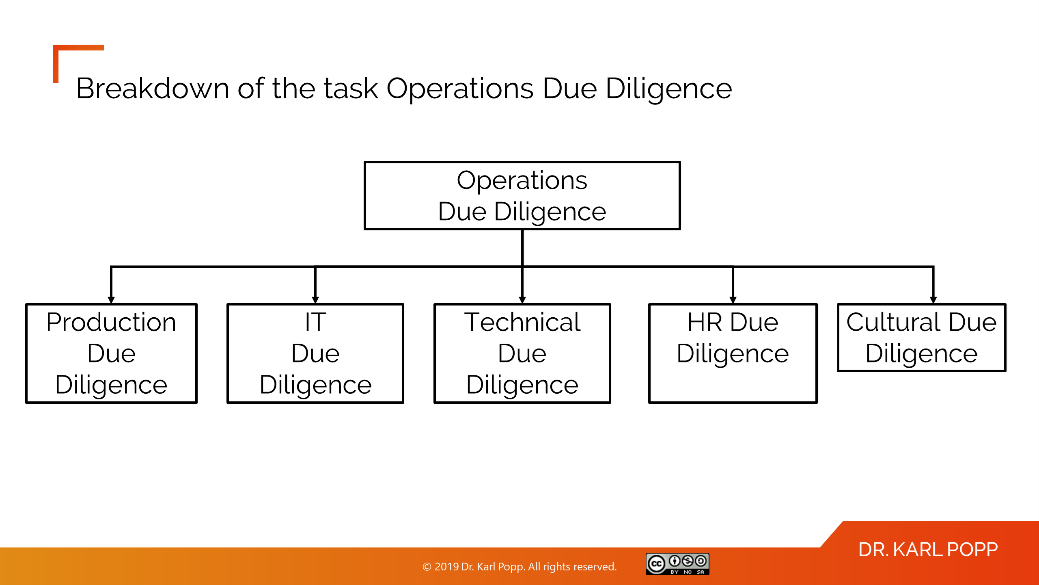

Due Diligence: Operations Due Diligence

THIS IS THE FREE, REDACTED VERSION OF THE TASKS IN THE M&A REFERENCE MODEL AND IT IS LICENSED UNDER Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International THE FULL SET OF DATA HAS TO BE LICENSED COMMERCIALLY. HERE is a full model example for one task. The task has the following goal(s):

Target operations model: analyzed

Draft Operations Integration Plan: prepared

The task has the following objectives:

Information asymmetry: minimized

Integration success: maximized

Short description of task Operations Due Diligence:

The Operations Model implements the business models of a company by allocating resources from the resource model. The operations due diligence covers the implementation of all aspects of the business model and includes in particular the examination of all operational processes of a company, including administrative processes, sales, supply chain and production processes.

The task uses the following business object types:

Target coverage of supply chain, Operations of the target production, Operations of the target GTM activities, Target company, Target business, Supply chain, Supplier relationship, Supplier of the target, Service, Product of the target,

Questions to be used during the execution of the task

The task is executed with the following questions, among others:

In which way is the value proposition of the target transported to the customers?

How are the target's customer segments addressed and supported?

How can the added value of the products and services be measured for the customer?

How is each individual business model of the target implemented operationally?

How is revenue planned, initiated and generated?

How does the target company interact with its customers (segments)?

How is the interaction on channels implemented operationally?

Which partners does the target company work with and in what way?

What is the value proposition for the partners?

Which resources are indispensable for service delivery (key resources) and how are they tied to the company in the long term?

What are the key activities that are indispensable for service delivery and the value proposition of the target?

Can the key activities be protected against imitation?

Do the key activities scale with the planned revenue?

Can the planned cost structure of the business model be maintained or improved as the company grows?

Do the cost structure and revenue generation allow a sustainable profit?

Which applications are used to implement the operational model?

What is to be done in concrete terms to achieve synergies from the complementarities between the target and buyer operation models?

THIS IS THE FREE; REDACTED VERSION OF THE TASK IN THE M&A REFERENCE MODEL: THE FULL SET OF DATA HAS TO BE LICENSED(C) Dr. Karl Michael Popp 2025