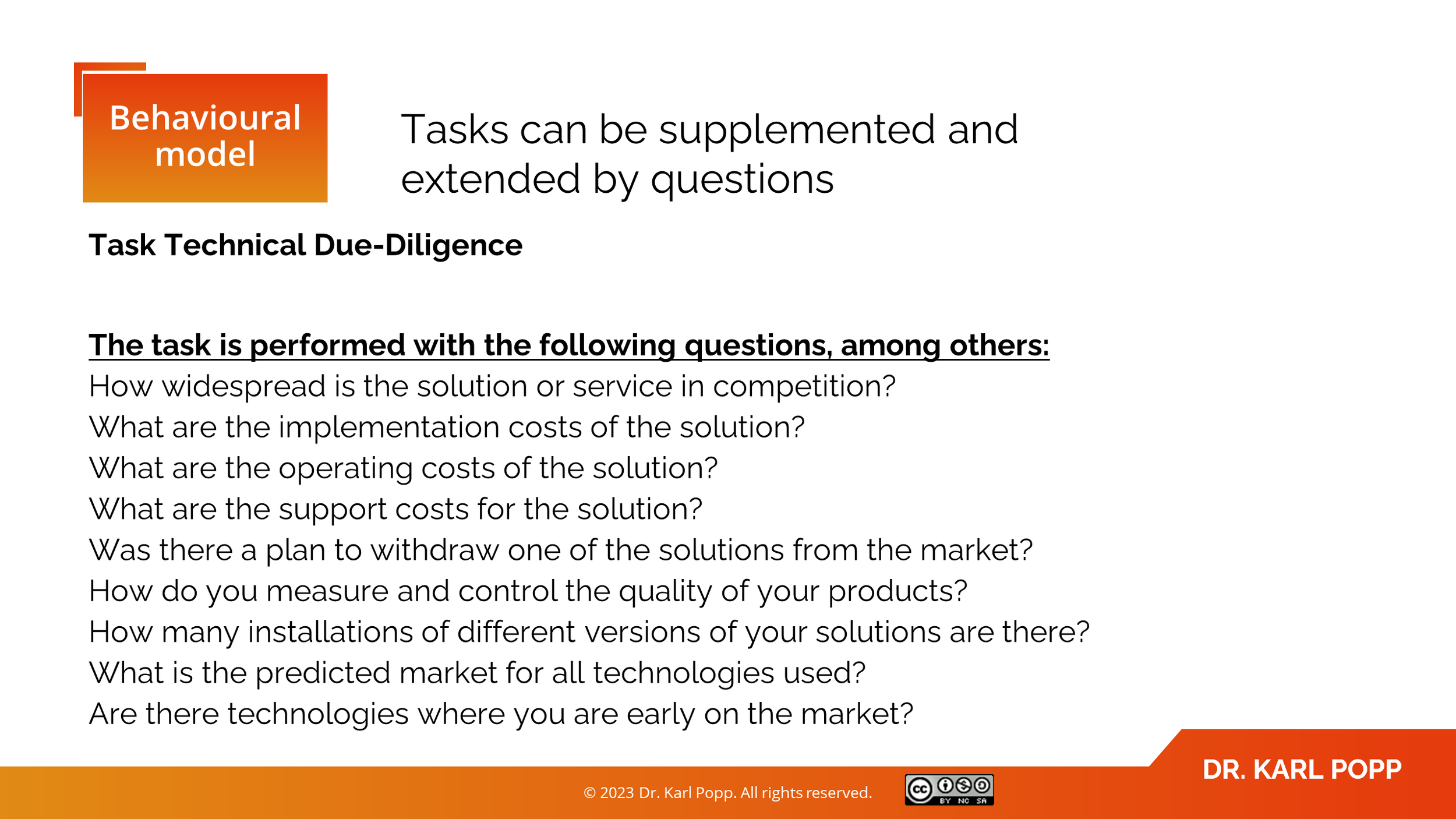

For the transfer of knowledge and the evaluation of tools, it can be useful to list questions from practice for a task. Here is an example of questions that can be assigned to a task:

Figure 10: Tasks and related questions

But how many questions do i get per task? Here are some examples.

Embedded M&A Strategy 76

Finding potential targets 50

Processing the long and short list 33

Evaluation of the fit of a target 31

Finalize and Approve Deal Proposal 14

Strategy Phase Project Management 25

Preparation and Negotiation of the Deal 28

GTM Due Diligence 80

IT integration 150

Context-specific questions, e.g., for a specific industry, can also be assigned to a task.

Automation and Automatability of Tasks

Decisions on the digitization of companies depend on the available implementation options. The goal is the extensive and meaningful automation of operational tasks.

Automation of tasks

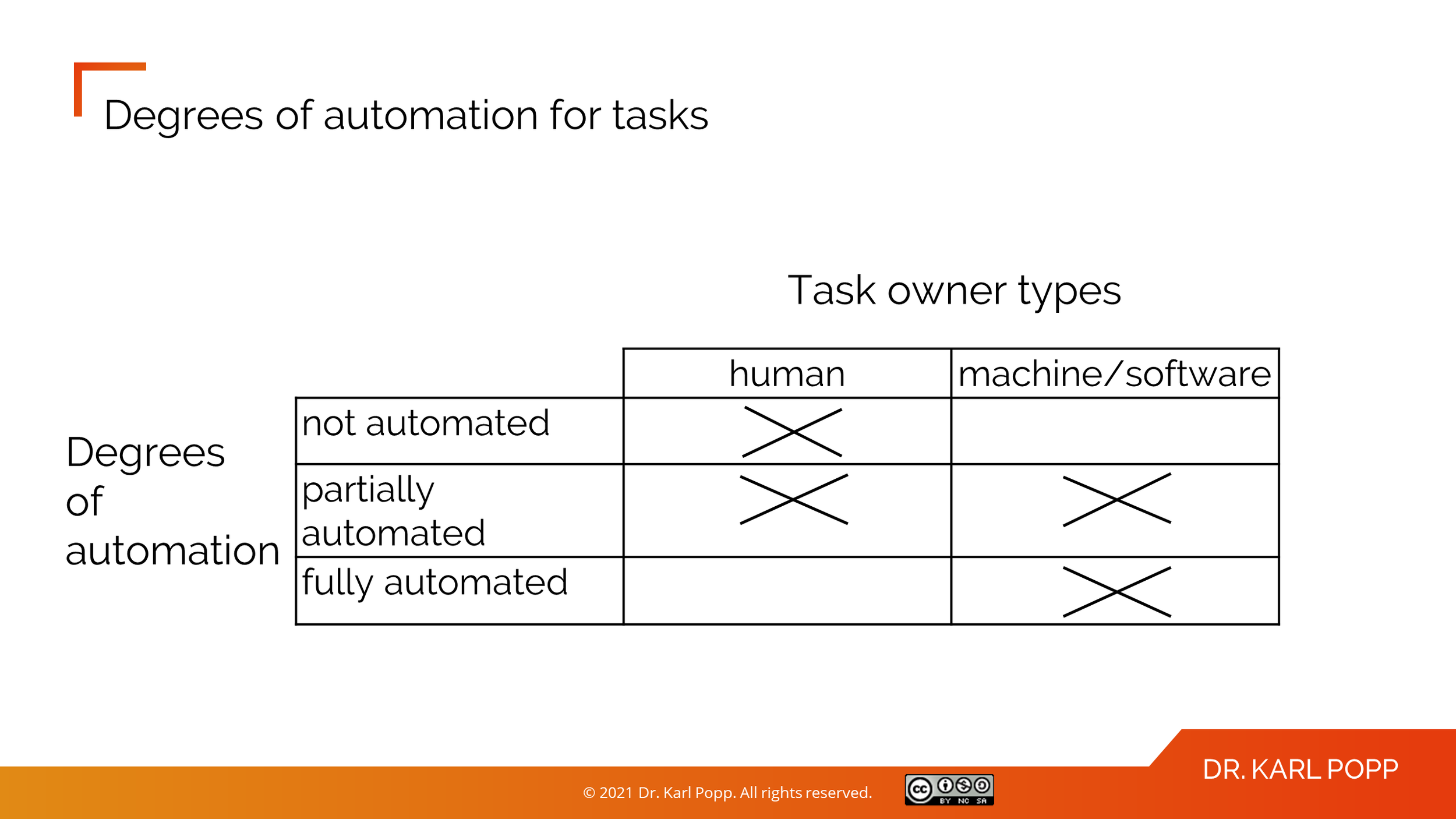

To fully automate a business process, both the tasks and the coupling of tasks within the process must be fully automated. In addition to full automation, there are other degrees of automation. The degrees of automation of tasks can be distinguished by the assignment of combinations of task owner types to tasks in Figure 28 [cf. FeSi97].

The available task owner types are personnel task owners (humans) and mechanical task owners (computers, automats, robots, software). If only personnel task owners are assigned to a task, it is not automated.

If personnel and machine task owners are jointly assigned to a task, it is called semi-automated. A task is called fully automated (automated) if it is assigned exclusively to automated task owners.

Figure 28: Degrees of automation of tasks, source: [FeSi,97]

Automated and semi-automated tasks and the associated application systems are relevant for digitization. In this book they are summarized under the term (partially) automated tasks.

Before a task can be automated, the automatability of the tasks must be clarified. Only a task that is automatable can be automated.

Automatability of tasks

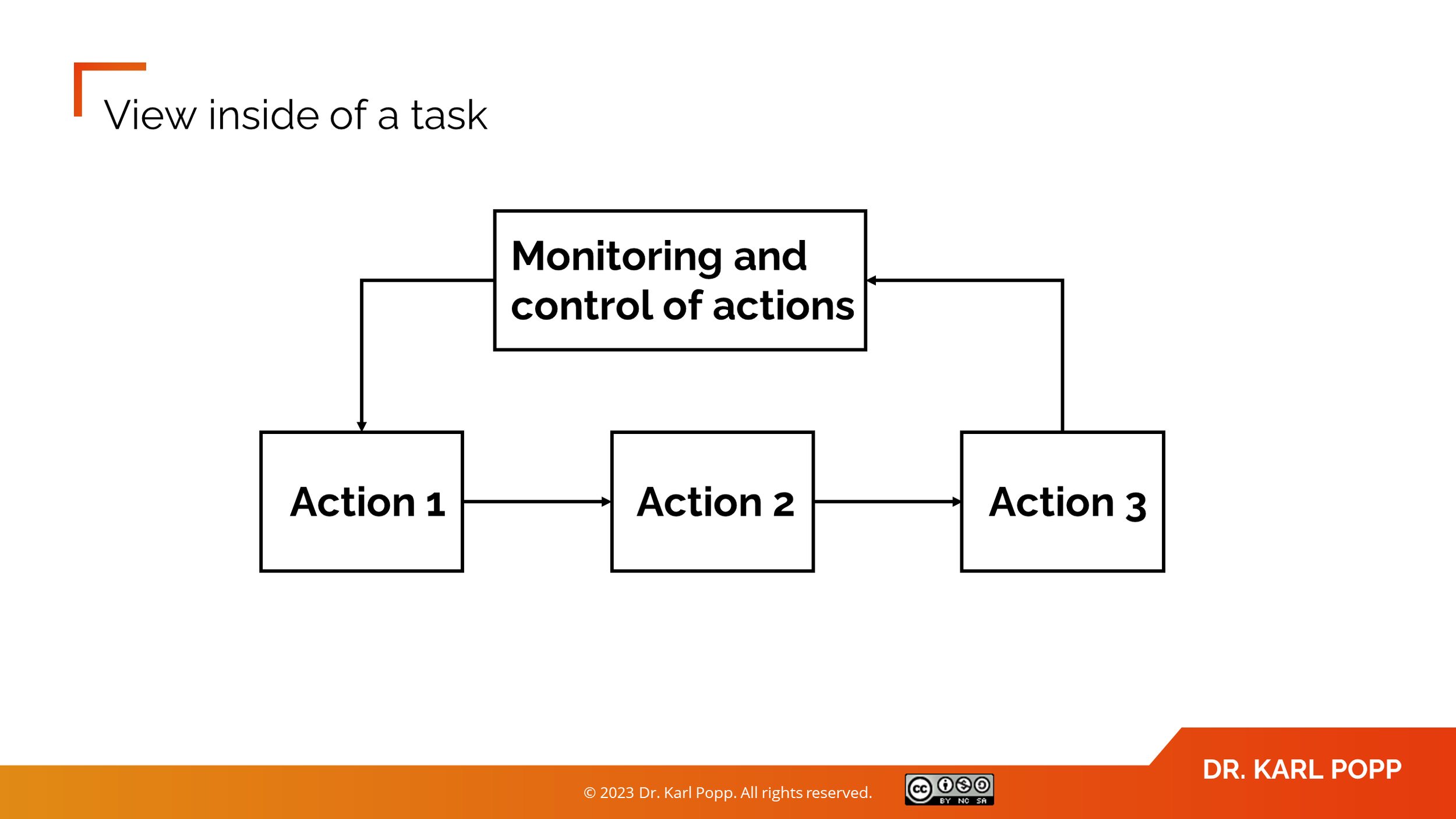

A procedure describes the execution of a task from an internal perspective. It consists of a set of actions that are linked together and controlled by an action control.

Figure 29: Actions and action control, source: [FeSi97]

Whether a task is automatable or not depends on the properties of the procedure for executing a task. More precisely: the automatability can be described by the automatability of all actions of the procedure for solving a task as well as of the action control. So, in our model it is possible to describe automation of actions, which is an important piece of information if you compare different tools that automate a task.

If the procedure for solving a task can be described algorithmically or by means of machine learning algorithms, the task is fully automatable. At the current state of the art, even tasks that cannot be functionally described can be automated (so-called decision tasks) using data science or machine learning approaches.

Many decision tasks that in the past could only be carried out by personnel, can now be fully automated. One example is an automated analysis of contract texts for specific features based on algorithms for natural language analysis. Today, action control can also be at least partially automated. Workflow systems, project control software or even data rooms with action control are available.

Example

Let us have a look at one of our tasks, Finding potential targets.

The task Finding potential targets consists of four actions. Let us have a look at how automated this task could be executed. Based on limited market research, say 16 Tools are available for this task. Each of the tools automates one or more of the actions of this task.

Here´s the overview of actions and corresponding partial or full automation if tools are used:

o Define selection criteria and market is automated by 7 tool(s).

o Scan sources for potential targets is automated by 3 tool(s).

o Review companies to join the longlist is automated by 5 tool(s).

o Define the longlist of targets is automated by 8 tool(s).

This task is clearly partially automatable. Using one of the tools allows the task to be partially automated or, if the tool automates all actions, fully automated.

Roles in the M&A Process

The following roles are assigned to tasks in the model. Please be aware that roles are generic in nature and each role can be held by one person or by multiple persons. In smaller companies, several roles can be assigned to one person. Later in the book we will show the assignment of roles to tasks in the M&A process. While we show roles for the buyer company only, the target company needs the same roles, too.

Business owner within the buyer company

The Business owner within the buyer company is representing the receiving organization, which is the organization the target company is acquired for. The managing director of a division or of a business might be staffed for this role.

Attorney of the buyer

The Attorney of the buyer is responsible for all legal aspects of an acquisition project. The role of a buyer's attorney, is to create, discuss and review the terms of the contract.

Auditor of the buyer

An auditor is responsible for conducting financial due diligence to assess the accuracy and reliability of the financial information of the target company. The auditor's objective is to provide an independent assessment of the financial statements and identify any potential financial risks or inaccuracies that may affect the value of the target company. The auditor also ensures that the target company is following accounting standards and regulations. The auditor's findings and recommendations are then used by the acquiring company to make informed decisions about the transaction.

CEO of the buyer

The Chief Executive Officer (CEO)is ultimately responsible for the success of the transaction. He/She sets the strategic direction for the company and ensure that the acquisition aligns with the company's goals and objectives. The CEO is also involved in the final decision on whether to proceed with the transaction. The CEO also plays a key role in communicating the rationale and benefits of the acquisition to employees, shareholders, and stakeholders.

CFO of the buyer

The Chief Financial Officer (CFO) of the buyer is responsible for all financial aspects of the buyer business. This role rules the available budget for mergers and acquisitions and is responsible for financing acquisitions.

Controlling expert of the buyer

Controlling expert of the buyer is a member of the Controlling department of the buyer company. This expert supports the M&A process by evaluating the financial and operational control systems of the target company. The controlling expert's findings are used to determine the feasibility of integrating the target company's control systems into the acquiring company's control infrastructure.

Ecosystem expert of the buyer

The Ecosystem expert of the buyer is a person working in the buyer company that has deep knowledge of the ecosystem relevant for an acquisition project.

External attorney of the buyer

External attorney of the buyer is an attorney of a law firm that was hired by the buyer company for an acquisition project.

External auditor of the buyer

External auditor of the buyer is a member of an auditor firm hired by the buyer.

External IP attorney of the buyer

External IP attorney of the buyer is an intellectual property law attorney of a law firm that was hired by the buyer company for an acquisition project.

Finance expert of the buyer

The Finance experts of the buyer is a member of the Finance department of the buyer company. They evaluate the financial aspects of the transaction and perform financial modeling to assess the potential financial impact of the acquisition. The finance expert also helps identify and assess financial risks associated with the transaction and makes recommendations on the structure and terms of the deal. They assist in negotiations with the target company and its advisors and provide insight into the tax implications of the transaction. The finance expert works closely with the legal, tax, and accounting experts to ensure that all financial aspects of the deal are thoroughly evaluated and addressed.

Human resources expert of the buyer

The Human resources expert of the buyer is a member of the Human Resources department of the buyer company. This expert reviews the target company's workforce and HR policies, procedures, and systems. In addition, this expert develops a plan to address any HR-related issues, such as employee compensation and benefits, and ensure that the target company's employees are protected during and after the integration.

Investment banker of the buyer

The Investment banker of the buyer is an employee of an investment bank, which specializes in providing advisory services to companies involved in a merger or acquisition. They evaluate potential targets, structure the transaction, and negotiate and close the deal. Investment bankers also provide market intelligence and help clients navigate the M&A process by managing the due diligence process, preparing offering documents, and leading the negotiations. They act as a liaison between the acquiring and target companies, ensuring that the M&A transaction progresses smoothly and that the clients' interests are protected.

IP Attorney of the buyer

The IP Attorney of the buyer manages all IP-related topics and issues for the buyer company. Intellectual Property attorneys protect the intellectual property rights of the acquiring and target companies. They conduct due diligence on the target company's IP portfolio to ensure that it is properly registered and protected and that there are no potential IP infringement or licensing issues. IP attorneys also review and negotiate IP-related provisions in the purchase agreement, such as representations and warranties, covenants, and indemnification provisions. They help ensure that the acquiring company's rights to use the target company's IP are properly transferred and that the acquiring company is protected from any IP-related liabilities. The expertise of IP attorneys is essential to minimize IP-related risks and ensure that the acquiring company fully benefits from the target company's IP assets.

Information technology expert of the buyer

This is an expert for all IT-related aspects for the buyer. This role will evaluate the IT of the target, containing the IT infrastructure, IT organization and processes as well as the application systems and application landscape of the target.

M&A Lead of the buyer

The M&A Lead of the buyer is the person that manages an M&A project along all phases.

Marketing expert of the buyer

This is an expert for all marketing-related aspects for the buyer. This role will evaluate the target´s market position, positioning of the portfolio of target products on the relevant markets and how the target goes to market with the different products.

Negotiation lead of the buyer

The Negotiation lead of the buyer represents the buyer company in all negotiations and coordinates any negotiation activities and the roles involved in the negotiation.

Post-Merger integration lead of the buyer

The post-merger integration lead of the buyer company is responsible for managing the integration of the target company into the acquiring company following a successful M&A transaction. They lead the integration planning and execution process, ensuring that the synergies and benefits of the acquisition are realized in a timely and effective manner. The post-merger integration lead works closely with other functional leaders, such as finance, operations, and human resources, to ensure a seamless integration of the two companies. They manage the integration timeline, budget, and resources and ensure that any potential risks or challenges are addressed and resolved.

PMI project manager of the buyer

The Post-Merger integration project manager of the buyer is a certified project manager responsible for managing the post-merger integration project. The role of a post-merger integration project manager is to oversee the successful implementation of the integration plan developed during the M&A process. They manage the integration timeline, budget, and resources and ensure that the integration goals and objectives are met. The post-merger integration project manager coordinates with other functional leaders to ensure a seamless integration of the two companies and works to resolve any issues or challenges that arise during the integration process.

Production expert of the buyer

This is an expert for all production-related aspects for the buyer. Production experts play a critical role in M&A processes by evaluating the production processes and capabilities of the target company. They assess the efficiency, quality, and capacity of the target company's production facilities and systems and identify any potential operational risks or inefficiencies. The production expert's findings are used to determine the feasibility of integrating the target company's production processes into the acquiring company's operations. They help develop the integration plan to ensure a smooth transition and identify any potential operational synergies that can be realized through the acquisition. The production expert also helps assess the impact of the acquisition on the acquiring company's supply chain and recommends any necessary changes to optimize the combined operations. The expertise of production experts is essential to ensure the smooth integration of the target company's operations into the acquiring company.

Sales expert of the buyer

The Sales expert of the buyer is a member of the Sales department of the buyer company.

Security expert of the buyer

This is an expert for all security-related aspects for the buyer. This role will evaluate the physical and IT-security of the target. Security experts assess the target company's security policies, procedures, and systems to identify any potential security risks or vulnerabilities. The security expert's findings are used to determine the feasibility of integrating the target company's security systems into the acquiring company's security infrastructure. They help develop a plan to address any security-related issues and ensure that the target company's data and systems are protected during and after the integration. The security expert works closely with other functional leaders, such as legal and IT, to ensure that the acquiring company's security and privacy requirements are met during the M&A process.

Strategy lead of the buyer

Strategy Leads provide strategic insight and guidance. They help evaluate the potential strategic fit and long-term benefits of the acquisition for the acquiring company. They analyze the target company's market position, products, and customers to determine how the acquisition can support the acquiring company's strategic goals. Corporate strategy experts also help identify any potential strategic risks associated with the transaction and make recommendations on how to mitigate these risks.

Tax expert of the buyer

The tax expert evaluates the tax implications of the transaction for both the acquiring and target companies. The tax expert assesses the tax consequences of the transaction structure, including the treatment of any liabilities and assets, and identify any potential tax risks or opportunities; in addition, the tax expert provides guidance on the tax planning and structuring of the transaction and works closely with the financial and legal teams to ensure that the transaction is structured in a tax-efficient manner. They also help negotiate and review any tax-related provisions in the purchase agreement, such as representations and warranties, covenants, and indemnification provisions.

Valuation expert of the buyer

The valuation expert will perform financial analysis, including discounted cash flow, comparable company analysis, and precedent transaction analysis, to determine the target company's worth. The valuation expert's findings are used to determine the purchase price, structure the transaction, and negotiate the terms of the deal. They also provide guidance on the tax implications of the transaction and help identify any potential deal breakers.

(C) Dr. Karl Michael Popp 2025